PAG IBIG has introduced a versatile saving Loyalty card for multiple purposes. This Loyalty Card functions as a discount card that offers exclusive benefits to restaurants, hospitals, groceries, tuition, fuel, and over 350 other partner establishments nationwide. Hence, you’re capable of upgrading your loyalty card to an updated form that’s used as your cash card.

Contents

What is PAG IBIG Loyalty Card?

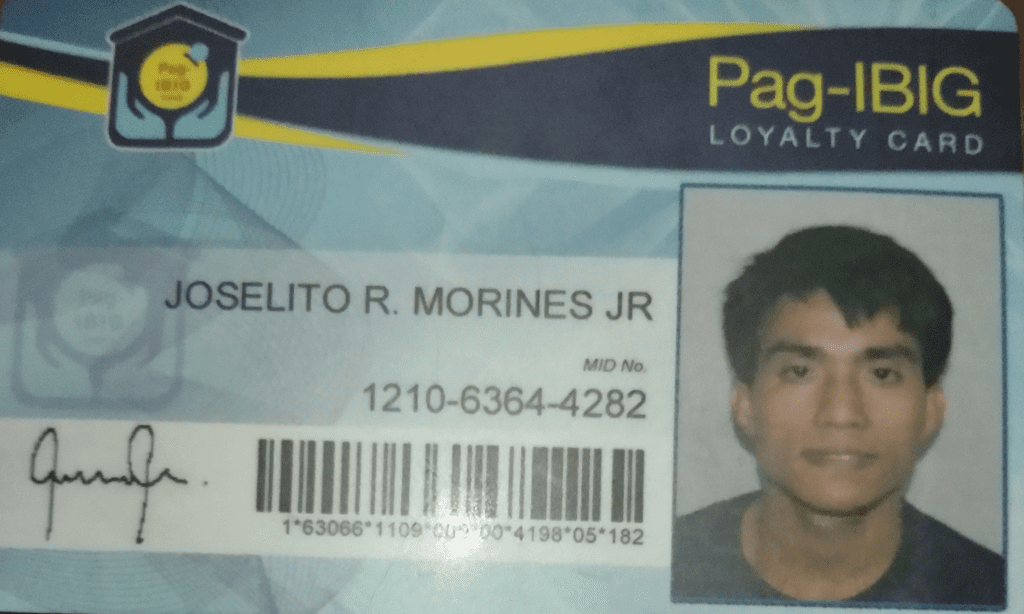

The loyalty card is a Government-issued identification card for all members that serves as their association with the PAG funding agency. This card brings access to unlimited advantages, provident benefits, calamity loans, housing, and more.

Hence, Loyalty card stands as one of the most affordable government IDs in the Philippines. It serves as a secondary valid ID for PAG IBIG borrowers. You may enjoy this no-expiration card and one-time purchase with rewards, discounts, and financial functionalities.

CHECK: Is PAG IBIG Loyalty Card a Valid ID?

Furthermore, we’ve upgraded our system; now your loyalty card is effectively associated with Asia United Bank (AUB) and UnionBank. This card extends its utility beyond the PAG IBIG agency to plenty of other nationwide establishments. Therefore, PAG IBIG membership owners are capable of renewing their cards in person or online every five years.

So, based on your membership registered name, signature, and clear photo, you can obtain this card. Afterward, your cashless transactions, loans, and saving withdrawals are possible at affiliated establishments.

LEARN HERE: How to Apply for a PAG-IBIG Loyalty Card?

Why consider getting PAG IBIG Loyalty Card?

What are the requirements for getting a PAG IBIG Loyalty Card?

Process of getting Loyalty Card for non-membership Applicants:

Activation Process: How to Activate PAG IBIG Loyalty Card?

How can you get your PAG IBIG Loyalty Card?

Process for Active PAG Membership Owners

This process is tranquil if you’re an active member of the PAG IBIG loans agency:

CHECK: How to Activate PAG IBIG Loyalty Card Plus?

Process for Employers

Well, employers are proficient in arranging loyalty card enrollment of their employees in PAG IBIG. Let’s facilitate your employees by following the process:

Member’s PAG IBIG Loyalty Card connection to Bank

If you’re enrolled in Asia United Bank or Union Bank, your loyalty card facilitates you more. However, you may know how you can get your card associated with your banking service.

Loyalty Card powers by Union Bank

PAG IBIG collaborated with Philippines UnionBank on June 4, 2021. This bank has served over a million PAG IBIG Loyalty card holders. Hence, you may explore it’s additional factors:

PAG Loyalty Card Powers by AUB

FAQs

How quickly may I get my PAG Loyalty card?

You, as a minimum of one (1) month of contributions, are qualified to acquire your Loyalty Card. Once you complete your Application process for this card you may obtain it immediately.

Can I use my PAG IBIG Loyalty card for online purchases?

Yes, this card allows you to make online purchases, cashless payments at point-of-sale systems (POS), cash withdrawals at ATMs, and other basic services.

How can I get discounts with a PAG Loyalty Card?

You must present your cards at affiliated establishments during purchases. Then you should check the terms and conditions of each promotion or discount because they may vary according to services. Once you’ve established your loyalty card verification and discounts & rewards, you can entirely get the benefits of it.

Final Verdict

Ultimately, when you’re willing to get your PAG IBIG loyalty card, you need to download the application form for this card. Then, fill up (complete related requirements) and submit it to the nearby PAG IBIG office. When our system captures your photo and verifies biometrics, your card process is accomplished. Though after receiving a claim stub, card release times vary, but generally take 15 to 45 days. You can obtain and enjoy your Loyalty Card is a valuable asset for your routine usage.