In the Philippines, if you want to be a regular member of PAG IBIG, you need to pay a one-time fee for the registration process and also submit a valid personal information card to the closest branch office

In the Philippines, Pag ibig has been known as a popular agency that provides its members with precise and comprehensive loan facilities for houses and other needs. Anyone can be a member of this platform, especially the workers who belong to the system, out of the area, along with other self-employed people.

But the main question is how to be a member of it. To clarify this, we will provide the most precise answer for your help in the section below. Be will give a detailed overview of the membership process, its types, and all other potential advantages a person or member can seek.

Contents

Step-by-Step Guide: How to be a Member of PAG IBIG?

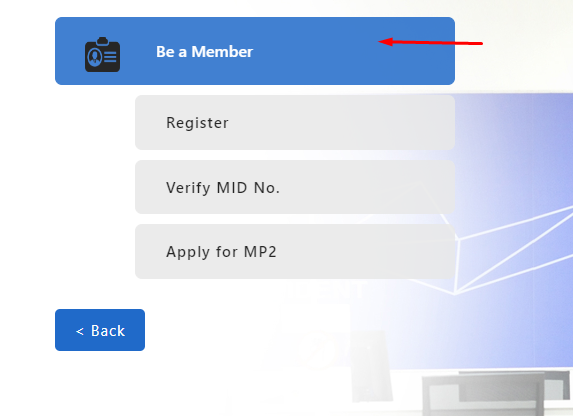

Wheeling membership on this platform is relatively easy. It is a simple process that can be done online or in person basics steps to follow our given next.

Determine your membership category

There are two categories for the membership process: one is mandatory, and the other is voluntary. As the law requires, members include employees, employers, and other self-employed individuals.

On the other hand, voluntary members are not required by the law. They are the freelancers and partners of those who work with the organization.

Membership Application form

After deciding the category for your membership, you can accomplish the application procedure. For this, you need a form that can easily be obtained through the official website or the nearest office branch of Pag ibig.

Submit the Basic Requirements

Once you have completed the details on the application form, you better provide that heritage with specific requirements:

Wait for the PAG IBIG ID Number

Once you have done with your application form and final submission of documents, the platform will assign you a permanent identification code number which you can use for the future transaction and online services.

CHECK: How to Get PAG IBIG ID Online or Offline?

Initiate your Funding and Contributions

Now that you have become an official member of PAG IBIG, you must begin your contributions in the funding procedure. The amount of assistance depends on the monthly income of the people. You can even check the contribution table from the official website.

Those who are the mandatory members of the project are required to contribute from their salary, or it gets automatically detected every month. In contrast, voluntary members are required to pay it separately from the bank or other payment centers.

Types of Membership

It has been mentioned earlier that there are two types of memberships mandatory and voluntary let’s describe and take a closer look at each of these types

Mandatory Membership

This type of membership is vital and is mainly for employees in the private and public sectors. As per the laws, a significant amount of the contribution will automatically be detected from the employees’ monthly salaries. The employees seek in-office benefits, including house loans and other mandatory services. It is a step toward a better future and building wealth through this platform

Voluntary Membership

Those employees over workers who do not fall under the category of mandatory membership are included in this type. It is an excellent option for saving for all those who want to be a part of this platform and avail themselves of the benefits of this government organization of the Philippines. The basic contribution ratio for voluntary employees is 2%, but as per the bill of voluntary members, they can contribute up to 5% of their monthly income.

What Benefits Does it Offers?

Both mandatory and voluntary members see several advantages from this offer, some most not were the points are described below

Basic Access to House Loans

As the name depicts, it provides affordable and reliable loans for housing needs. Various programs have been introduced, including user finance and construction. It offers affordable and flexible housing loans to all registered members so that they can buy a dream house of their own choice, a condominium unit, or even a lot where they can build their homes.

CHECK: How to apply for PAG IBIG Housing Loan?

The employees have a flexible time period to pay this loan, and this period exceeding 30 years is trendy due to the low rate of interest as well as affordable monthly payments. If not, then users all registered members can borrow the Philippines 6 million rupees as per the capacity or the demand of property employees bought.

Savings and Investment

Pag ibig has yet to be a professional source of investment opportunity. Users can process savings of around Philippine 200 per month, and the contribution ratio depends upon their monthly income. In addition to this, various credits and Tax details are also included in this.

In addition to this, the platform also offers modified programs for savings. This program has a fixed tenure of 5 years and provides an annual dividend rate of up to 7.5%, making it a great investment option for members who want to earn more from their savings.

Short-term Loans

A part of all the programs and loan processes discussed, it also provides an assessment for short-tenure loans to help members during emergencies or unexpected expenses. These loans are also called multi-purpose, and emergency loans people can use for education and health over travel expenses. Additionally, the RP table is for up to 24 months with a total accumulated value of 80%.

Further, it is the most reliable option for all members affected by natural disasters, including typhoons, earthquakes, or floods. Recent recently, people also availed of these loans in covid-19 Panda with the same time span of payable return.

Retirement Benefits

As everyone is seeking benefits from this, it also has something for all those who retire from their jobs. These loans are returnable for at least 240 months, around 20 years. The eligible people will receive a lump sum equivalent to the total accumulated value plus the total divided. Additionally, various centers are available for those who were previously members and get retirement from the same platform.

Other Benefits

From the benefits mentioned above, it offers its employees some particular sorts of benefits there. These specific benefits include loyalty divided and provident claims.

Final Statement

When you become an official member of the platform IT office, you receive various benefits, including future protection, house investment, and retirement benefits. Also, the whole process of becoming a member of this program is very straightforward, and contributions are easy to make, so if you want to seek reliable and affordable benefits, you better be considered to be a member of this funding.