PAG IBIG provides the precise option to apply for secure loan payments through its virtual platform. Whether you’re a current member of the PAG IBIG loan scheme or a beginner in the funding world, now you are interested in obtaining the convenient PAG IBIG salary loan. To assist you in this regard, it’s essential to understand how you can qualify and the basic requirements for this loan. We’ve brought a comprehensive guide for all salary loan enthusiasts.

CHECK: Pag Ibig Salary Loan Calculator

Contents

- 1 What is PAG Salary Loan?

- 2 Interest Rate

- 3 Requirements

- 4 Eligibility Criteria for Salary Loan

- 5 Apply for PAG IBIG Salary Loan

- 6 PAG IBIG Salary Loan Form

- 7 PAG-IBIG Salary Loan Computation

- 8 Maximum Amount of Salary Loan

- 9 Pay for Salary Loan in PAG IBIG

- 10 How can you claim your PAG Salary Loan?

- 11 Pag ibig Salary Loan not Paid?

- 12 FAQs

- 13 Conclusion

- 14 Author

What is PAG Salary Loan?

PAG IBIG represents the salary loan as a Multi-Purpose Loan; MPL. You may know that MPL and calamity loan is the cash assistance programs. PAG IBIG has established a cash loan (of about 36.5 billion Pesos) for all loaners during 2021. Fortunately, this loan is accessible in easy returnable terms for around 2-3 years. You are capable of acquiring a salary loan for immediate financial needs. There are some of the following purposes for getting this loan:

Interest Rate

A salary loan is delivered to all qualified applicants with a specific interest rate (10.% per annum).

Therefore, a salary loan is accessible to all members at a lower interest rate of 10.5% per annum. The worth-noted point is that some of your income is derived from the PAG and will return to you as dividends. Though, you will get your earnings with higher dividends when needed.

Requirements

Therefore, your ‘Net payment Certificate’ must be completely accomplished both from the front and back by the employer. Or you can also submit your pay slip verified by your company’s authorized signatory.

CHECK: How to Apply for a Salary Loan?

Employment letter for Self-Employed Workers (any of the following)

Employment letter for OFWs

Whenever you’re going to apply for the PAG IBIG loan, either a Salary loan or regular savings, you must prepare photocopies of your documents. Although you have copies of all paperlets, you must keep the original documents for verification.

CHECK: Can I Loan in PAG IBIG without Work?

Eligibility Criteria for Salary Loan

Hence, you understand the salary eligibility scenario. Another important fact is that all qualified loaners can get 80% of their results savings. This saving amount comprises the accumulated dividends earned, your employer’s contributions, and monthly payments.

It represents that the more money you submit in your regular savings account, the more payments you can achieve in your salary loan. Furthermore, being the loan applicant, you must go through the calculation and computations for salary loans under PAG IBIG programs.

PDF Form Download

Apply for PAG IBIG Salary Loan

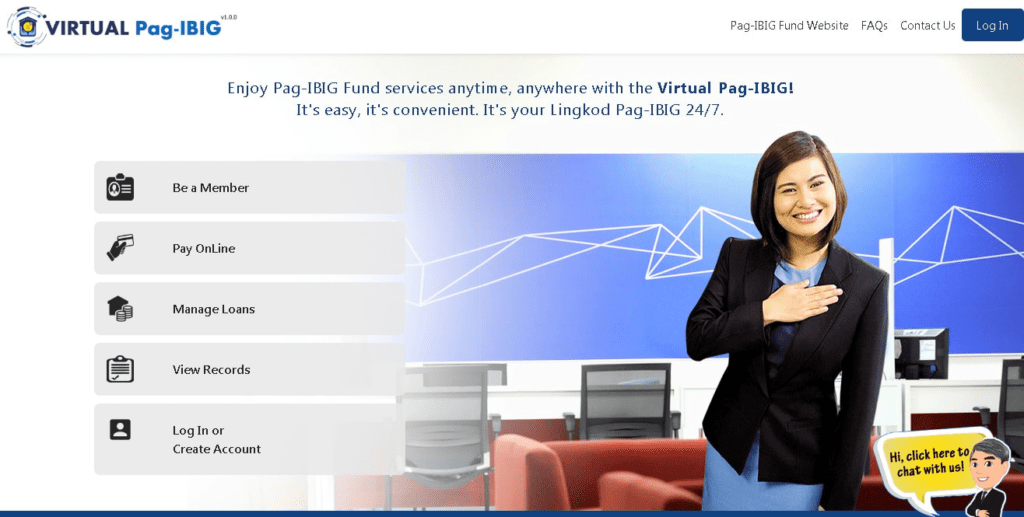

You have the simple and easy steps to apply for your salary loan without going through the in-person method. However, there are two ways Email and Virtual portal to apply for the loan.

Apply via Email

You can also email your nearby PAG branch. There are the following possible emails and relevant branches:

| Email Address | Branch |

| [email protected] | Makati-Ayala Avenue, Las Pinas-Robinsons Place, Dasmarinas |

| [email protected] | Quezon Avenue, Cubao, Marikina, Caloocan Mandaluyong – Shaw Zentrum, EDSA and Antipolo |

| [email protected] | Cauayan, Solano and Tuguegarao |

| [email protected] | SBMA, Malolos, an Fernando, Cabanatuan, Angeles, and Meycauayan |

| [email protected] | Vigan, Baguio, La Union, Urdaneta, Dagupan, and Laoag |

| [email protected] | Naga and Legazpi |

| [email protected] | Iloillo-Molo, Bacolod, Iloilo-Manduriao, Roxas, and Sagay |

| [email protected] | Calamba, Lucena, San Pablo, Sta. Rosa, and Palawan |

| [email protected] | Pagadian, Dipolog and Zamboanga |

| [email protected] | Valencia, CDO-Lapasan, Surigao Butuan, and Iligan |

| [email protected] | Cotabato, General Santos, Davao-Bajada, Kidapawan, Digos, Polomolok |

| [email protected] | Cebu-Colon, Dumaguete, Ormoc, Danao, Toledo, Cebu-Ayala and Calbayog |

Apply for Salary Loan by Virtual Account

PAG IBIG Salary Loan Form

However, when applying for a salary loan virtually, there’s no need to print and scan your form. You may utilize the SignNow, digital ways of PAG IBIG to fill up and prepare your salary loan form. Its intuitive interface has made the form fill-up more reliable and convenient in 2023. Follow the simple steps to finalize your form:

When applying for short-term salary loans, PAG IBIG prefers the simplest and easy ways for members. That’s why SignNow is a remarkable system for you.

PAG-IBIG Salary Loan Computation

PAG is the Philippines Government entity and prefers easy things for loan members. However, to provide straightforward ways to all applicants, we’ve brought the whole computational system for salary loans. How can you compute your loanable amounts? Remember, your whole accumulative amount is associated with your salary & employment source.

Therefore, you have the ability to compute the salary loan amount according to your monthly contributions. So, your contributed value is multiplied by your amount. This amount meets with PAG IBIG’s recommended %age.

| Monthly Contributions | TAV |

| 24 to 59 months | Greater than 60% |

| 60 to 119 months | More than 70% |

| 120 months | Greater than 80% |

Suppose members’ monthly contribution to the loan is 200.00 Pesos. How to compute the salary loan with this amount:

PHP 200 × 35 months = 7,000 Pesos

PHP 7,000 × 60% = 4,200.00 Pesos

Applying the same formula, you can obtain your interest rate for the annual salary loan amount. Furthermore, viewing your significant role in short-term salary loans, we’ve also offered low-rated funds. This offer is open and accessible throughout the country. Meanwhile, you should remember that you have to return the same amount in your referred period to PAG IBIG.

Maximum Amount of Salary Loan

When applying for a salary loan, one common confusion is determining the amount you can acquire or the actual loanable amount of PAG IBIG for a salary loan. The fundamental fact is PAG brings 80% of members’ regular savings for the salary loan. So, you can proceed with your salary loan in two working days.

Usually, a qualifying member can borrow a maximum of 6,000,000.00 Pesos (Six Million PHP). Although, this maximum amount is repaid in a 30-year relaxing period. While applying for a salary loan, you are acquiring the maximum amount of your savings and contributions. This loan must be amortized in 24 months (2 years). Your amortizations will start after three months when your salary loan is released from the PAG IBIG counter.

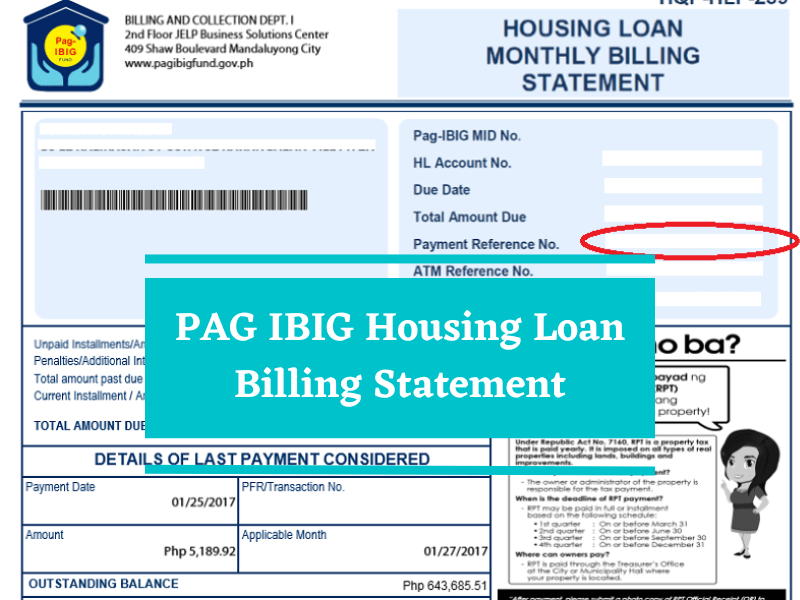

Pay for Salary Loan in PAG IBIG

Loaners have the great option of Salary loan payment in 2 years. They can also pay their delayed amount and remain for 36 months (3 years).

Moreover, there are further possibilities for borrowers; suppose you’re employed, then amortization can happen from salary deduction along with employer member. If you want to pay the advanced amount, you can visit your nearest branch via your virtual access or any other easiest means of PAG IBIG.

Alternatively, while getting a salary loan as an OFW member, you can precisely pay your loan by your virtual portal or in person. You can also try any additional online platform that associates with PAG and allows you to pay your loan amount.

How can you claim your PAG Salary Loan?

When getting the membership confirmation for a salary loan, the most appreciated step is to choose the loan-releasing mode. Some of the trustworthy modes for salary loan owners are:

Fortunately, you may collect your entire information and assign the PAG manager to assess your information quickly. He will analyze it and then inform you whether you qualify for it.

Pag ibig Salary Loan not Paid?

- Interest and Penalties: The loan will accrue interest and may also have penalties for late payment. This can increase the total amount you owe significantly over time.

- Negative Record: Non-payment or delinquency can reflect negatively on your Pag-IBIG records. This might affect your future borrowing or loan privileges with Pag-IBIG and potentially with other financial institutions.

- Legal Action: If the loan remains unpaid for a significant amount of time, Pag-IBIG may take legal action to recover the unpaid amount.

- Offset against Benefits: Your outstanding loan balance can be offset against any benefits you might be entitled to from Pag-IBIG, such as your Total Accumulated Value (TAV) if you decide to withdraw it.

- Notification: Pag-IBIG will notify you of your unpaid balance, and it’s essential to communicate with them if you’re facing difficulty in repayment. They may offer some arrangements or restructuring options to help you settle the debt.

- Credit Score Impact: The Philippines has credit reporting agencies like TransUnion or CIBI. Continuous non-payment of loans can negatively affect your credit score, making it more challenging to get loans or credit in the future.

FAQs

How much amount can I get for your salary loan from PAG IBIG?

PAG IBIG salary owners can get around 1,250,000 – 6,000,000 pesos. Though, PAG offers an 80% loan for your whole payment.

How to compute the salary amount from PAG IBIG?

Salary loaners achieve the 80% loan amount. This payment usually depends on your monthly contribution; PAG offers monthly %age and TAV.

What are the basic requirements for a salary loan?

1) Active membership of at least six months and one month of saving

2) Member’s two years regular saving plan

3) Additional documents; original and copies

Is a salary loan accessible for all members in the Philippines?

Yes, PAG IBIG has offered the salary loan along with all other loans for qualifying inhabitants. However, salary loan is allowable for OFWs, employed, and self-employed people.

Conclusion

PAG IBIG allows the salary loan as the restructuring extension, which commonly depends on your requirements and your contributed amounts. When you meet the organization’s eligibility criteria, you can get your desired interest rates. Then, you can compute your payments and make the top-notch decision to acquire your loan.