PAG IBIG offers higher earning returns than its regular savings scheme. Are you worried about PAG IBIG MP2 Risks? PAG MP2 is the higher saving program. While the majority of Filipinos have started investing in our profitable program, the question of risk has become a concern to some extent. To respond to these concerns, we’ve brought up the risk aspects and ways you can manage your queries.

Usually, we look for an investment plan that provides profitable and secure outcomes. Do you want to find a money-saving platform with lower risks? You’re definitely on the right platform; PAG IBIG funding MP2 is your picture-perfect option.

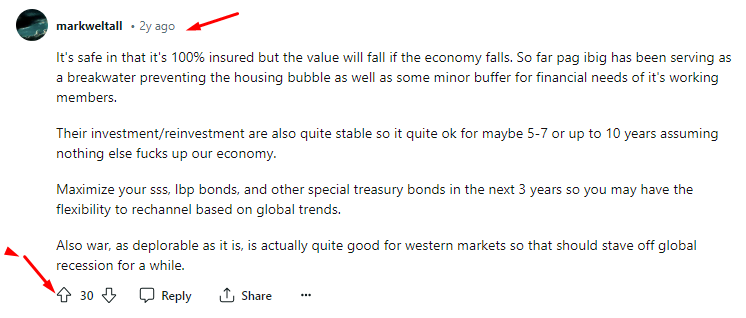

How safe will Pag-Ibig MP2 be if we fall under bad administration?

byu/artoffhours inphinvest

CHECK: PAG IBIG MP2 Computation

Contents

- 1 PAG-IBIG MP2 Savings

- 2 PAG IBIG MP2 Risk: Saving Program

- 3 PAG IBIG MP2 Historical Dividend Performance

- 4 Capital preservation

- 5 Long-term investment plan (over 10 Years)

- 6 FAQS

- 6.1 What are the potential risks associated with the PAG-IBIG MP2 Savings Program?

- 6.2 Can I lose money if I invest in the PAG-IBIG MP2 Savings Program?

- 6.3 How does the PAG-IBIG Fund manage its investment portfolio to minimize risk?

- 6.4 Are there any government guarantees for the PAG-IBIG MP2 Savings Program?

- 6.5 What factors can affect the returns on my PAG-IBIG MP2 investment?

- 6.6 How is the dividend rate for the MP2 program determined?

- 6.7 How can I minimize the risks involved in the PAG-IBIG MP2 Savings Program?

- 6.8 How can I monitor the performance of my MP2 investment and stay informed about potential risks?

- 6.9 Is it possible to withdraw my MP2 savings before the maturity period in case of financial emergencies?

- 6.10 Can investing in PAG-IBIG MP2 be a good option for risk-averse investors?

- 7 Final Thoughts

- 8 Author

PAG-IBIG MP2 Savings

It is a great way for PAG IBIG loan owners to earn higher dividends. When they register for this savings plan, then their determined amount is deducted from their salary (in many other ways).

This deducted amount will increase with a specific additional amount of PAG organization. Hence, at the end of five years, the whole amount with higher dividend rates is transferred to members’ accounts. Moreover, MP2 saving allows you to get your amount when you need it before five years as well.

However, MP2 savings contribute to your business’s long-term goal and financial stability. Whether you are a beginner at PAG IBIG or starting your saving journey, there are a lot of questions and misperceptions regarding investment programs.

Although, commonly, investing plans carry a certain amount of risks in general. Fortunately, investment risks are relatively too low in PAG IBIG MP2 savings. Millions of people are contributing to us for the sake of higher dividend earnings.

PAG IBIG MP2 Risk: Saving Program

Fall in Dividend Rates

The major purpose of MP2 savings is the highly gained dividends. PAG IBIG members are lured towards this saving plan just due to higher amounts. Now dividends are usually higher in 2022-2023. Meanwhile, you should take into account that there might be lower dividend rates. However, you may get a decreased savings payment from your overall investment.

The propitious aspect of PAG IBIG is that, unlike all other investment plans, the principal payments of contributors are kept safe. On behalf of the Philippines Government, it’s the guarantee of the PAG organization.

It represents that which amount deducted from your salary into MP2 savings is entirely secure. It does not depend on the economy or whether whatever is going on in the country. Your money will be saved and returned to you intact form after your maturity period.

Inflation

You must bear in mind that there are a few risks that you must note before going to saving your payment. One of these menaces is the ‘chances of Inflation‘. It may reduce the powers of your saved purchasing with time.

The sustained elevation of your usual goods’ prices and services in your economy with time is taken as inflation. In such circumstances, the purchasing power of currency is reduced. Thus, the same amount of income will be used to buy a few things as before.

Thus, the major cause behind this risk can be any inflation caused in your economy. As these causes are consumer demand is changed, production costs may increase, the money supply is increased, or the supply chain of goods may be disrupted. Thus you must remember these things as well.

CHECK: Pag-IBIG MP2 Calculator

Fail to provide Funds

Rather PAG IBIG is governed by super authorities of the country. The risk-free scheme is working efficiently. At the same time, there is a noticeable point and if the Government or agency holders may split up, both communities fail to organize the PAG funding agency. In such conditions, MP2 savings are at risk because it’s a long-term process, and dividends change yearly.

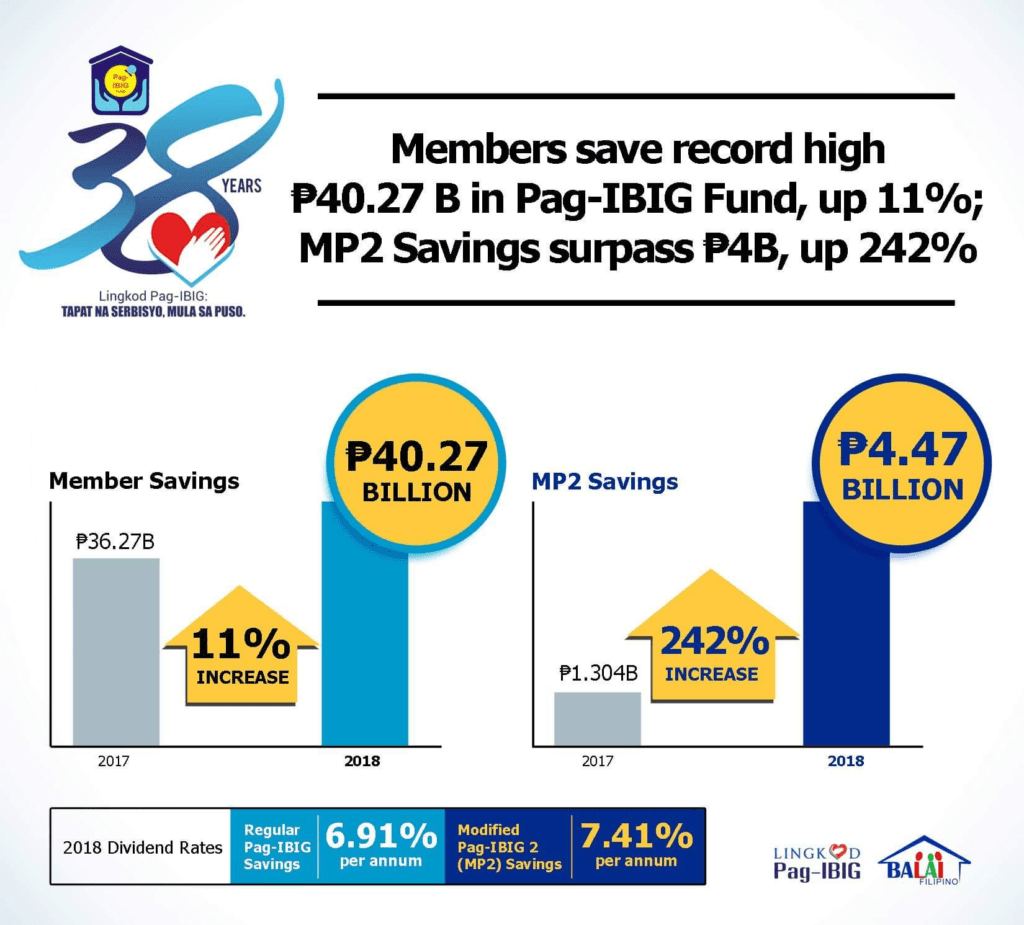

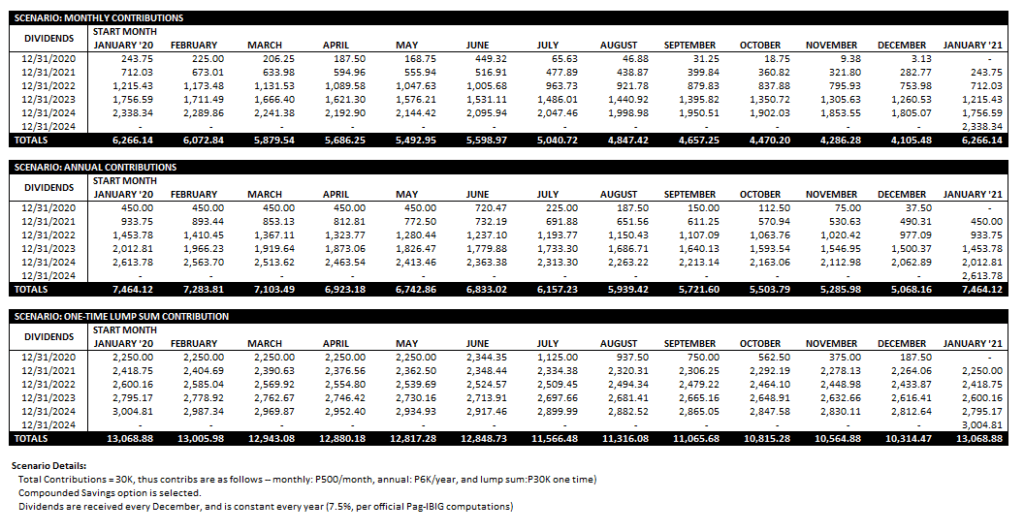

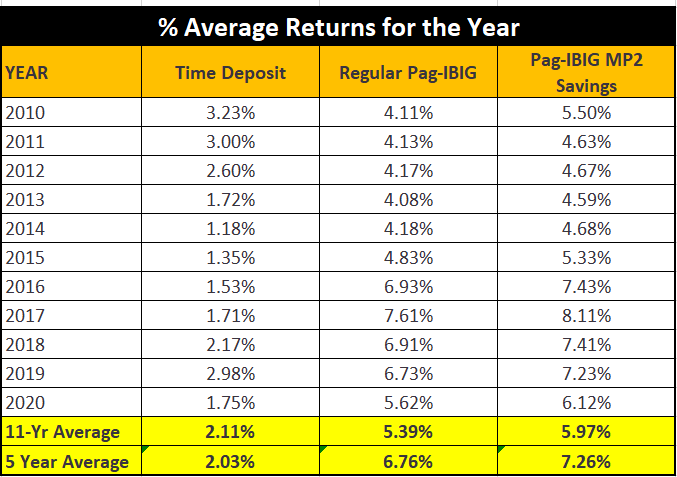

For instance, the recorded dividends of 2017 were 8.11%, and that of 2018 was 7.41%. Though, the dividend rates in 2017 were higher than in 2018.

The good thing is there is no such condition happening in the history of the PAG IBIG organization. It’s a fairly beneficial and successful investment saving agency, along with loan distribution. Hence, you can get your desired savings with a higher (7%) dividend rate.

Create Account: How to Apply for PAG IBIG MP2?

PAG IBIG MP2 Historical Dividend Performance

| Years | Dividend Rate (MP2) | Dividend Rate (of Regular Savings) |

| 2022 | 7.03% | 6.53% |

| 2021 | 6.00% | 5.50% |

| 2020 | 6.12% | 5.62% |

| 2019 | 7.23% | 6.73% |

| 2018 | 7.43% | 6.91% |

| 2017 | 8.11% | 7.61% |

| 2016 | 7.43% | 6.93% |

| 2015 | 5.34% | 4.84% |

| 2014 | 4.69% | 4.19% |

| 2013 | 4.58% | 4.08% |

| 2012 | 4.67% | 4.17% |

| 2011 | 4.63% | 4.13% |

Capital preservation

Suppose you’re in the retirement era of your life. Your first preference is not to initiate the long-term investment plan. Instead of it, you may move towards capital preservation. Though, your payments don’t waste their worth to inflation.

You may visit our official board or website without bothering about this risk and check our criteria. We can assist you in your savings plan with an annual dividend payout scheme. So you can keep your payments in the MP2 savings just for one year, and you can do this process as follows:

CHECK: PAG IBIG MP2 Enrollment

Long-term investment plan (over 10 Years)

The PAG IBIG loan owner is of age 20s or 30s. So you’ve got a longer period to invest your money. You can set your target of acquiring your furnished department or getting a brand new setup after your retirement. Now in your longest investment plan of more than ten years.

PAG IBIG savings offer isn’t more attractive. Even if it seems risky. You may go for investments for five years only. After every five years, you’ve to re-invest in your account. Meanwhile, you must remember that dividends change every year. You would never like to take the risk of joining it for a longer investment period, which may include two to three re-invested registrations.

These are the unusual risks of PAG IBIG mp2 savings. You may monitor these risks, understand the actual reason, get your emergency savings, and after five years with your intact invested payment, are the familiar and convenient ways to overcome your risk.

Furthermore, you must know that there are official rules and regulations to accomplish the PAG IBIG schemes. Since there are a few risk factors compared to traditional saving schemes. These factors may not be directly linked to your savings but can generally affect your whole savings period. So, in money investment programs, the risk factor is always involved.

FAQS

What are the potential risks associated with the PAG-IBIG MP2 Savings Program?

The primary risk associated with the MP2 Savings Program is the fluctuation of dividend rates, which depend on the financial performance of the PAG-IBIG Fund. Additionally, there is a risk of not being able to withdraw your investment before the 5-year maturity period, except in specific cases like unemployment, permanent disability, or retirement.

Can I lose money if I invest in the PAG-IBIG MP2 Savings Program?

While the PAG-IBIG MP2 Savings Program is considered a low-risk investment, there is always a possibility of lower returns due to economic factors or poor fund performance. However, the Philippine government guarantees the contributions made by members, meaning you will not lose your initial investment.

How does the PAG-IBIG Fund manage its investment portfolio to minimize risk?

The PAG-IBIG Fund follows a conservative investment strategy, focusing on low-risk investments like government securities, corporate bonds, and housing loans. By diversifying its investments across different asset classes, the fund minimizes the risk of loss and ensures stable returns.

Are there any government guarantees for the PAG-IBIG MP2 Savings Program?

Yes, the Philippine government guarantees the contributions made by members to the PAG-IBIG MP2 Savings Program. This means that your initial investment is protected, even in the case of poor fund performance or economic downturns.

What factors can affect the returns on my PAG-IBIG MP2 investment?

Returns on your MP2 investment can be affected by factors such as economic conditions, market interest rates, inflation, and the overall performance of the PAG-IBIG Fund.

How is the dividend rate for the MP2 program determined?

The dividend rate for the MP2 program is determined by the PAG-IBIG Fund’s financial performance and is based on the fund’s net income. Higher net income results in higher dividend rates for MP2 members.

How can I minimize the risks involved in the PAG-IBIG MP2 Savings Program?

To minimize risks, consider investing regularly and consistently over time, rather than making a single lump sum investment. Additionally, diversify your investment portfolio to include other assets like stocks, bonds, or mutual funds to spread risk.

How can I monitor the performance of my MP2 investment and stay informed about potential risks?

You can monitor the performance of your MP2 investment by regularly checking the PAG-IBIG Fund website for updates on dividend rates and financial performance. Additionally, stay informed about economic conditions and factors that may affect your investment.

Is it possible to withdraw my MP2 savings before the maturity period in case of financial emergencies?

Yes, you can withdraw your MP2 savings before the 5-year maturity period in specific cases such as unemployment, permanent disability, or retirement. However, you may receive a lower dividend rate if you withdraw early.

Can investing in PAG-IBIG MP2 be a good option for risk-averse investors?

Yes, the PAG-IBIG MP2 Savings Program can be a suitable investment option for risk-averse investors, as it offers relatively stable returns and has government guarantees for the contributions made by members. However, it’s essential to diversify your investment portfolio to minimize risk further.

Final Thoughts

Contribute to PAG IBIG savings MP 2 plan is usually risk-free for investors. You may have some risks related to our organization’s policies. Though you can satisfy yourself at first by monitoring our savings history, and future workouts, diversify your knowledge about savings. Your risks can be mitigated, and you may acquire healthy dividends on your investment.