Home Development Mutual Fund (HDMF) members are entitled to avail benefits of PAG-IBIG membership. They can obtain housing loans, payments for savings, and even short-term participation.

Contents

PAG IBIG Policy

This funding agency was launched to accomplish basic needs such as shelter for Filipino citizens and savings programs. A high authority, Presidential Declaration #1530, organized it. After that, it was operated under Human Settlements Ministry. Therefore, in 1979, it converted to an independent company that was led under the virtue of Executive ruling #538,

Before considering a housing loan, you should briefly figure out the vital data of PAG-IBIG.

CHECK: Pag ibig Housing Loan Requirements 2023

Dynamic points of IBIG Housing Loan

Guide of how you can avail of the PAG IBIG

You have the option to avail of our funds for housing purposes with 30 years of repayment terms. Thus, you need to go through the following steps:

Step #1 Be conscious of requirements

The employers must prepare these necessities for availing the PAG fund. These include Valid IDs. Company-issued copy of your profile, a housing-loan agreement, income resources proof, your desired property locality details, extra information for loan payment purposes proof, and. a tax receipt with the latest tax declaration.

Step #2 Application of Housing loan submission

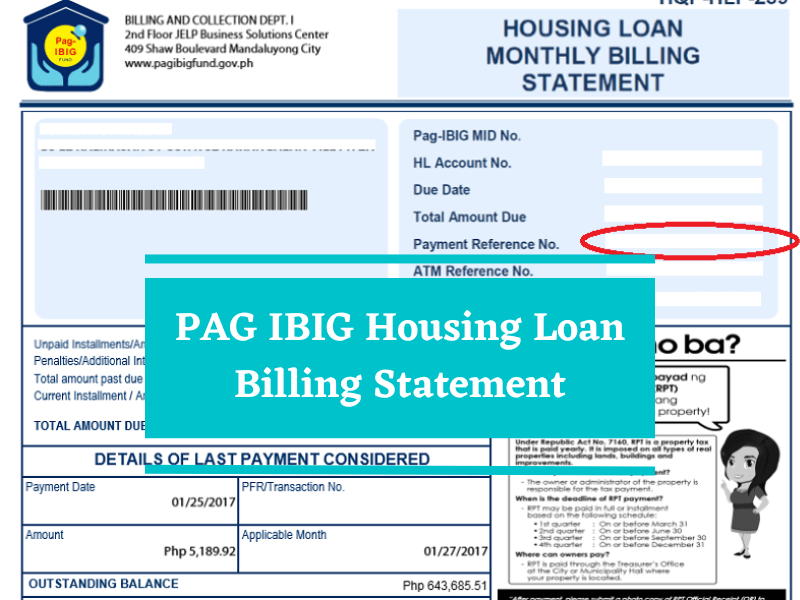

You can submit your contract letter to JELP, Shaw Boulevard, Business Solutions Building, or Mandaluyong in central offices. On the other hand, there are several other alternative options, like submitting it to your nearest branch of PAG IBIG. Before submitting your letter, you must ensure that your data is precise.

Step #3 Receive your NOA and LOG

Notice of approval and letter of Guaranty, NOA, and LOG, respectively, are claimed at the head department of services. You may visit the upper floor of the same building. As a result, our PAG community will create these documents in 15-17(working) days.

Step #4 NOA basic requirements

You have to check and accomplish these NOA chunks: tax receipt and latest declaration letter, Transfer certification of title (TCT), and mortgage documents of loan.

You have three months to complete all these required documents to avail of your House loan.

Step #5 Get your Loan Payment

You can visit our Serving Department and must bring your annotated papers. Once your payment is ready, it will be released within 10 days. You can achieve your dream money after these 10 working days.

Step #6 Monthly paybacks are initiated

Once you avail yourself of your profitable money, your monthly repayments start after a month. You can repay this amount after getting your money check.

Purpose of availing of PAG IBIG loan for the Housing Program

Other Requirements; if applicable

Employers Valid IDs List

FAQs

Who is qualified to avail of our offered PAG IBIG housing Loan?

Users who are vigorously enjoying the membership of IBIG are qualified to avail of this loan. Thus, you’re a member of an existing housing loan and must provide your accurate account details, Calamity Loan, and MPL as proof of your income. These details should not be wrong.

How large is an amount availing to employers when borrowing from IBIG?

All workers and other local citizens can avail of more than PHP6 million. This amount is accessible under reasonable rates and customer-friendly terms.

Does the PAG IBIG loan avail online or not?

Yes, Employers can apply and avail of their required loan via the Virtual MPL option. They need to complete the fundamental requirements for creating their account profile. Hence, they can easily avail of it online.

Final Verdict

Well, PAG IBIG is a highly recommended funding agency to have your property. You must prepare your genuine documents and avail of your loan. You are facilitated to submit your application in any branch, including Cebu City, Carcar City, Mactan Island, and many other regions.

Moreover, it would help if you calculated your income. How you can achieve profit by investing this loan amount. Once you avail of the loan opportunity, you can get higher payments when needed.