The voluntary saving plan of the Philippines government, PAG-IBIG MP2 savings, is beating around ₱33 billion in 2022. The savings program’s progress is entitled to increase by about 57% which was ₱21.43 billion in 2021. 2022 proves the best-performing year for PAG IBIG members.

However, it’s the best saving plan and enhancing the money for Filipino people. You may know that the COVID-19 pandemic has badly hit the economy. MP2 saving plan is the perfect approach for improving the livelihood and making money-saving plans. Let’s consider comprehensive information about the PAG MP2 Savings Program. Then you can imagine the real worth of this saving plan for collecting your investments.

Apply here: PAG IBIG MP2 Enrollment

Contents

What’s the actual mean of PAG-IBIG MP2 Savings?

The enhanced savings plan is delivered by HDMF (usually known as PAG IBIG). MP2 represents its modified edition from the optional savings system of PAG IBIG. It’s established for all former and current members acquiring loans from our PAG organization.

Use this: Pag-IBIG MP2 Calculator

It’s offered to assist all the members and save them money. You can earn higher dividends from this system than from regular savings programs. We’ve brought a great offer for those who are interested in growing their balance.

CHECK: PAG IBIG MP2 Computation

Key Features of MP2 Savings

However, investing and saving money has become more reliable, profitable, and affordable for Filipinos. These are some vital attributes of the MP2-savings program:

Brief View:

Tax-Free dividends

PAG IBIG members are capable of achieving tax-free dividends. This payment is accessible to you for five years or every year. So, on account of your requirements, you can get this amount without tax deduction.

Budget-Friendly asset

You can invest (as a PAG member) around ₱500 amount per month in MP2. Suppose now you want to skip your contribution. You don’t need to pay the penalties for missing the era on your rejoining time. Thus, for your appropriate experience, you must contribute regularly.

CHECK: PAG IBIG MP2 Risk

Enlarged Maturity Period

PAG IBIG offers five years for your account maturity. After that, you’re able to withdraw your payment. However, it’s the salient feature of our MP2 savings for providing the mid-term investment goals as well.

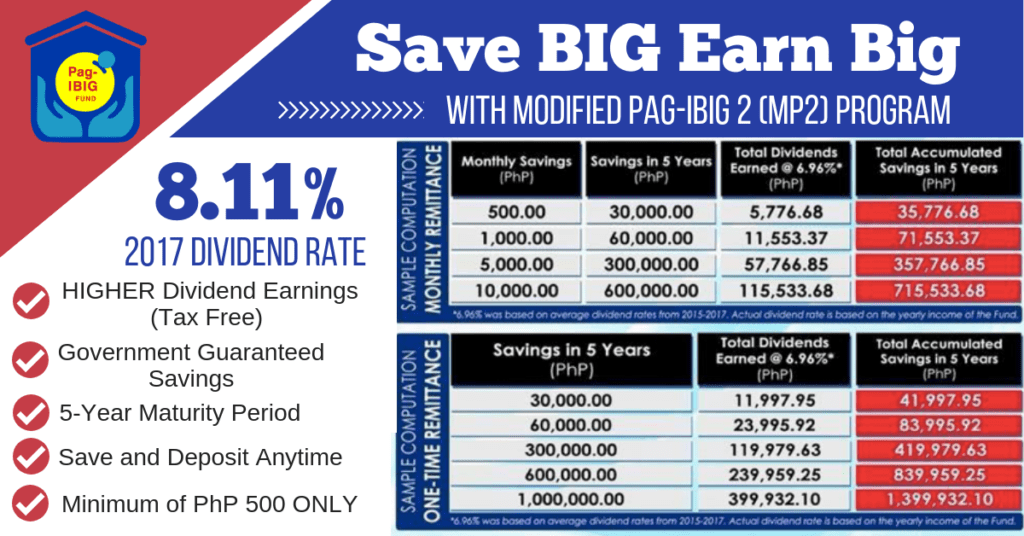

Over 6% Dividend rate yearly

Fortunately, you can enjoy higher interest rates than your continuous savings of loans. It’s a higher rate than all other investing ways, including time deposits, bank accounts, and other investing platforms.

CHECK RATE: Pag Ibig MP2 Dividend Rate

Government-organized savings

If you’re a new loaner at PAG IBIG, this specific information is relatable to you. You don’t lose your loan principal. Even you may enjoy your journey because the Philippine government entirely governs it.

Several MP2-Saving Accounts Access

You may create multiple MP2 accounts according to your requirements. Hence, you can boost your investing and savings for many purposes, including retirement, travel, emergencies, tuition, etc.

Unlimited Amount of Saving

You can remit as much money as you want to save. PAG has not assigned limits on submitting the amount. Although for one time, members are proficient to pay more than ₱500,000, now your personal check must be verified.

Benefits of PAG IBIG MP2 Saving System

MP2 saving system has brought various benefits for PAG investors. You can analyze your savings in PAG IBIG:

Low ADB and Higher Interest Rate Yearly

We are providing a 6% earnings on your savings per year. It makes our track record as higher-yield savings. Thus, you can visit the interest rates of our system and the rates of the banks in the following table:

| Savings | Average Daily Balance | Average Interest Rate Yearly |

| PAG IBIG MP2 Savings | ₱6,000 | 7.0000% |

| BPI Regular Saving plan | 5,000 | 0.0625% |

| Union-Bank Savings | 25,000 | 0.1000% |

| Land-Bank ATM Savings | 2,000 | 0.0500% |

| Robinsons Bank Regular-Saving | 10,000 | 0.1250% |

| East-West Bank Regular Saving | 10,000 | 0.0125% |

| PBCOM Regular Savings | 5,000 | 0.1000% |

| China Bank ATM Savings | 10,000 | 0.0125% |

| PNB Debit Savings | 10,000 | 0.1000% |

| May-bank Regular Savings | 10,000 | 0.2500% |

| AUB Starter Savings | 1,000 | 0.1000% |

You can get your average daily amount by multiplying the monthly amount ₱500 by 12 (month) yearly. Finally, PAG IBIG brings higher interest rates as compared to other banks.

Withdraw your Payment anytime.

Your MP2 saved money is maintained conveniently for five maturity years. Although, you can get your Payment in any emergency situation as well. You’re not restricted to following any strict schedule for getting your Payment.

Flexible saving options

You can select a fixed amount monthly or make a lump sum deposit. So, PAG allows a minimum contribution an amount of PHP 500.

Authoritatively Guaranteed Program

The Filipino government guarantees your saved amount. You can compute and get your annual dividend. You must learn the essential factors of savings.

Straightforward Account Creation

Once you’ve decided to earn the savings plan, open our webpage. Fill up the registration form for MP2 Savings via your virtual portals. Your enrollment has been accomplished. You can contribute to your saving whenever you want.

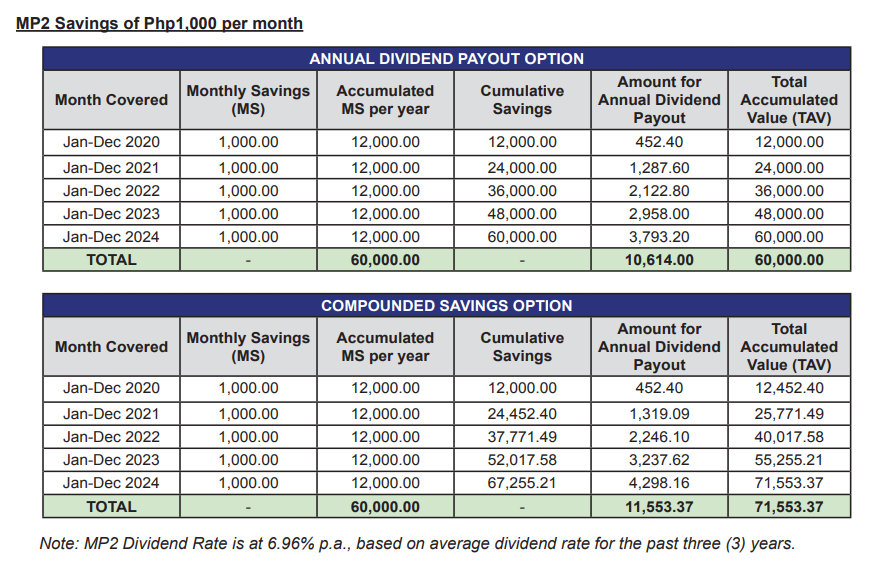

Saving Dividends withdrawing option per year and after 5 Years

Our system allows PAG IBIG loan members to acquire their rates in compound interest form (5 years) or yearly. You can look at your PAG IBIG contribution, profits, and bank contribution.

PAG-IBIG MP2

| Year | Savings Charges | Earned Dividends |

|---|---|---|

| 1st | ₱6,000 | ₱226.20 |

| 2nd | ₱12,226.20 | ₱659.54 |

| 3rd | ₱18,885.74 | ₱1,123.05 |

| 4th | ₱26,008.79 | ₱1,618.81 |

| 5th | ₱33,627.60 | ₱2,149.08 |

| Total over 5 Years | ₱30,000 | ₱5,776.68 |

Bank

| Year | Savings Charges | Earned Interests |

|---|---|---|

| 1st | ₱6,000 | ₱240.00 |

| 2nd | ₱12,240.00 | ₱489.60 |

| 3rd | ₱18,729.60 | ₱749.18 |

| 4th | ₱25,478.78 | ₱1,019.15 |

| 5th | ₱32,497.89 | ₱1,299.92 |

| Total over 5 Years | ₱30,000 | ₱3,797.85 |

MP2 offers 6.9% profitable savings on dividend rates per annum. Meanwhile, banks may offer 4% interest rates annually. Moreover, bank interest rates are taxable, and the MP2 saving plan is tax-free.

Potential Earning of PAG IBIG MP2

You can accomplish your earning by dividends. Moreover, your return amount also depends on the whole money that you save in your MP2 account. It’s overall considered as your legal and valid investment. You can check and get your payment on account of your requirements.

Therefore, PAG IBIG offers long-term saving plans. You can save your hard-earned money in the trustworthy investment market of the Philippines. You can make your trust in our system by joining and getting the membership card as well.

Eventually, you’re reporting an example of your MP2 savings computation. Suppose in 2015, you gained a single investment of about ₱100,000.

| Years | Saving Amount |

| 2016 | ₱105,330 |

| 2017 | ₱113,156 |

| 2018 | ₱112,332 |

| 2019 | ₱131,397 |

| 2020 | ₱140,987 |

| 2021 | ₱148,966 |

FAQs

What will happen to my MP2 savings account after five years (payment lock period)?

When your 5 years are completed, then your payment is transferred to your regular savings account. Your funding can be considered as the regular amount of your account.

How can I enroll in the PAG IBIG MP2 saving?

1) Visit your nearest PAG IBIG counter and fill out the MP2 Savings Membership Form.

2) Attach your first amount and valid ID with the form and submit

3) Get your saving account number. This number is allotted to your mobile number or registered email.

Conclusion

PAG IBIG MP2 Saving is a productive and affordable saving plan for all communities. However, those people who set their long-term goals can easily pick this program and save their money with tax-free payments. The Philippine government has provided flexible savings options with guaranteed payment.