Looking for affordable real estate properties? Check out PAG IBIG Acquired Assets! From residential to commercial properties, PAG IBIG offers a wide range of assets that are sure to fit your budget. Browse through their listings and find your dream property today.

PAG IBIG-acquired asset is a specific property that is officially foreclosed. The PAG IBIG housing loan (original) owner fails to pay his monthly loan amortizations. In such circumstances, the PAG IBIG organization offers a chance to delinquent borrowers to re-purchase their foreclosed houses after paying their penalties and amortizations.

Contents

About PAG IBIG-Acquired asset

Although PAG IBIG is a government corporation established to serve Filipino citizens as a retirement fund to encourage savings. Managing the savings program brings various beneficial plans for loan members. Now, members can proficiently avail of the low-interest loan for their home acquisition. You can repay your payments over the yearly period according to the real member’s selected terms.

When the original property owner can’t repay his loan, we have the official authority to foreclose that property. We have the authority to announce that any other desired person can accommodate this property after recovering the default housing loan. Once this is auctioned off to the Philippines community, the real owner loses his home property possession. Now it is considered as the PAG IBIG Acquired assets. There are 7400+ assets for sale currently under the PAG IBIG organization.

Advantages of Pag-IBIG Foreclosed Asset

Should you purchase the PAG IBIG Acquired Asset?

While thinking about purchasing the foreclosed asset from PAG IBIG, it may make sense for these two reasons:

The first and foremost point is that PAG IBIG provides this elegant property at lower prices than market values. Thus, financial instability is a great hurdle if you want to purchase a home or construct a furnished house for your family. Your dream of making a home is not yet fulfilled. So, you don’t need to buy a brand-new property to construct your home. Instead of wasting money on brand-new places, you have the best option of buying a foreclosed property. This property enables you to own a home with flexible monthly amortizations. Moreover, Pag-IBIG financially stabilizes you by providing a discount on payments.

Second, PAG IBIG is a great source of investment. Foreclosed properties are the trustworthy assets than other marketplaces. You become the owner of your own home with low rates. These property values are much lower than that in real estate. As real estate increases, its charges with the passage of time, this PAG-acquired asset is an affordable source for all communities.

Before purchasing your foreclosed property, you must know the risks of buying such a place or home. These properties are sold in terms of “AS IS – WHERE IS”, representing that these are secondhand properties. Or you may say there might be some damaged parts and imperfect regions.

If your required foreclosed property condition is not renovated and ideal, you have to repair it first and then occupy it. Now you can estimate your budget and purchase low price property. Then spent some money or fixed things monthly and then shifted into this home or got heavy rents from it. The home rent payments can fulfill your need to pay the PAG monthly amortizations.

Inspect your Foreclosed selected property for due diligence

It’s the vital step while buying the acquired assets:

How can you find the PAG-IBIG-acquired asset list for sale?

Pag-Ibig foreclosed propert… by Cherry Vi Saldua Castillo

This guidebook will assist you if you are unaware of PAG IBIG’s foreclosed property details. There are two important ways to find the foreclosed property listings of PAG IBIG:

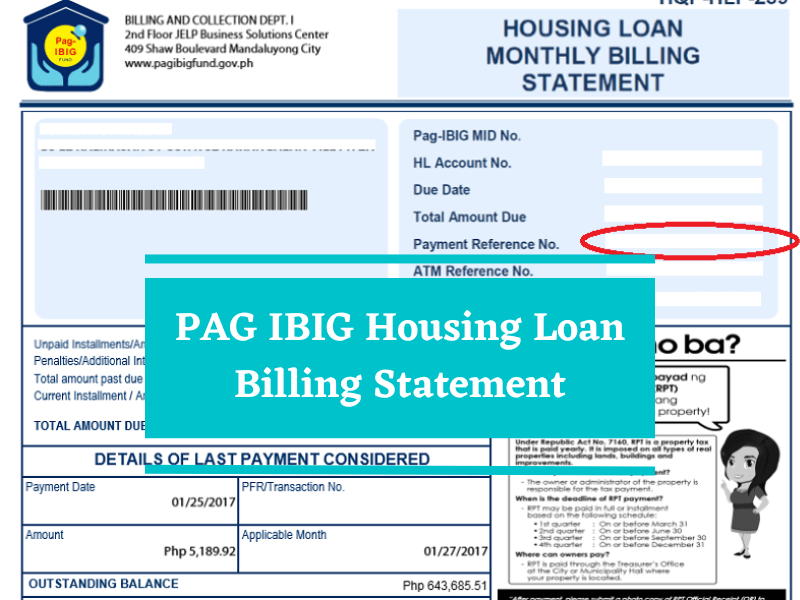

Once you acquire your foreclosed home property, the next step is to visit the office. Manage your time and visit the Mandaluyong; JELP Business-solution Center, second floor, 409 Shaw Blvd. (for Metro Manila properties). You can also visit your regional branch of Pag IBIG (for provincial properties).

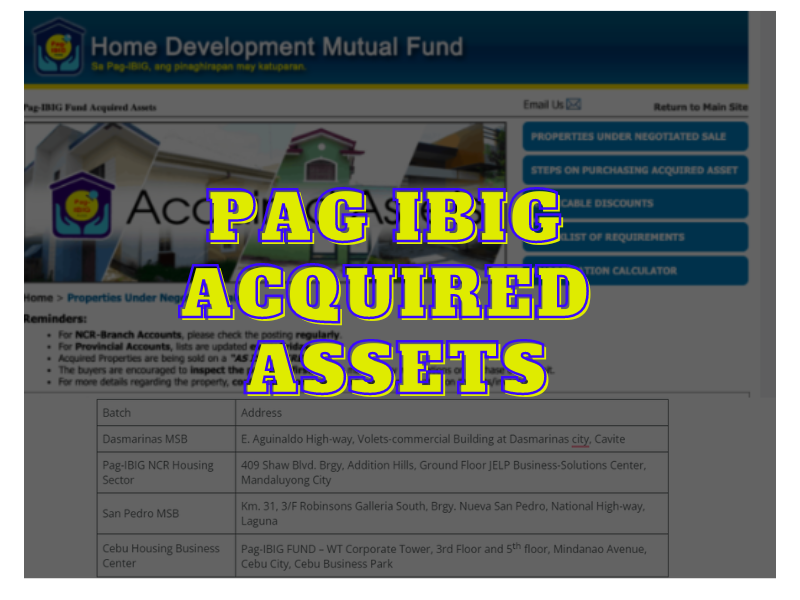

Negotiated Sale Acquired Assets list Details

The PAG IBIG loan owners are allowed to access the online list of acquired assets. For this purpose, check the PAG IBIG website’s foreclosed properties page. Moreover, the official site updates the list every Friday.

Find out the online Pag-IBIG acquired assets.

Find the criteria for further verification by pressing the “Search Button.” You can see all the foreclosed properties available at this time with these details:

Then Press on the button of “View Property” with:

The print button appears here; click it when you get the details and want to copy it. Your foreclosed property’s information is entirely available to you now.

Enlisted the PAG IBIG organization’s offices in different regions:

| Batch | Address |

| Dasmarinas MSB | E. Aguinaldo High-way, Volets-commercial Building at Dasmarinas city, Cavite |

| Pag-IBIG NCR Housing Sector | 409 Shaw Blvd. Brgy, Addition Hills, Ground Floor JELP Business-Solutions Center, Mandaluyong City |

| San Pedro MSB | Km. 31, 3/F Robinsons Galleria South, Brgy. Nueva San Pedro, National High-way, Laguna |

| Cebu Housing Business Center | Pag-IBIG FUND – WT Corporate Tower, 3rd Floor and 5th floor, Mindanao Avenue, Cebu City, Cebu Business Park |

PAG IBIG Acquired Asset Cebu

Over 225 PAG IBIG assets are considered Foreclosed Properties which are accessible to but in Cebu. The general location of the office is Pag-lBIG FUND, WT Corporate Tower, Cebu Business Park, 5th Floor, Cebu City.

| Acquired assets | Cebu City |

| 11 | Cebu City |

| 22 | Talisay City |

| 33 | Minglanilla, Cebu |

| 2 | Naga City, Cebu |

| 4 | Carcar City, Cebu |

| 54 | Lapu-Lapu City, Cebu |

| 1 | Cordova, Cebu |

| 9 | Mandaue City, Cebu |

| 12 | Consolacion, Cebu |

| 1 | Compostela, Cebu |

| 32 | Liloan, Cebu |

| 6 | Danao City, Cebu |

| 3 | Medellin, Cebu |

| 3 | Bantayan, Cebu |

| 32 | Bogo City, Cebu |

There are more than 309 acquired assets of PAG IBIG in different regions, including Cavite, Laguna, Bulacan, and others.

- 135 in Cavite

- 174 assets in Laguna, Rizal, Bulacan, and Metro Manila

These properties include; a row house, single attached, townhouse, lot-only duplex, quadruplex, and condominium unit.

Overviewing the PAG IBIG Acquired Assets for Auction List

Suppose you want to bid on your profitable acquired property under negotiated sale. It would help if you viewed the foreclosed properties for bidding on the genuine PAG website. Various people get confused about how they can check the public auction assets:

- Open your preferred page of PAG IBIG Acquired Assets.

- Now scroll down to the section of ‘Public Auctions Schedule’. Here is the division of the schedule into no discount and with discount properties.

- Tap on your required bidding in one section from the whole schedule. Once you have clicked on it, a pop-up comprises listing foreclosed properties and bidding guidelines.

- You must have a deep view of these guidelines and then fetch the appropriate listing. It would be more professional if you consider these things before bidding and buying:

- Property location

- Property number

- Transfer Certificate of Title (TCT)

- Minimum bid

- Type of property

- Appraisal date

- Floor area

- Lot area

PAG IBIG Acquired Asset for Bidding

There are officially recommended instructions for those viewers who have plans to buy the foreclosed property. Thus, they can learn how to bid for an acquired asset of PAG IBIG.

Bidding Requirements

Before going to the PAG IBIG assets in public bidding, you must follow these requirements and instructions. These instructions are required to prepare yourself for these acquired assets. So, you must prepare these documents and save them in your envelope.

Erratum Posting Analysis on PAG IBIG Site

Once bidding on the property, you just need to visit the PAG page almost five days before the auction schedule. Check the schedule if any owner or organization posted for erratum on the property listing. You can attend it before going to this upcoming update to the public.

An erratum is an asset comprising the properties list removed from the public bidding list. These properties are acquired assets but are excluded from bidding because various buyers purchase them before the auction. However, you can become a member of PAG IBIG assets by buying this property.

Furthermore, you have to verify that your required foreclosed property is still accessible for bidding and selling.

Must Attend the PAG-IBIG Scheduled Bidding

You have visited the bidding lists and finalized your property. The important aspect is approaching the PAG technical working group to submit your bidding sealed envelope. Once the bid submission deadline goes on, all new applicants’ sealed bids will open officially. Those winners who have accomplished their bids with higher rates will win the property.

Fortunately, suppose you won the bid, 10%of your bid price (bidder bond) would be considered your down payment for that foreclosed property. You total of 90% is left that you can pay in installments, in cash, or thru your PAG IBIG house loan. Moreover, PAG IBIG will return your bidding bond back if you’ve lost the bid. In the acknowledgment receipt, we will also update you about your missing information and official requirements. Hence, PAG IBIG is quite friendly for all workers.

How to buy PAG IBIG-Acquired Assets (Negotiated Sale)?

Here is detailed information about these footfalls:

Foreclosed Property reservation

It would help if you visited the PAG office leading the acquired asset sale. You go with these requirements (IDs & income source) for reserving your property:

You have effectively prepared your reserving documents; now, you need to fill out the Reservation Form. You would also get the form of Purchase which indicates your payment mode. You can select purchasing sources as installments, cash, or avail loan. Therefore, your payment modes might be different, with varying discount rates.

| Payment Mode | Discount Price | Payment Term |

| Cash | 30% | 1-month |

| Installment | 20% | Interest rate12%, over 12 months |

| PAG House loan | 10% | Below 70 age, over 30 years |

Purchasing requirements submission

These are requirements for those people who want to buy this property via a PAG IBIG house loan. Well, you have to submit these papers within 30 days of reservation fee submission.

Receive NOA (notice of approval) for the loan.

Once your loan is officially approved, then you will receive the loan NOA and Disclosure Statement. You have to pay your remaining charges and other documents within 30 days of getting this notification letter.

Mortgage document preparation and submission

Therefore, buyers need to submit their notarized Deed of mortgage documents. These documents accommodate your verification in the PAG IBIG organization.

Prepare your payments

Cash: this payment is accomplished within 30 days after your reservation date.

Installments: these are accommodated within 12 months in installments.

Tips for purchasing the PAG IBIG Acquired Assets

Conclusion

PAG IBIG-acquired assets are the best option for buyers looking to purchase properties at a lower cost. These properties are noteworthy investment assets for real estate investors and housing buyers. Hence, you have to find out the appropriate property, complete your requirements process, and bid on it. Finally, you can purchase this foreclosed property in your desired city in the Philippines via PAG IBIG.

meron po bang for closure kapayapaan bill. Canlubang calamba Laguna?

How to avail forceclosed housing

i am OFW ask ko lang how to avail foreclosed property

Steps to Avail a Foreclosed Property from Pag-IBIG:

Visit the Pag-IBIG Website or Office: Start by visiting the official Pag-IBIG Fund website to check the list of available foreclosed properties or visit any Pag-IBIG office. These listings are often updated, providing details such as location, floor area, minimum bid price, and the schedule for the public auction.

Attend a Public Auction: Pag-IBIG conducts public auctions for the sale of foreclosed properties. The auction details, including date, time, and venue, are announced on their website. Make sure to check if there are specific requirements for OFWs participating in the auction.

Review the Property Details: Before participating in the auction, thoroughly review the details of the property you’re interested in. Consider the location, condition, and any outstanding obligations tied to the property.

Inspect the Property: If possible, inspect the property personally or ask a trusted representative to do it for you. This will help you assess the property’s condition and evaluate if it meets your expectations.

Prepare the Requirements: For the auction, you’ll need to prepare several documents, such as valid IDs, proof of income, and a duly accomplished application form. As an OFW, you may also need to provide additional documents like your employment contract or a certificate of employment and compensation.

Bid for the Property: During the auction, submit your bid for the property you’re interested in. Ensure that your bid is within your budget and considers any additional costs such as repairs or renovations.

Settle the Payment: If you win the bid, you’ll need to settle the payment according to the terms set by Pag-IBIG. Payment options may include cash, installment, or through a Pag-IBIG housing loan.

Complete the Purchase: After payment, complete any remaining paperwork to transfer the property’s ownership to your name. This might involve signing a deed of absolute sale and registering the property under your name.