Checking PAG IBIG contribution online is a straightforward procedure that can help you by offering offers convenience, accurate information, and easy tracking.

Pag-IBIG is a popular savings and loan program in the Philippines that is mandatory for employees, self-employed individuals, and voluntary members to contribute to. The popularity of Pag-IBIG contributions can be attributed to several important factors.

CHECK: PAG IBIG Contribution Calculator

Contents

SHORT METHOD to Check Pag Ibig Contribution

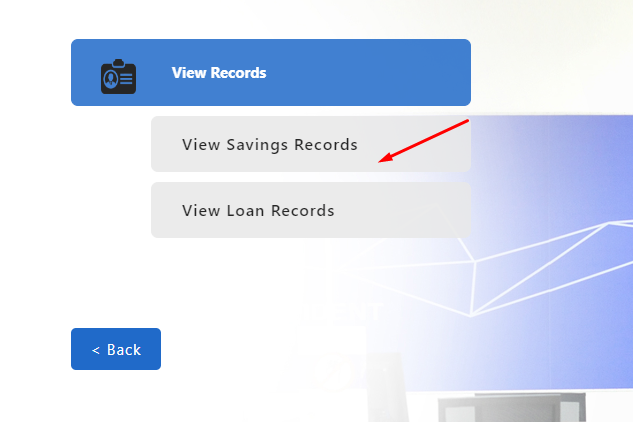

STEP 1: VISIT: https://www.pagibigfundservices.com/virtualpagibig/ViewRecords.aspx

STEP 2: Click on View saving records

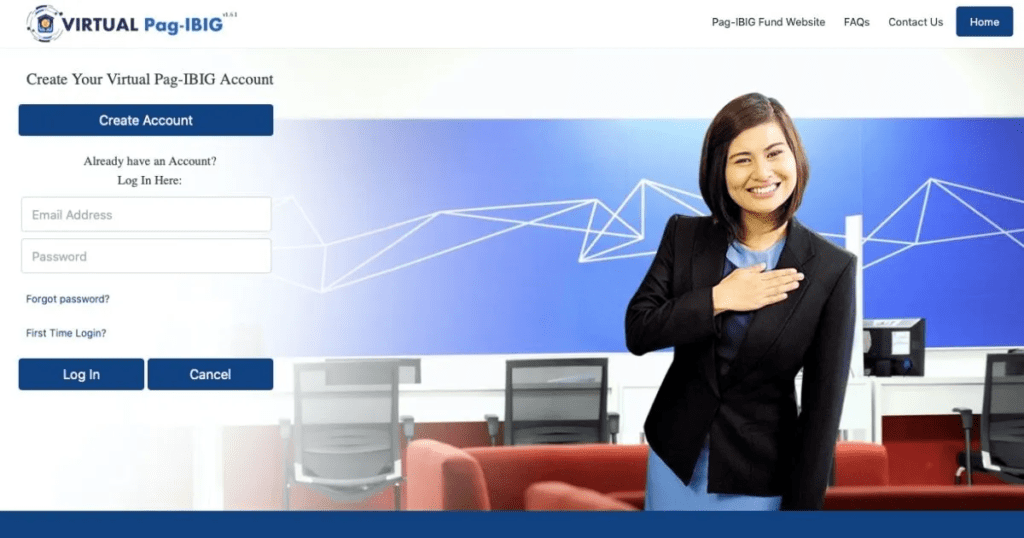

STEP 3: Log in to your Virtual Pag Ibig Account

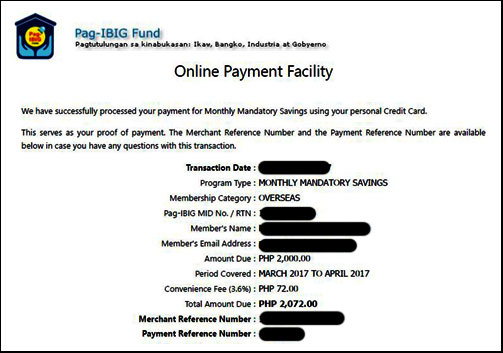

STEP 4: Now Check your savings contributions.

CHECK: Pag IBIG Contribution Table 2024

Employers are required to deduct and remit Pag-IBIG contributions from their employees’ salaries. This ensures that employees are enrolled in the program and have a savings and loan program to rely on.

To narrate the detailed procedural guide to you, here is a little attempt to provide you most summarized information in the next section;

RELATED: How Much Are PAG IBIG Contributions?

Step-by-Step Guide to Check PAG IBIG Contribution Online

If you’re a member of the Pag-IBIG Fund in the Philippines, it’s essential to regularly check your contributions to ensure that you’re up to date and eligible for benefits.

Fortunately, checking your Pag-IBIG contribution online is easy and convenient. In this article, we’ll walk you through the steps to check your Pag-IBIG contribution online.

Step 1: Website Link

The first step is to visit the official website of Pag-IBIG Fund. The website is www.pagibigfund.gov.ph.

It would help you to locate the rest of the process more comprehensively.

The whole process is not that tricky; it accompanies quite a logical and straightforward procedure

Step 2: E-Services

After reaching the website, click on the e-Services tab. Once you’re on the Pag-IBIG Fund website, click on the “e-Services” tab at the top of the homepage.

Step 3: Be Member

Select Membership Registration from the e-Services menu. For this precisely, tap “Membership Registration” and then click the “Online Registration” button.

Step 4: Fill Form

The next step falls for account creation. To create an account, you must provide your personal information, such as your name, birthdate, and contact information. You will also need to create a username and password.

Step 5: Account Login

Afterward, log in to your account. Once you’ve created an account, you can log in by entering your username and password; that would be very easy to navigate. Enter your Pag-IBIG MID number, last name, first name, and date of birth. You’ll also need to input the captcha code to confirm that you’re not a robot.

Step 6: Contributions Page

This step will help you to check your contributions. Once logged in, you can narrow your Pag-IBIG contributions by clicking the “Membership Savings” tab. Here, You can easily see your total accumulated savings, monthly donations, and the total amount of assistance.

Step 7: Check Status

At the last stage, you can check your loan status. If you have any outstanding loans with Pag-IBIG Fund, you can also check the status of your loans by clicking on the “Loan Balance” tab. However, you might skip this step if you find it unrelated.

RELATED ARTICLE: How to Withdraw PAG IBIG Contribution?

Reasons to Check PAG IBIG Contribution Online

There are several reasons why checking your Pag-IBIG contribution online regularly is essential. Some of them are narrated to you in the section provided below;

Accuracy and Credibility

Checking your Pag-IBIG contribution online helps you ensure that your donations are accurate and current. It’s essential to ensure that your employer deducts the correct amount from your salary and remits it to the Pag-IBIG Fund. Your contributions must be corrected to avoid delays or even loss of benefits.

Eligibility Verification

By checking your Pag-IBIG contribution online, you can verify if you have made enough contributions to qualify for benefits such as housing loans, calamity loans, and retirement benefits. You can also check if there are any discrepancies or missing contributions that could affect your eligibility for these benefits.

Checking the Status of the Loan

If you have any outstanding loans with Pag-IBIG Fund, checking your contribution online can help you monitor the status of your loan payments. This way, you can ensure that your loan payments are up to date and avoid penalties or late fees.

Plans and Strategy

Checking your Pag-IBIG contribution online can help you plan for your retirement by showing how much you can expect to receive in retirement benefits. You can adjust your contributions or explore other retirement savings options if necessary.

Issues Identification

By checking your Pag-IBIG contribution online, you can promptly identify and address any issues or discrepancies with your donations. This can help you avoid delays or problems when you need Pag-IBIG Fund benefits.

CHECK ALSO: Can I Withdraw my PAG IBIG Contribution?

Benefits of Checking PAG IBIG Contribution Online

Some of the most worthy and beneficial contributions of checking PAG IBIG are;

Frequently Asked Questions

Is it necessary to register to check my Pag-IBIG contribution online?

Register and have a Pag-IBIG MID number to check your contribution online. If you don’t have a MID number, you can register online on the Pag-IBIG Fund website or go to the nearest Pag-IBIG office.

What to do when a Pag-IBIG contribution online doesn’t match actual contributions?

If you notice any discrepancies between your online Pag-IBIG contributions and your actual contributions, contacting Pag-IBIG Fund immediately to rectify the issue is essential. You can contact their customer service hotline or visit a Pag-IBIG office near you to report the problem.

Final Statement

To sum up, checking your Pag-IBIG contribution online is a simple and convenient process that can help you stay up to date with your savings and eligibility for benefits. Following these steps, you can easily access your contribution information and ensure you’re on track toward your financial goals.