You acquire the PAG IBIG Housing Loan payment. Hence, it’s a grand amount, and now you are looking for the appropriate repayment plan. Whatever the reason is the majority of Filipinos are hesitant about online transactions. They might be scared of losing an enormous amount somewhere between the online systems. For instance, your interest package is in P2,000 – P35,000 range.

Contents

How to Pay PAG IBIG Housing Loan Thru Gcash?

The repaying amount is quite considerable, so he will not be confident in an online transaction, especially if he is PAG-IBIG’s new user. In this way, he has to find out the physical counter for repayment monthly.

This approach is quite expensive and a hassle. He must visit an appropriate office, wait for the long queue to finish, and then pay his amount. Thus, Counter payments are consuming your time and are inconvenient.

CHECK All Pag Ibig Methods of Payment

Steps to Pay Loan through GCASH

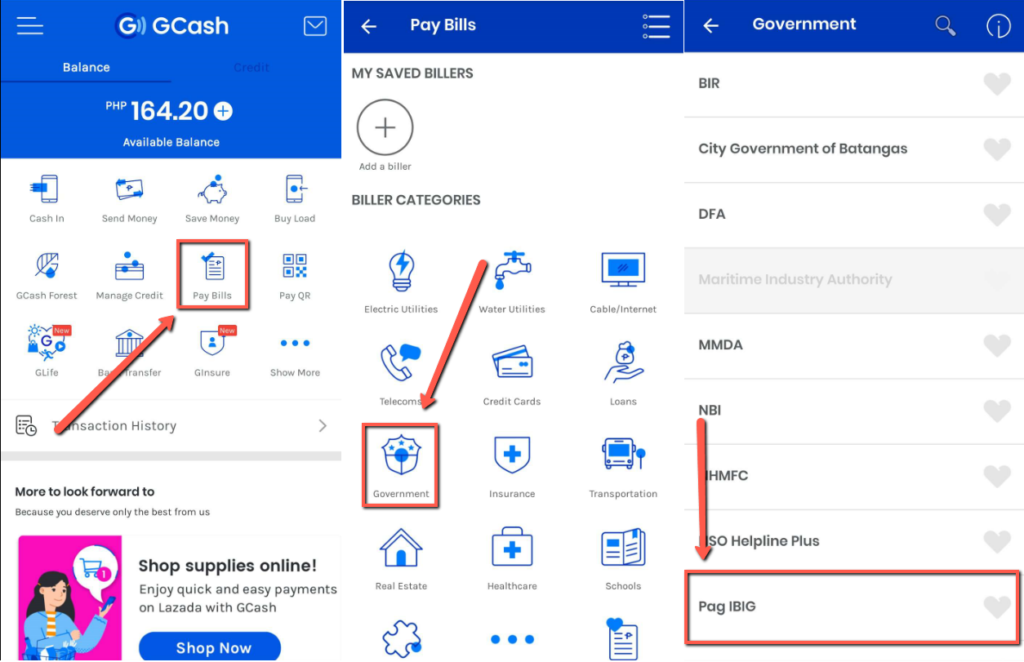

In-depth details of using the Gcash App are accessible in steady steps;

CHECK: PAG IBIG Housing Loan Payment Verification

Before using your Application, you must submit the required repayment amount to your wallet. The next vital point is to ensure that you have an activated Gcash application on your phone. Next is the most important phase of linking your bank card with your Gcash profile.

On the other hand, online amortization transactions are undoubtedly reliable, quick, and more valuable. You get rid of the long queue, traveling to official counter troubles, and time consumption. Furthermore, online availability is cheap and reduces your complexities. The most diverse way to lessen the risks is to pay your PAG IBIG Housing Loan through a Gcash application.

Advantages of ‘Paying PAG IBIG Housing Loan Thru Gcash’

FAQs

What is required to Gcash login and pay loans?

Gcash is designed as a mobile wallet. The PAG IBIG employers need to install this Application on their phones. Login to their personal contact number and enable a PAG account to perform their Housing loan payments. Moreover, now customers can get this Application on their PC for PAG payouts.

Can I pay my loan online instead of counter payments?

Yes, you have various options to pay your PAG payments online. The more tranquil, secure, and convenient way is the Gcash payment tactic.