The PAG IBIG Loan Voucher is a writing that plays a significant role in the loan application process of the PAG IBIG Fund. It will be correct to say it is proof of the loan transaction between the borrower and the PAG IBIG Fund. It also signifies the terms and conditions of the loan.

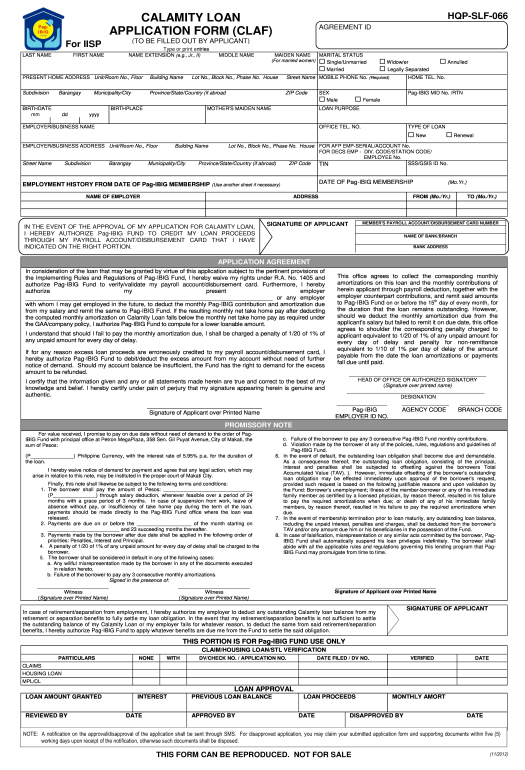

Here is a PDF of the Request Slip to get PAG IBIG Loan Voucher

In this article, we will take an in-depth look at the PAG IBIG Loan Voucher, its purpose, and the relevant and considerable information for it.

CHECK: PAG IBIG Loan Status

Let’s explore the details in the section below;

Contents

What is PAG IBIG?

Before we dive into the PAG IBIG Loan Voucher details, people must clearly understand what PAG IBIG is.

PAG IBIG stands for the Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno Fund, which is a government agency that provides affordable housing and financing options for its members.

Moreover, PAG IBIG operates under the Department of Human Settlements and Urban Development and is one of the largest government housing finance institutions in the Philippines.

PAG IBIG Loan is specifically known for its loan effectiveness. PAG IBIG Loan is a loan that the PAG IBIG Fund offers its members.

The loan can be used for various purposes, including home construction, acquisition, improvement, and personal expenses such as tuition or medical fees. The loan can be paid back over up to 30 years, depending on the purpose of the loan.

What is a PAG IBIG Loan Voucher?

A PAG IBIG Loan Voucher is a written explanatory document provided to the borrower at the time of loan release. It contains essential information about the loan, including the loan amount, interest rate, loan term, and monthly amortization.

PAG IBIG Loan Voucher: Importance

The PAG IBIG Loan Voucher is an essential document for the borrower and the PAG IBIG Fund.

For the borrower, it serves as proof of the loan transaction and outlines the terms and conditions of the loan. This information can be used to verify the loan amount, interest rate, and monthly amortization and as a reference when making loan payments.

Whereas, for the PAG IBIG Fund, the voucher serves as a record of the loan transaction and can be used to track the borrower’s loan payments. It also serves as a reference for future inquiries or concerns regarding the loan.

CHECK: PAG IBIG Online Verification

What information is contained in a PAG IBIG Loan Voucher?

A PAG IBIG Loan Voucher contains a variety of information about the loan. It has specified sections. Some of the informational sections include:

Application for the Loan Voucher

The PAG IBIG Loan Voucher is an essential document that must be completed and signed by borrowers applying for loans from the PAG IBIG Fund.

Below are the critical steps involved in the application process for a PAG IBIG loan voucher:

Eligibility Criteria

Before applying for a loan, borrowers must determine if they can apply for a loan from the PAG IBIG Fund. This may involve meeting specific requirements such as having a certain amount of contributions, being an active member of the Fund, and meeting other specific criteria depending on the type of loan being applied for.

CHECK: How to Apply for Pag Ibig Housing Loan?

Application form

Once eligibility has been determined, borrowers must fill out the loan application form the PAG IBIG Fund provided. The condition typically requires information about the borrower’s personal and financial background and details about the loan being applied for.

Submit the loan application form

After completing the loan application form, borrowers must submit it to the PAG IBIG Fund and any other required documentation, such as proof of income or collateral documents.

Approval for Loan

Once the loan application has been submitted, borrowers must wait for the PAG IBIG Fund to review and approve it. The approval process may take several days or weeks, depending on the type of loan and the volume of applications being processed.

Receiving the Voucher

If the loan application is approved, the borrower will receive a loan voucher from the PAG IBIG Fund. The loan voucher will outline the terms and conditions of the loan, including the loan amount, interest rate, loan term, and monthly amortization.

Acknowledgment

Before receiving the loan proceeds, the borrower must sign the Acknowledgment of Receipt section of the loan voucher. This legal document serves as proof that the borrower has received the loan voucher and acknowledges the terms and conditions of the loan.

Loan Proceeding

After signing the Acknowledgment of Receipt, the borrower will receive the loan proceeds from the PAG IBIG Fund. The loan proceeds will typically be disbursed to the borrower following the disbursement schedule outlined in the loan voucher.

Frequently Asked Questions

What is the purpose of a PAG IBIG Loan Voucher?

The voucher serves as proof of the loan agreement and provides information about the loan amount, interest rate, repayment terms, and other relevant details.

How do I obtain a PAG IBIG Loan Voucher?

To obtain a PAG IBIG Loan Voucher, you must first apply for a loan from the PAG IBIG Fund. Once your loan application is approved, the Fund will provide you with a loan voucher outlining the loan terms and conditions. You can also request a copy of your loan voucher from the PAG IBIG Fund if you need it for reference or documentation purposes.

Can I make changes to my PAG IBIG Loan Voucher?

No, you cannot change your PAG IBIG Loan Voucher once it has been issued. It is a legal document for your loan agreement with the PAG IBIG Fund, So any changes to the contract must be made in writing and agreed upon by both parties.

The Conclusion

Overall, the PAG IBIG Loan Voucher is an important document that plays a significant role in the loan application process of the PAG IBIG Fund. It serves as proof of the loan transaction between the borrower and the PAG IBIG Fund and outlines the terms and conditions of the loan.

Paano ulit mababayaran ung loan na di nahulugan Ng 1 year nawala KC ung voucher kng magkno ung babayaran ulit sa 3rd loan