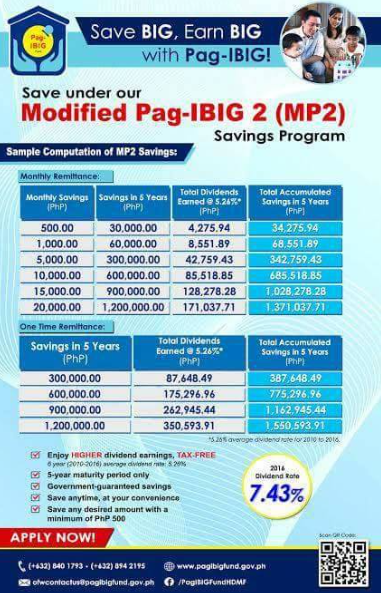

Learn about the Pag-IBIG MP2 Dividend Rates and how they can impact your savings under the program. PAG IBIG agency has acquired the highest dividend rates during Covid-2019. HDMF has expanded its funding coverage, including overseas Filipino workers (OFWs).

Likewise, the voluntary membership is open for all permanent Filipino abroad residents, Filipinos naturalized in other countries, and Filipino immigrants. In 2024, its Regular savings for PAG IBIG members reached 6.55%. Meanwhile, the Savings rate of Modified PAG IBIG 2 (MP2) is increased to 7.05% per annum.

Well, your MP2 Savings dividends are at the highest rate than the regular PAG IBIG savings plan. Besides high rates, these earned dividends are tax-free. Pag members enjoy dividends that are not less than 70 percent of their PAG IBIG’s net income annually. The Pag-IBIG MP2 Calculator is a tool used to compute the potential earnings of an individual’s savings under the Pag-IBIG MP2 program.

Contents

PAG IBIG MP2 Savings Dividend Rate Table 2024

PAG IBIG has assigned the MP2 Savings for members with a 5-year maturity savings facility. Those members who want to save and earn the highest interest with their regular savings must go for this program. Moreover, this saving program is allocated for retirees and pensioners who were former members of PAG IBIG.

| Year | Dividend rates of MP2 Savings |

| 2024 | 7.03% |

| 2023 | 7.03% |

| 2022 | 7.03% |

| 2021 | 6.00% |

| 2020 | 6.12% |

| 2019 | 7.23% |

| 2018 | 7.41% |

| 2017 | 8.11% |

| 2016 | 7.43% |

| 2015 | 5.34% |

| 2014 | 4.69% |

| 2013 | 4.58% |

| 2012 | 4.67% |

| 2011 | 4.63% |

PAG organization has set at least 70% of its yearly net income and awarded it to its members as dividends. It shows that you can save the higher dividends that you will earn. Here you have seen the MP2 Dividend Rates since 2011.

With Monthly Savings (PHP500), the annual Dividend Payout

You may know, with a 7.5% dividend interest rate, how your Savings can grow:

| Month Covered | Monthly Savings (MS) | Yearly accumulated MS | Cumulative Savings | Payout of Annual Dividend | TAV |

| Dec 2020 | 500.00 | 6000.00 | 6000.00 | 243.75 | 6000.00 |

| Dec 2021 | 500.00 | 6000.00 | 12,000.00 | 693.75 | 12,000.00 |

| Dec 2022 | 500.00 | 6000.00 | 18,000.00 | 1,143.75 | 18,000.00 |

| Dec 2023 | 500.00 | 6000.00 | 24,000.00 | 1,593.75 | 24,000.00 |

| Dec 2024 | 500.00 | 6000.00 | 30,000.00 | 2,043.75 | 30,000.00 |

| Total | – | 30,000.00 | – | 5,718.75 | 30,000.00 |

PAG IBIG 1 Saving Plan

PAG organization offers all OFWs the opportunity to enhance their hard-earned income at the highest rates they can earn from Philippines banks. In 2018, our agency PAG declared the dividend earnings (6.91%). This amount equals PhP28.23 Billion, which is credited to all these members in their accounts without tax charges.

| Monthly Savings | Yearly Savings – 20 years | Total Dividends (6.09%) | TAS in 20 Years – 6.09% Dividend Rate |

| 200.00 | 48,000.00 | 44,085.00 | 92,085.00 |

| 600.00 | 144,000.00 | 132,254.99 | 276,254.99 |

| 1,200.00 | 288,000.00 | 264,509.97 | 552,509.97 |

| 3,000.00 | 720,000.00 | 661,274.93 | 1,381,274.93 |

PAG IBIG is trustworthy because it offers all the legit plans to its members. Though, it guarantees to a refund of Total Accumulated Value (TAV) or Members’ savings. It comprises all dividend earnings, employer counterpart, and his/her savings on the following grounds:

CHECK: Pag ibig mp2 risk review

Saving plan of Modified PAG IBIG 2 (MP2)

The voluntary savings program Pag Ibig MP2 Savings provides a higher annual dividend rate than PAG. MP2 saving members have the opportunity for compounded dividend earnings or yearly dividend payout.

Monthly Payment:

| Monthly Savings | Yearly Savings – 5 years | Total Dividends (6.59%) | TAS in 5 Years – 6.59% Dividend Rate |

| 500.00 | 30,000.00 | 5,444.90 | 35,444.90 |

| 1,000.00 | 60,000.00 | 10,889.79 | 70,889.79 |

| 5,000.00 | 300,000.00 | 54,448.96 | 354,448.96 |

| 10,000.00 | 600,000.00 | 108,897.91 | 708,897.91 |

One-time Payment might be:

| Remittance | Total Dividends (6.59%) | TAS in 5 Years – 6.59% Dividend Rate |

| 30,000.00 | 11,276.57 | 41,276.57 |

| 60,000.00 | 22,553.13 | 82,553.13 |

| 300,000.00 | 112,765.67 | 412,765.67 |

| 600,000.00 | 225,531.33 | 825,531.33 |

| 1,000,000.00 | 375,885.55 | 1,375,885.55 |

On the MS maturity with a five-year plan, the members must decide to avail of the MP2 program and apply for a new MP2 account.

The Pag-IBIG I members should follow these things for withdrawal or Pre-termination of MP2 continuous saving plans. These requirements can be applied:

The members shall be allowed to do the following, with pre-termination of MP2 membership:

FAQs

What minimum payment can a member save in the MP2 saving Program?

The lowest saving plan in PAG IBIG is PhP500.

Does PAG IBIG assign a limit on saving?

No, PAG IBIG has not allocated any limit. You are proficient in saving as much as you want. If your savings payment exceeds PhP500,000, you must remit your amount by your manager’s or your personal check.

How can I save my amount under MP2 Plan?

PAG IBIG allows saving members’ amounts regularly with a minimum amount (PhP500) in their MP2 saving plan. Thus, you can save regularly on your Membership amount.