You’re a dedicated member of PAG IBIG and diligently paying your contributions. Although having a precise contributing career with PAG, various members want to know the entire status of their contributions. Along with unlimited PAG benefits, you can claim contributions when needed.

However, you may wonder where your contributions or savings went or whether you’ve contributed enough or not. So, if you’re eager to know about withdrawing your contributions. We have brought the efficient claiming process of including the solution to all these queries. You can learn the requirements and how to claim your PAG loan savings contribution.

CHECK: How to Compute PAG IBIG Contribution?

Contents

Provident Benefits Claim of PAG IBIG

PAG IBIG loan owners have the great option to withdraw their maturity savings with regular savings. However, you have to accomplish the entire life span of their selected option.

You are informed that claiming your benefit of PAG contributions is represented as the PAG IBIG Provident claim. Thus, PAG brings rewards for every loan participant on contributes funds here. To achieve this claim, you need to fulfill the eligibility criteria.

CHECK: How Much Are PAG IBIG Contributions?

Claiming your PAG IBIG Membership Benefits Guide

PAG IBIG allows you to claim or withdraw your funding due to any of these circumstances:

CHECK: Pag IBIG Contribution Table 2024

How and When you can Withdraw PAG Contribution?

Once you’re paying your PAG IBIG contributions per month and the whole year, you’re officially eligible for a Benefits Claim. We’re delivering various ways to claim your withdrawal:

Full: How to Withdraw PAG IBIG Contribution?

Optional Withdrawal

This loan is accessible only when a member has accomplished his loan without gaps. It shows that when your membership reaches 18 years, this loan payment will be automatically claimed according to your past contribution. It may decline if you already omitted your payments.

To acquire the optional withdrawal or claim, you must fulfill the following requirements:

Requirements for qualifying for the Optional Withdrawals:

READ: Can I Withdraw my PAG IBIG Contribution?

Membership Maturity

Usually, PAG IBIG allows members to claim contributions after 20 years. Hence, you can proficiently withdraw it regardless of intervals or contribution gaps. Moreover, PAG allows the Overseas Program member to claim after 5-10-15-20 years.

Your membership maturity is accomplished by 12 months x 20 = 240 months > Total 240 contributions

Requirements for qualifying for the Membership Maturity:

Retirement

There can be two sorts of retirement.

Compulsory Retirement

In the Philippines, the mandatory age of retirement is 65. However, it’s compulsory retirement that is announced by laws. However, to get your compulsory retirement provident benefits to claim, you have to accomplish these requirements:

Optional Retirement

This retirement grants Members 60 years of age. Though, it’s also profitable to acquire your savings benefits. Just prepare these documents:

ALSO SEE: How Much PAG IBIG Contribution For OFW?

Insanity or Entire Disability

If PAG IBIG members have some mental or physical disability, they are eligible to claim for their loan savings. For applying the Provident Benefits Claim, they need to prepare these documents:

Separation from Job due to Health Issues

Suppose you’ve suffered critically and can’t continue your Job. Unfortunately, you’ve to leave your Job. Now you’re able to claim for your contributions. You can prepare these documents for the appropriate claiming process:

Death

After the PAG IBIG member’s death, his provident benefits claim will be automatically provided to his beneficiaries. You’ve to prepare these requirements for legally claiming your loan:

Departure from the Philippines

Various people leave their country due to abroad settlement, food, jobs, or other reasons. If you’re going abroad permanently, you can withdraw your contribution. Before your departure, you need to fulfill the PAG IBIG requirements for your convenient claiming:

How can you withdraw your PAG IBIG contributions?

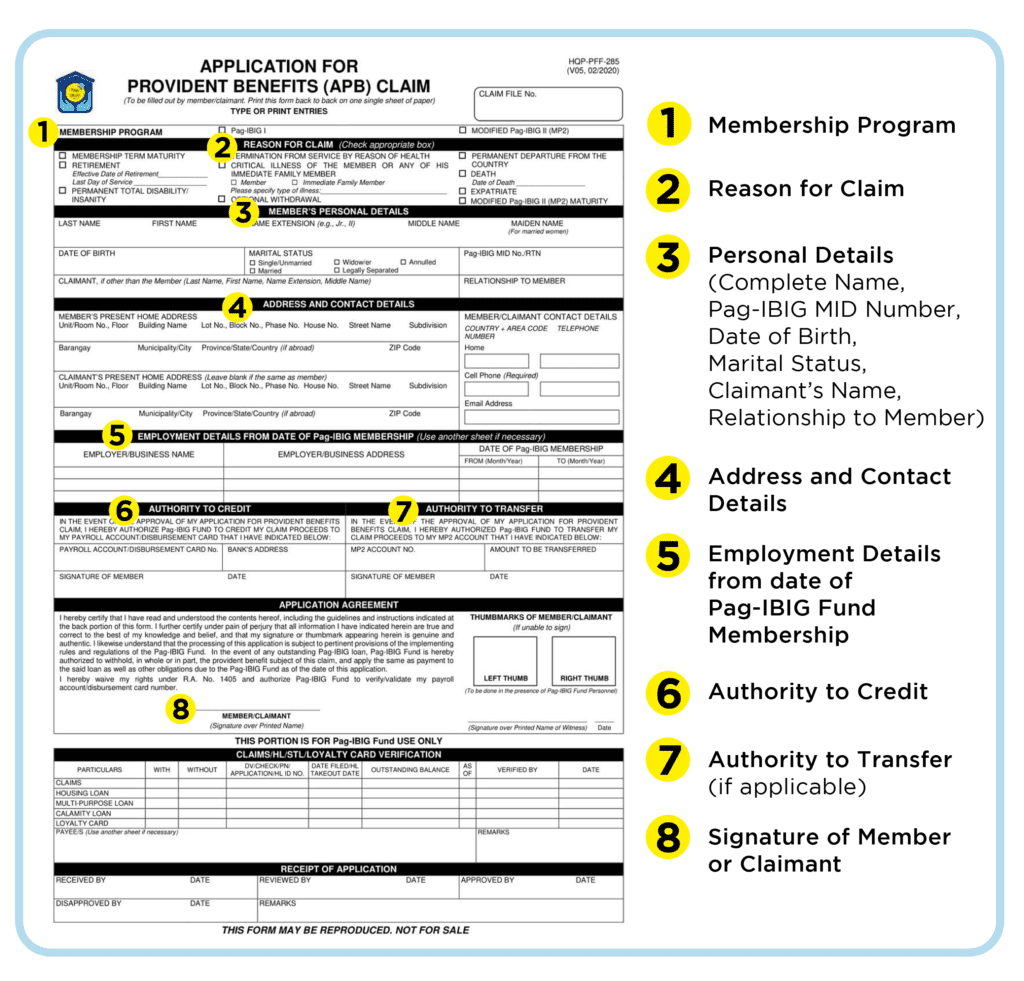

Here you may learn about how you can claim your funding at PAG IBIG.

Along with your documents, you must attain your IDs:

Guide on PAG IBIG Claiming Online

Full guide: How to Check PAG IBIG Contribution Online?

FAQs

Am I capable of claiming my PAG IBIG contribution?

PAG IBIG allows you to claim on accomplishing the 180-240 contributions. Then you can withdraw your payments with the claim’s policies and terms.

How to apply for my PAG IBIG contribution claim online?

Your PAG IBIG virtual account access, lets you open your membership profile, open and fill up your provident benefits claiming application, and submit it. You’ve successfully applied for your contribution claim.

How much benefit savings may I claim from PAG IBIG?

The Member’s provident benefit depends on his entire contributions. So, you can calculate your entire claimable amount:

PAG IBIG claim benefits = Member’s entire contribution + Dividend high Earnings + Employer’s Contribution

Remember, PAG IBIG dividends may alter every year. So your real contribution can be changed and isn’t completed.

Conclusion

Making your claim application for PAG IBIG contributions is a vital step to ensure your benefits. However, you need to know the eligibility and documentary requirements to apply for your claim. Then you can get your benefits by simply claiming your PAG contributions.

REF: https://www.pagibigfund.gov.ph/ProvidentBenefitsClaim.html