The pivotal supportive funding agency, PAG IBIG, is owned by the Philippines Government. It’s organized under the Urban & Housing Development Coordinating Council.

Hence, it maintains the funding and loan process in the best way. Loan owners are acquiring the easiest ways to approach their loans. They can utilize the dedicated online way to pay concerns and check their PAG IBIG membership.

Contents

- 1 Payment Contribution Channels of PAG IBIG

- 2 Online Payment Methods

- 3 Conclusion

- 4 Author

Payment Contribution Channels of PAG IBIG

PAG IBG loan-qualified members are allowed to pay their funds in several ways. You may acquire your fascinating online or offline concerned channels.

The online payment approach is more trustworthy and beneficial for loan contributors. So, here are the requirements of a direct online system to clear both regular savings as well as MP2 savings.

Online Payment Methods

Remember, while following the online services or third-party systems for your payment contribution, this record may take two to three working days. It may take a longer period to process your record as well.

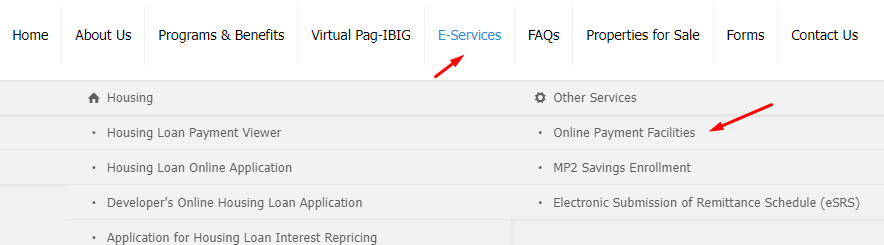

Virtual PAG IBIG

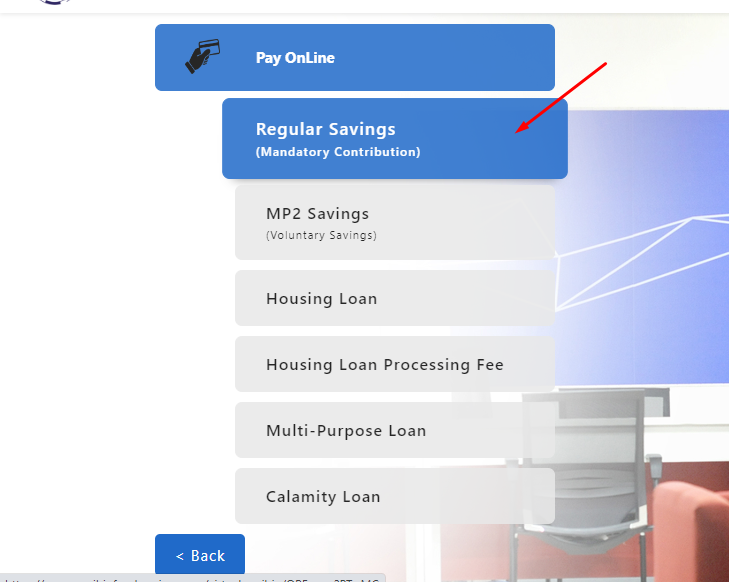

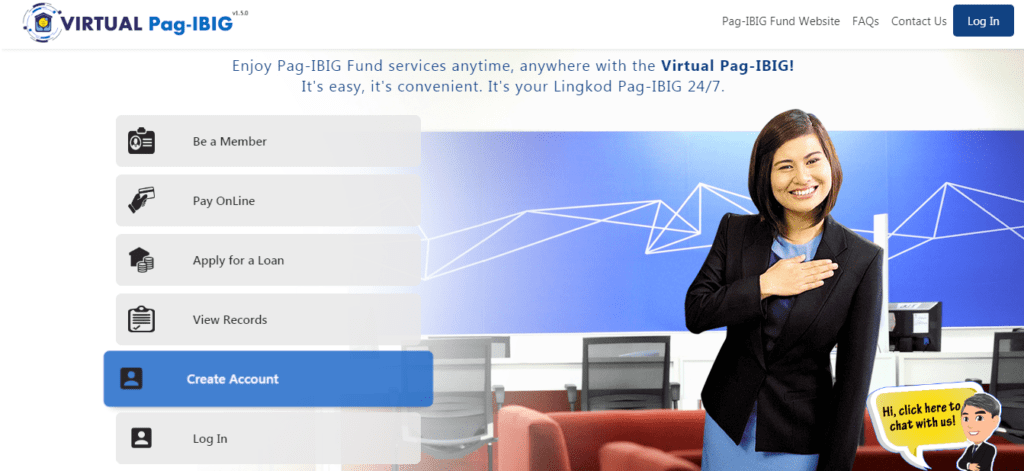

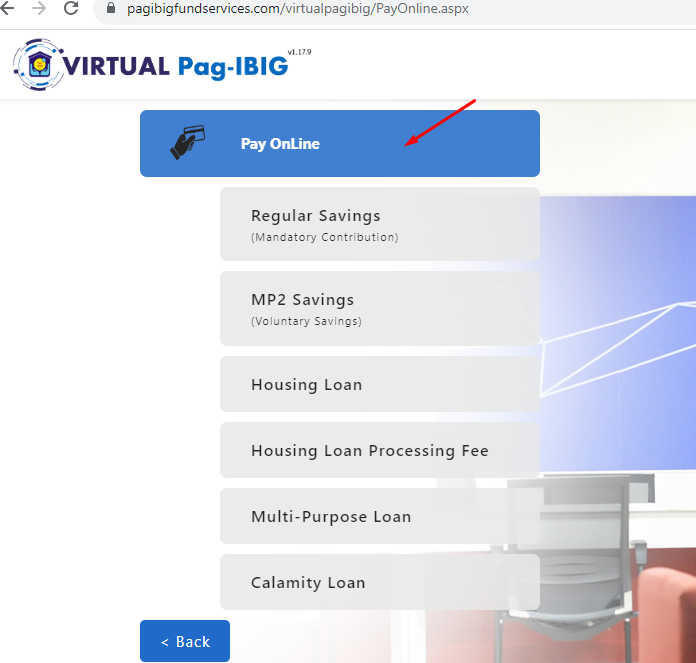

PAG membership owners can accomplish their whole transactions via virtual accounts. These transactions can be from online applying for the loan application to check the payment records. Therefore, you can initiate your loan process without your physical presence at the PAG IBIG branch.

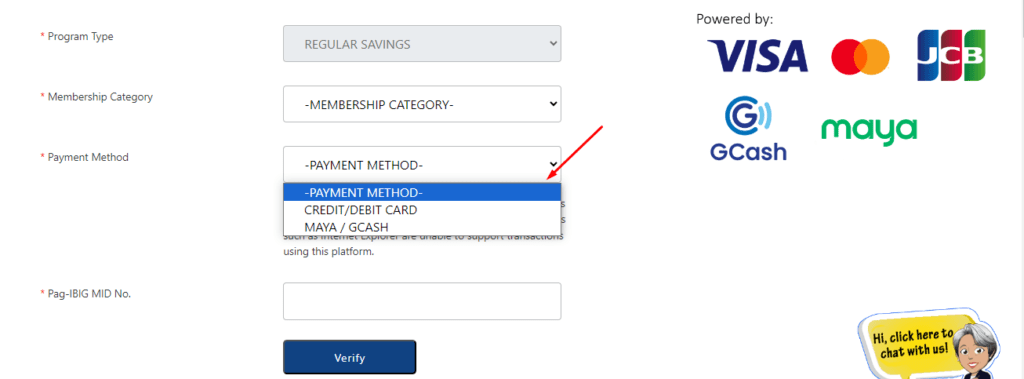

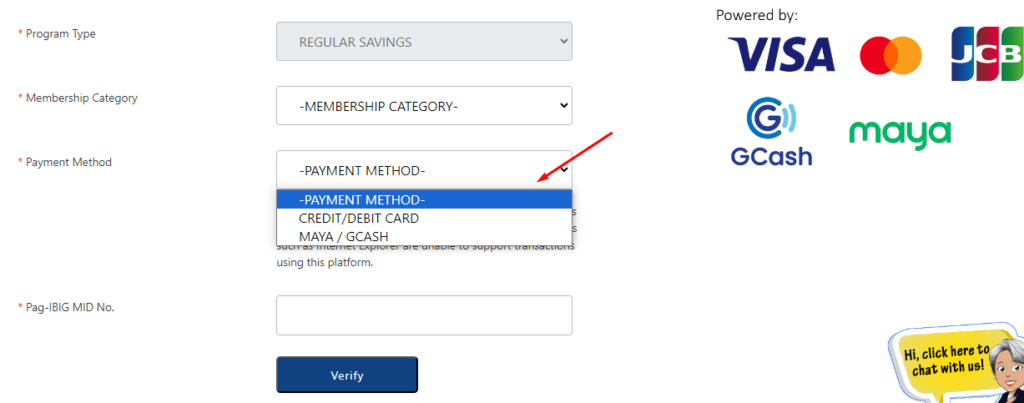

However, you may achieve online services to pay your loan by G-Cash, Paymaya account, or credit or debit cards. For all these options, you must create your virtual account. Thus, your payment process will start as early as you can move to your virtual account.

Contribution Method

When we explored and tested the virtual payment method, it proved noteworthy for our users. After that, we brought various other payment ways. These are essential because multiple people from different categories come to join for loan membership. Everybody can’t access or go for virtual means at our official corner. Sometimes, you may face the workload on each platform. So, you can access anyone from multiple options.

Pay PAG-IBIG Loan with G-Cash

For PAG IBIG members, this method is accessible for Touch and Globe Mobile prepaid and postpaid subscriptions. In this regard, you’ve to utilize your registered sim for G-Cash.

It’s usually free of charge. Once you convert your SIM to this account. Then you can transfer cash to GCash. There are multiple further options to do this, including any G-Cash channels, Banc-Net ATM, and online bank transfers.

Full details: How to Pay PAG IBIG Housing Loan Thru Gcash?

First, you need to enter this channel for funding outflow. Next time you may have some funds in your G-Cash account. Thus, you can now access your upcoming payments like monthly loan amortization.

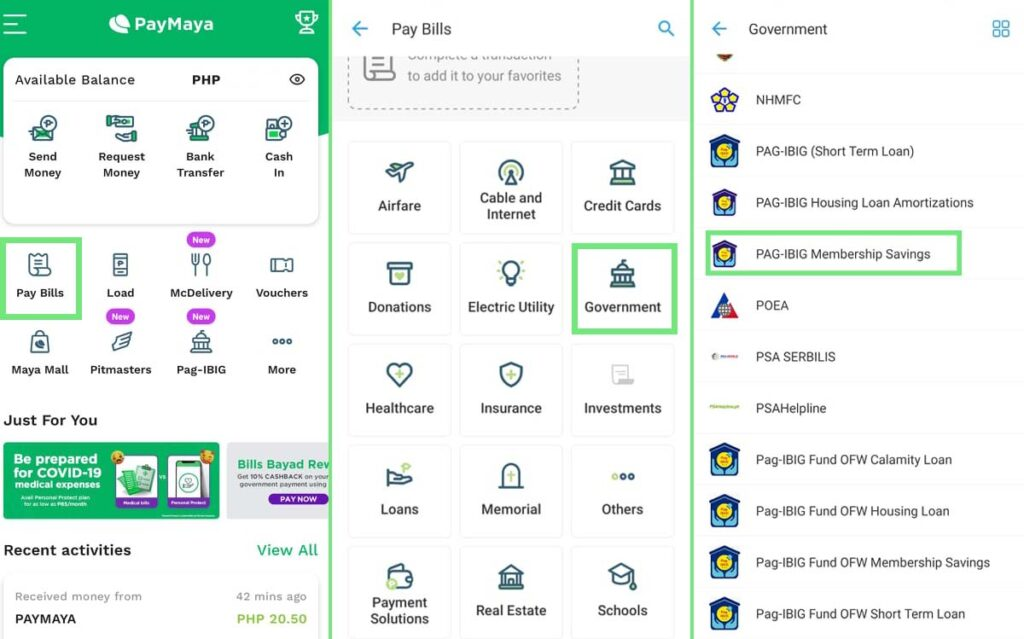

PayMaya Payment method of PAG IBIG

PAG IBIG members have great access to online loan payments via PayMaya. If you have no credit card, then you can pay your payments using this method.

Thus, its payment method is similar to that of G-Cash. The only difference is instead of choosing the card, you may go to ‘Pay-Maya’.

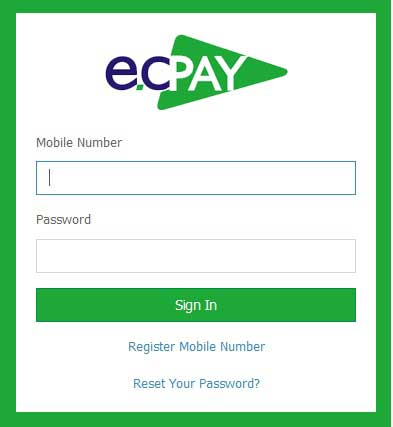

PAG Loan Payment via ECPay in 7-Eleven Branch

However, over 9000 PAG IBIG partners utilize the ECPay throughout the Philippines. You can access to ECPay payment submission facility on your mobile phone online. It’s not only restricted to 7-Eleven branches. So, we’re providing its easy-to-apply payment method in the following steps:

Online Payment of PAG IBIG Amount by Cryptocurrency & Bitcoin

Although PAG IBIG is the one-stop online platform for loan holders in the Philippines. Here we’re going to teach you a great way to PAG payment transfer via credit cards along with crypto-currency.

Eventually, you will be proficient in paying your monthly amortizations and savings into your regular savings as well as MP2 savings programs.

Process of online enrollment for payments

Coins.ph App

This application is just like G-Cash-e-wallet. It allows payments that are associated with government-owned agencies. For registering your account here, you can also use the services of 7-Eleven stores as well.

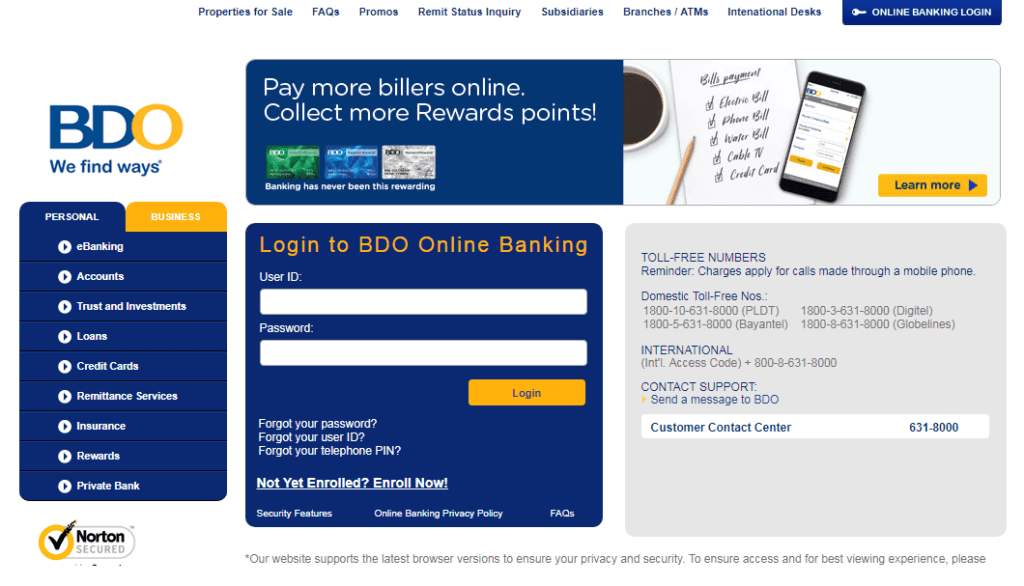

BDO online PAG IBIG Payment Approach

Membership owners have access to another convenient way for their payment submission online. The key point is that this method applies only to MP2 payments.

When you open the log-in of your PAG IBIG ownership. Must click on MP2 contribution and use this method only for the highly earned dividend rating of Modified PAG 2 savings.

Conclusion

PAG IBIG online payment is a hassle-free and convenient way. This system ensures that you are a satisfactory financial funding agency member. However, we’ve provided the most trusted ways for online payment submission. You must fulfill the payment requirements, submit your amounts, and save time.