PAG IBIG permits membership owners to register their loyalty cards in associated banks and acquire countless discounts and awards. When you’ve obtained your loyalty card or want to utilize this card, you must understand how you can withdraw your money using this card.

However, this loyalty card is utilized as your ATM or credit card. On approval of your loyalty card, you obtain the PIN Mailer from the bank for claiming your PAG IBIG contributions. This PIN Mailer includes your PIN for transactions. This PIN assists you in withdrawing your money as point-of-sale transactions or ATM withdrawals.

Withdrawals Using BancNet ATMs: You can use your Pag-IBIG Loyalty Card Plus to withdraw funds from any ATM machine powered by BancNet. There’s a daily withdrawal limit of up to PHP 50,000 (AUB Philippines).

Contents

How is Money withdrawal Processed using a PAG Loyalty Card?

Where to withdraw your money using a loyalty card from PAG IBIG?

When your card is issued from Unionbank or AUB, you must ensure that you’ve received it with the PIN Mailer envelope. This envelope comprises a temporary PIN for activating the cash card functionality in these banks.

So, on activation of your card at Unionbank or AUB ATM, you’ll receive an SMS with your corresponding Account Number. You can withdraw your PAG IBIG contributed money and other amounts from any associated BancNet-ATM. There is no need for an additional amount to maintain your withdrawal transactions.

These banks are associated with PAG IBIG and conveniently allow you to acquire your transactions using your card as your ATM. With the assistance of this ATM card, you may explore the entire benefits of a loyalty card from more than 350 partnered merchants.

Loyalty Card transfers and withdrawals:

Loyalty card holders can utilize their cards for hassle-free withdrawals at any BancNet-powered ATM. If you are willing to transfer funds to other bank accounts, you may simply navigate through the Hello PAGIBIG Mobile Application.

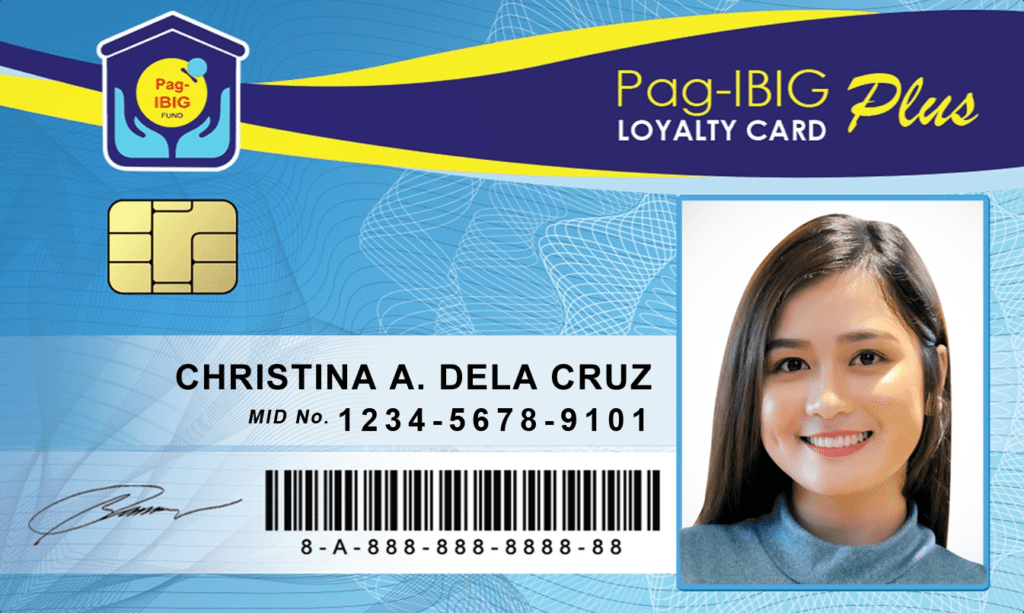

What is the upgraded Loyalty Card of PAG IBIG?

It’s a versatile member’s discount card that’s usable nationwide and offers up to 50% discounts at partner establishments. This card has no expiration and eliminates the need for renewals. It helps you to withdraw your MPL, provident benefits, MP2 contributions etc.

You can acquire the convenience of withdrawing your funds at any BancNet ATM with this card. Additionally, it’s considered a valid ID for various private and public transactions.

In 2019, the loyalty card was upgraded to a new version that works as both an identification and cash card. It streamlines the PAG IBIG benefits and brings further features for members. The surprising feature of this new card is the addition of an EMV chip for enhanced security, and it converts it into an ATM card as well.

PAG IBIG loyalty card holders are facilitated to withdraw their money and lead transactions with partner banks such as Union Bank of the Philippines (UnionBank) and Asia United Bank (AUB). Well, the key difference is that it’s an improved version of the old card and offers upgraded features and increased convenience.

FAQs

How can a PAG IBIG Member withdraw his Money using an ATM/Loyalty Card?

You can visit your PAGIBIG office and evaluate your claim amount along with two valid IDs at the counter. This aspect is suitable while you proceed with your transactions via check.

In case of bank or ATM transactions, you may visit the associated banks with your loyalty cards. Now, you can confirm if your money has been credited and then proceed to make a withdrawal.

Can I withdraw my money from Loyalty Card PAG IBIG?

You can withdraw your funding using your loyalty card once your amount is credited. This loyalty card works as your Debit Card ATM Visa in an affiliated bank with the PAG agency.

Final Words

The updated Loyalty Card of PAG IBIG adds valuable benefits to members. It provides additional financial capabilities for all users. Now, it works as your ATM card and facilitates you with easy withdrawals.

You just make sure that your card activation includes a PIN mailer that contains your PIN code or account number. This security cord allows you to accomplish your withdrawals securely using your loyalty card. You need to simply visit your affiliated bank, insert your loyalty card, and access your money hassle-free. You can also utilize it for online transactions during shopping and for other expenses.