PAG IBIG is an authoritative company that routinely caters to millions of Filipino workers. There is a vast range of loans, and you must activate your account to take this loan and renovate your dream house. This loan is also called as House Improvement loan.

Thus, PAG-IBIG house renovation loan Calculator is advanced software used to associate customers with our official PAG agency. This software assists you in House loan interest calculation, amortization, and acquiring your desired loan. It is lucrative for saving your and PAG Company’s time and developing healthier contributions.

CHECK: Pag Ibig Housing Loan Calculator Philippines

PAG IBIG House Renovation Loan

Home Developing Mutual Fund (HDMF) is a Filipino government-owned loan-delivering corporation. This corporation is about to take professional, affordable, and profitable loan services for your shelter construction. The corporation accomplishes guidance about applying, saving, and managing your payments.

Corporation has developed an excellent tool to create a great payment plan. You can put your house renovation estimated requirements and check how much payment you can achieve. Your income tax, plan, and the whole debt ratio are right next to you. Before knowing the calculation steps, let’s take a look at this purpose.

Purposes of PAG Housing Renovation Loan

CHECK: Pag Ibig Housing Loan Requirements 2024

Renovation Loan Calculator Guide

The first and foremost step in the appropriate calculation is employer needs to know the worth of the property. By the way, your Borrow Payments are closely associated with property rates where you will renovate your shelter. Just eyeing up the property, and the estimated value is added to our calculator. It will instantly encounter the maximum amount, so you can quickly build your house. The noticeable point is that this loan amount is PAG IBIG Company-based. Furthermore, the PAG Loan Calculator tells your regular amortization. Well, now you must go through the following steps:

These steps will lead you to the final results of how much you have to repay during your desired amortization period. Such steps and characteristics make this Loan Calculator reliable for Interest package and repayment calculation. Thus click on our provided button and contribute to the magical world of loans.

Therefore, the PAG-Housing calculator exposes the customers’ monthly income and gross annual. These details must qualify your required loan, and PAG offered plan. However, PAG is delivering ₱6,000,000.00 amount for the loan. Our calculator is skilled to prompt if your entered amount exceeds the limits.

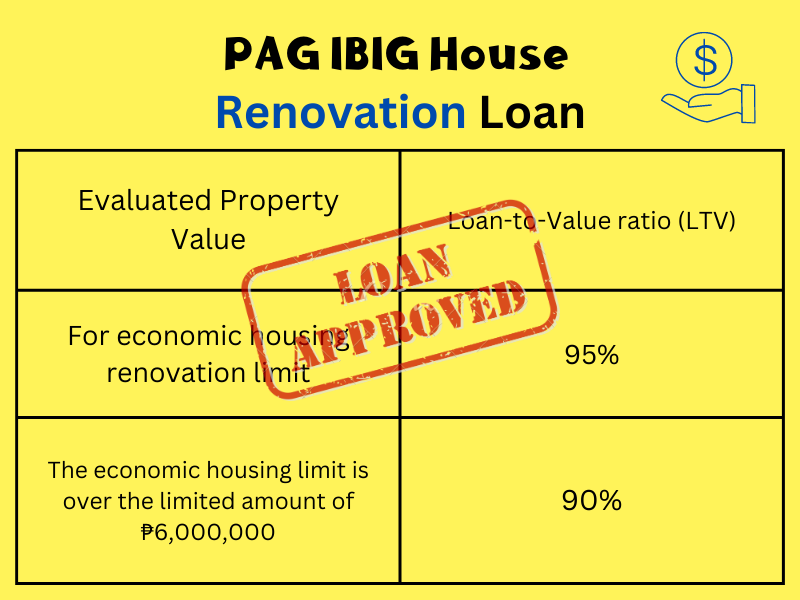

Loan Calculation According to Property Value

PAG offers more than 95% expense of the total property value of a customer. You can get your requisite percentage:

| Evaluated Property Value | Loan-to-Value ratio (LTV) |

| For economic housing renovation limit | 95% |

| The economic housing limit is over the limited amount of ₱6,000,000 | 90% |

The general housing limit in the Philippines is ₱1,888,889, and our system is based on the economic limit. In this sense, when you visit the property zone and want to purchase it, the LTV is definitely near 95%.

What is the defined formula for calculating income?

PAG-IBIG Loan calculator formulates accurate results for your calculations via specific formulas. You are skilled in selecting the rate of monthly interest by fixed-pricing criteria.

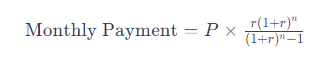

The formula of Amortization Calculation:

Monthly Payment=P×(1+r)n−1r(1+r)n

Where:

This formula calculates the fixed monthly payment required to pay off the loan over its term, including both principal and interest components.

For example, if you have a Pag-IBIG loan of PHP 1,000,000 at an annual interest rate of 6% for a term of 20 years, you would first convert the annual interest rate to a monthly rate by dividing it by 12 (0.06/12 = 0.005) and then calculate the total number of monthly payments (20 years * 12 = 240 months). Plugging these numbers into the formula would give you the monthly payment amount.

The formula of interest Calculation:

For monthly compounding, you would set n to 12. The total amount A includes both the principal and the interest. To find just the interest, you would subtract the principal from this total.

Please note that this is a general formula. Pag-IBIG might have specific terms or additional factors like mortgage insurance, fees, or other charges that could affect the total interest calculation on their housing loans. It’s always best to consult directly with Pag-IBIG or a financial advisor for the most accurate information regarding your specific loan conditions.

Here: PrincipalI: Interest

This formula generally calculates the monthly loan payment and repayments.

FAQs

How can you calculate your Pag-IBIG housing Renovation Loan?

PAG offers a maximum 80% loan of savings total-Accumulated-Value; TAV. You can calculate your payment according to property charges and other requirements. This borrowable amount contains monthly contributions and repayments and is based on yearly pay slips. Your contribution via regular savings is the most important factor for higher loan applications.

Why is the PAG-IBIG Calculator required, mentioned via the house renovation loan calculation example?

For instance, if you get a PAG-loan ₹10,00,000), the amount of annual interest is 7.2%. This percentage is for 12 months. EMI calculation as;

EMI= ₹10,00,000 * 0.006 * (1 + 0.006)120 / ((1 + 0.006)120 – 1) = ₹11,714

If you are calculating each payment manually, it’s a tedious process. PAG-IBIG Loan Calculator will show you the results instantly.

How does the PAG-IBIG Calculator work for monthly home loan payments?

The calculator backend works by multiplying your loan amount with interest package charges. Then divide the total days of the year. The resulting value is the per-day charge of the loan. Accordingly, it calculates the monthly and then yearly charges. The end statement is the sum of real value.

Usually, the process remains the same until your repayments are accomplished and the principal balance comes to zero. Your loan payments become mature, and calculations come to an end. For your perfect experience, you must follow the agency’s instructions.

CHECK Improvement Loan Reference:

Hi, i have a housing loan under PAGIBIG for 20 yrs and i have been paying for just like 6 or 7 years, is it posible for me to apply for renovation loan?

Yes, it is possible for you to apply for a renovation loan from Pag-IBIG even if you currently have an existing housing loan. You can apply for a Pag-IBIG Multi-Purpose Loan (MPL) to finance your home renovation project.

Hi my husband have housing loan in the bank can we apply house renovation

to pag ibig.?

Yes

Can I apply for house renovation loan even if the house title is under my mother’s name? My family and I still live under one roof with my mom

You mother can apply

If my father or my mother is not a contributor of pagibig and like what Nikki said my family is living in one roof, can i use my pagibig privilege loan of renovation?

Yes, you can apply for a house renovation loan from Pag-IBIG even if your husband has an existing housing loan with a bank.

Hi I have a housing loan in the bank, can we apply house renovation loan to pag-ibig? If yes, how

Yes, you can apply for a house renovation loan from Pag-IBIG even if you have an existing housing loan with a bank. The Pag-IBIG Multi-Purpose Loan (MPL) can be used for house renovations or home improvements. Here’s how to apply:

Check your eligibility:

Obtain the application form

Prepare required documents

Submit your application

Await approval and loan release

Hi, is loan for Home Improvement under MPL? Or there’s a separate loan for Home Improvement/Renovation? Thank you.

Hi.can i apply for pagibig housing loan renovation if i dont have a housing loan on pagibig?our pagibig housing loan is under my husbands name..

How to apply house renovation loan,may wage minimum only .imposible po ba na mag approyako sa loan at magkano maloloan?

Applying for a home renovation loan, even with a minimum wage, is not impossible, though the amount you can borrow will be dependent on a variety of factors including your income, credit history, and the equity in your home. Here’s a general process for how you might apply for a home renovation loan:

Review your finances: Understand how much you can afford to pay back each month, and how much your renovation is likely to cost.

Choose the right type of loan: Depending on your situation, a home equity loan, personal loan, or a home improvement loan through a program like Pag-IBIG’s Home Improvement Loan program may be the best option.

Compare lenders: Look for lenders who offer the type of loan you’re interested in, and compare their rates and terms.

Apply for the loan: Once you’ve chosen a lender, you can apply for the loan. You’ll likely need to provide personal information, proof of income, and details about your renovation project.

Wait for approval: After you apply, the lender will review your application and decide whether or not to approve your loan. This can take anywhere from a few days to a few weeks.

If you’re in the Philippines and you’re interested in a home improvement loan through the Pag-IBIG Fund, you’ll need to meet the following eligibility requirements:

You must be a Pag-IBIG member for at least 24 months and have made at least 24 membership savings contributions.

If you have an existing Pag-IBIG housing loan, it must not be in default at the time of application.

You must be under 65 years old at the time of application, and not more than 70 years old at loan maturity.

You must have passed satisfactory background checks by Pag-IBIG Fund.

The amount you can borrow will depend on your need, your capacity to pay, and the loan-to-appraisal value ratio. If you meet the requirements, I would recommend reaching out to Pag-IBIG Fund directly to understand how much you might be eligible to borrow for a home renovation loan.

Hello, where can I submit my housing renovation loan requirements/docs. thank you!

Hi. What is the requirements of mpl for home improvements/renovation loan.

My home located in cebu.

If my father or my mother is not a contributor of pagibig and like what Nikki said my family is living in one roof, can i use my pagibig privilege loan of renovation?

What if po kumuha kami ng House sa pagibig via pagobig po 30 years. But its bare type po. For construction loan po para ma renovate, would it fall under construction loan and can we apply for it po knowing na we have an existing Housing loan? Or MPL pa rin po mag ffall? How much po ba yung limit sa MPL?

I have housing loan under Pag-ibig and it was turn-over last December 2023. Can I apply for Home improvements/Renovation loan to Pag-ibig?

Thank you and Godbless 🙂

Can I apply for PAG IBIG House Renovation Loan even if the property is under my name?

Yes, you can apply for a Pag-IBIG House Renovation Loan if the property is under your name. The Pag-IBIG Home Improvement Loan, part of the Pag-IBIG Housing Loan offerings, is designed for existing homeowners who wish to finance renovations, improvements, or extensions to their homes.

Can i avail house improvement loan if the house or lot title is in my Mothers Name?

my mother is not a pag-ibig member pls. advise thanks