Do you want Pag Ibig MP2 enrollment and save your money? Learn about the benefits and requirements of the program, and find out how to enroll online or in person with our step-by-step guide. Start earning higher returns on your savings today!

COVID-19 has had a significant impact on our finances and lives. Maximum jobs and businesses are lost. Moreover, expenses are increased due to the pandemic. It has left societies struggling and has highlighted the importance of saving money.

In this regard, PAG IBIG has designed the saving facility, the MP2 program, with 5-year maturity. Along with regular saving plans for local employers, modified PAG comes with higher dividends. Thus, this optional savings system is opened for retirees & pensioners who are prior members of PAG IBIG and current loaners.

CHECK: PAG IBIG MP2 Computation

However, you’re an experienced user of PAG IBIG or a first-time investor in the PAG scheme. We’ve brought a guide on MP2 savings Enrollment. After looking at it entirely, you’ll surely be able to create your own account appropriately.

Contents

The Process to Check Enrollment Eligibility

For those investors who’re falling in any of the following categories, the MP2 savings database is waiting for you:

CHECK: Pag Ibig MP2 Dividend Rate

Furthermore, inactive loan owners who don’t clear their previous amortizations may also be capable of applying for these savings just after meeting their two years contributions. For your beneficial and secure saving experience, you must acquire your PAG membership with two years (24 months) of payments and then enroll in MP2 savings for account creation.

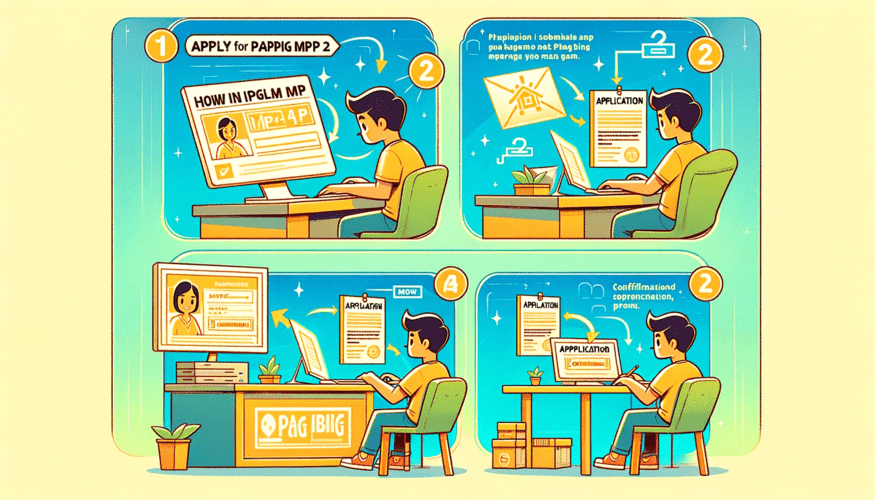

PAG organization has offered two major ways of enrollment in the MP2 Saving Scheme

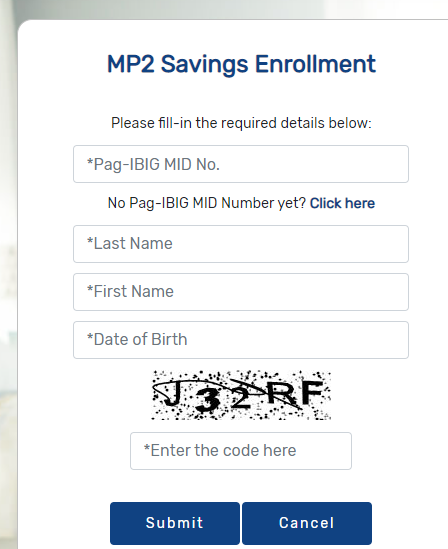

Online PAG IBIG MP2 Enrollment

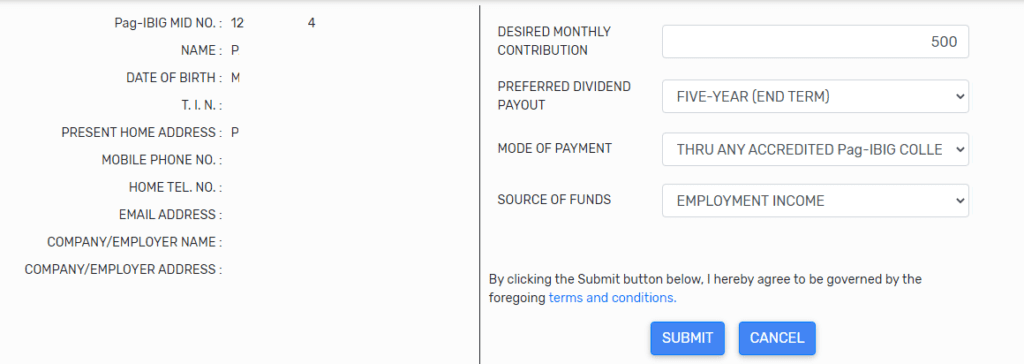

PAG IBIG investors should accomplish the enrollment procedure first. To enroll in a profitable savings plan by following and submitting the following requirements:

The Pag-IBIG MP2 Calculator is a tool that helps you estimate the potential earnings on your MP2 savings. It takes into account factors such as your contribution amount, contribution frequency, and the prevailing dividend rate.

In-Person Enrollment

You’re interested in creating your savings account locally. You may find the PAG-IBIG branch near your location. Know about our PAG official counter’s working hours. It’s compulsory to note the time schedule of our management. It may change on account of Philippines Government regulations. Besides our regulation, it was changed during the pandemic.

Acquire the PAG IBIG MP2 membership by following these steps:

Your MP2 registration accomplishes by submitting these required documents at the counter. Your investment criteria have been initiated. Make the most of your time with your selected payment methods for saving money.

Investor’s Funding Source

Where do you pay your MP2 Savings?

Online channels for payment submission in PAG IBIG2 saving

Over-counter payment submission in PAG IBIG

These are overall payment-accepting facilities for PAG IBIG members. Sometimes, new people pick any payment option unintentionally. You must select the ‘MP2’ savings accepting corner. Because some payment-receiving options never work for MP2 savings. So, if you choose these places, you can’t get your MP2 account to insert your specific code. This process will be opened into the right option, allowing you to continue saving with them.

Payment Modes for PAG IBIG ModifiedP2 Enrollment

- Personal payment way at PAG IBIG official center

- Salary deduction

- By your accredited collection partner

Our recommended way is the salary deduction. It’s quite a favorable and approachable method for investors of all categories. Though MP2 savings payment can be deducted from your wages and securely transmitted to your saving account. Notable, it’s the best option for entrepreneurs, freelancers and other self-employed persons to submit their savings contributions.

How to check your PAG MP2 Saving?

Well, you’re capable of keeping your payment record via your virtual portal. Check your savings income and transaction when needed. Don’t bother to visit the official corner for this purpose. You just get your PAG membership account in your system. Your portal lets you know about your dividends, such as:

FAQs

Who is eligible to enroll in the MP2 savings program of PAG IBIG?

This scheme is launched for all groups, including Pensioners, OFWs, employed & unemployed workers, retirees, and former and current loan owners.

Can I enroll in the PAG MP2 savings virtually?

Yes, MP2 enrollment is accessible physically and virtually. Simply open your PAG IBIG account > Select the MP2 enrollment letter > Fill it > Submit with the salary deduction method (optional).

How is MP2 enrollment more beneficial?

Investors can save their money by simply signing in to MP2 saving programs. This scheme brings higher dividends, flexible contributions, tax-free, and short-long term maturity. Moreover, members can access this enrollment both online and offline. So, this enrollment is more reliable than the PAG IBIG regular saving.