Nowadays, people have plenty of different options to accomplish their financial emergencies. How to Apply Short Term Loan? There can be various organizations including lending companies, private banks, or other government agencies. Regarding this Philippines government has offered the PAG IBIG Funding agency to fulfill your emergencies.

We’re glad to share that many Filipinos are members of our official agency. They are members of this dedicated housing loan program and facilitate their families. This loan-offering opportunity is a gold mine for all low-wage Filipinos and OFWs.

CHECK THIS: Pag-ibig salary loan

Hence, beyond our usual housing loan, PAG IBIG also provides a versatile solution to emergencies: Short Term Loan (STL). This STL is a multipurpose loan that can be used for various needs, such as funding events, buying gadgets, covering car repairs, paying utility bills, or all in a single loan. So, it’s convenient to learn how you can apply your STL online or in person. Meanwhile, you must note the requirements for applying for this short-term loan.

Contents

What is a PAG-IBIG STL Program?

PAG IBIG Short-term loan or MPL program serves the purpose of offering financial assistance to its members. In different situations where you need funds to meet minimal requirements or address unforeseen emergencies, you must go for this loan.

Remember, to avail of this STL, you must ensure a continuous 24-month contribution and your active membership. Your existing loan is the surety to enjoy your short-term loan amount if you face any emergency.

However, once you apply for it, you may obtain 80% of your total PAG-IBIG contribution. You can claim your loan in just 2 days, which exposes our STL program’s efficiency.

This versatile Short-term loan can be utilized for various needs, including:

MUST LOOK: Pag ibig Multi-Purpose Loan

How to apply for a PAG short-term loan (STL)?

Requirements for Applying Short-term Loan

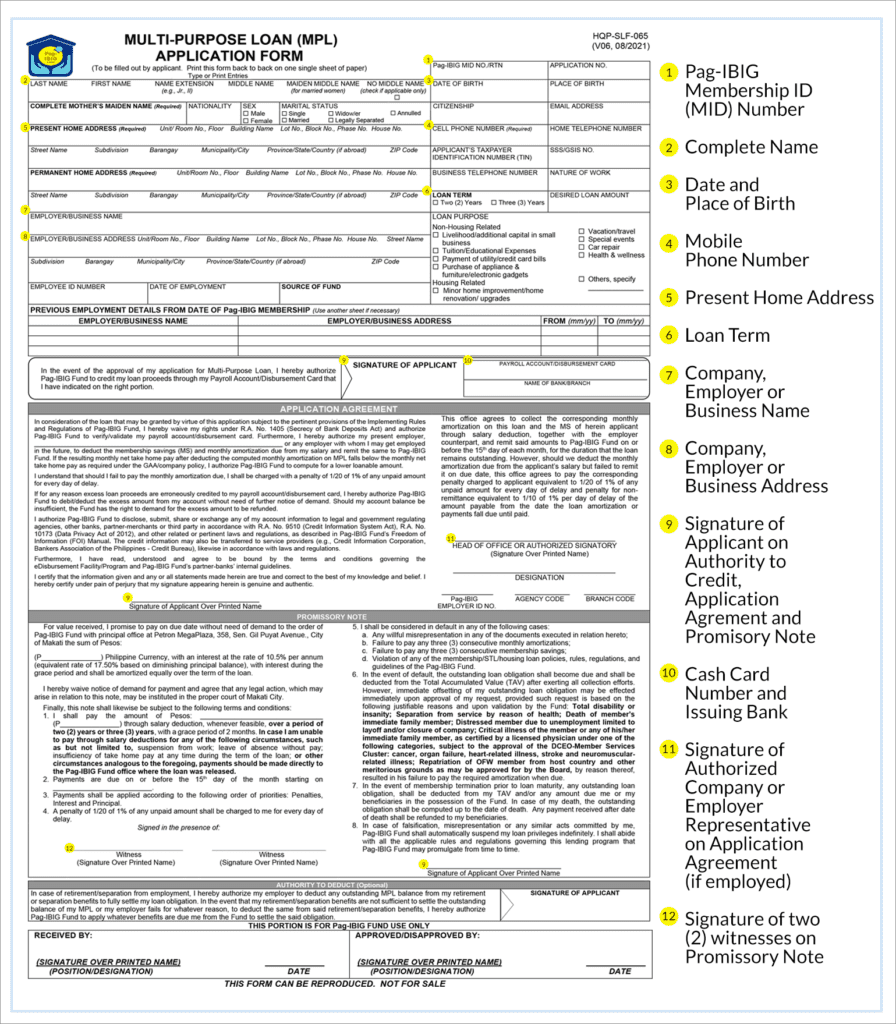

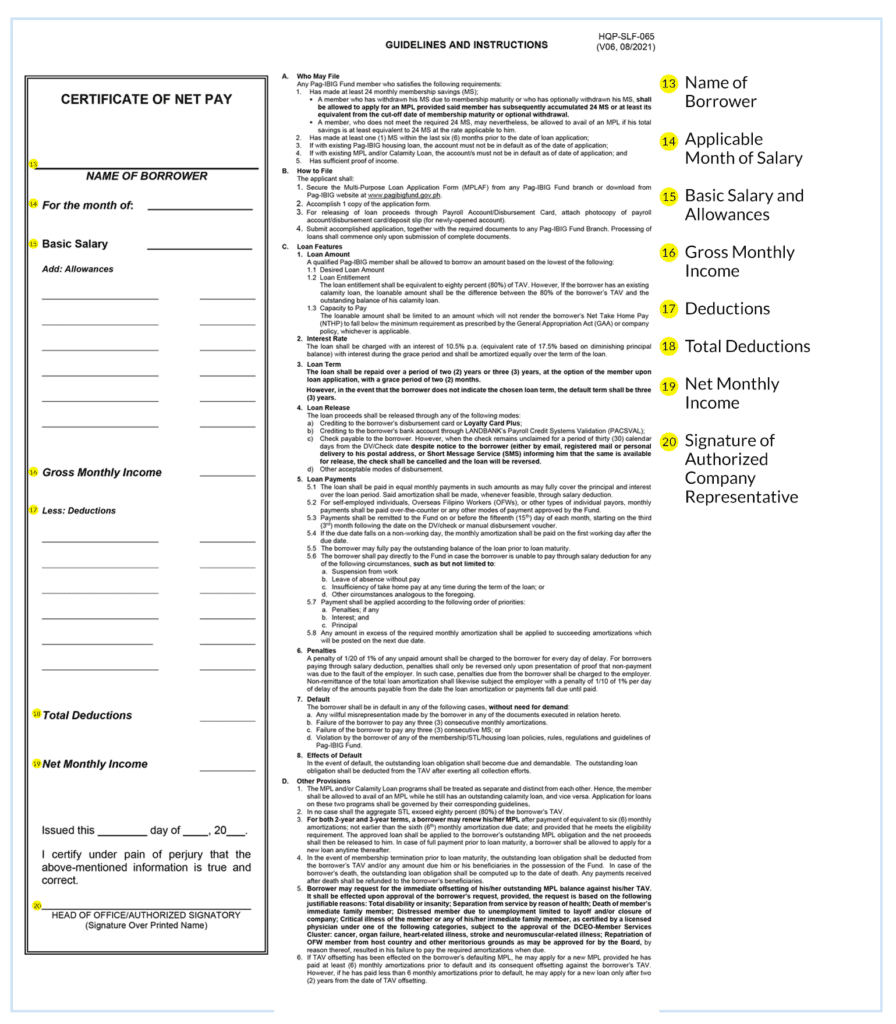

You must ensure that you’ve prepared these documents:

READ THIS GUIDE: How to Fill up PAG IBIG Loan Form?

Or Go to this Official Page after: https://www.pagibigfundservices.com/virtualpagibig/STLApplication.aspx

Eventually, this loan application access will be conveniently provided online by our PAG organization. So, by registering on the Virtual PAG-IBIG platform, you can easily apply for various short-term loans.

How can you claim your Short-term PAG IBIG Loan?

Once your STL application is allowed, you’ve numerous ways to obtain your loan payout.

Furthermore, you must note that you’ve collected all your previous work information. This approach will streamline the assessment of your requirements by our PAG team.

FAQs

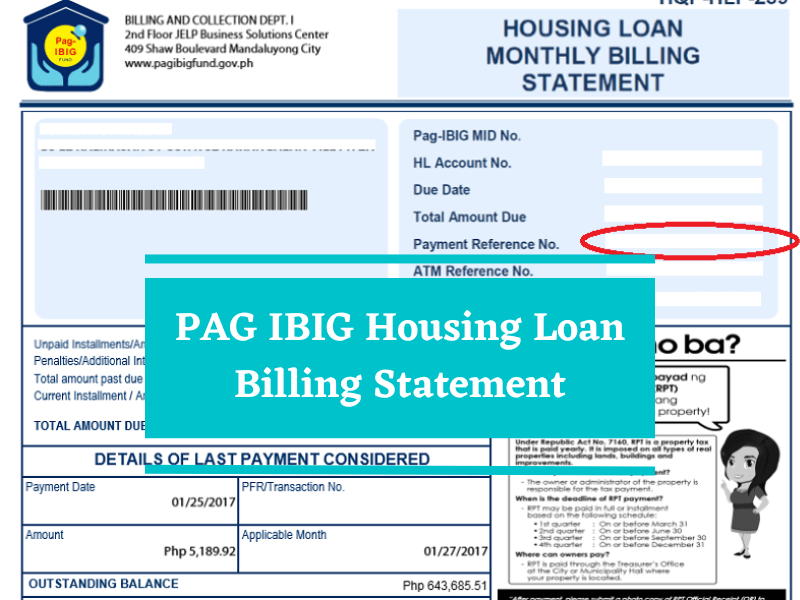

Where can I make payments for my short-term PAG IBIG loan?

Our PAG organization’s authorized payment partners include:

> Metrobank.

> SM Hypermarket.

> M Lhuillier.

> SM Businesses Service Centers.

> LANDBANK.

> Savemore.

> Bayad Centers

> ECPay

How many months does my STL cover?

This STL has a repayment period ranging from 6 to 12 months with some extending over 18 months. This loan is designed for small amounts that can be repaid quickly.

What is the maximum fund for my short-term PAG loan?

You may borrow over 80% of your PAG IBIG’s regular savings. Additionally, this loan may be available in two business days.

Which is more cost-effective PAG Loan fund, short-term or long-term loans?

STL terms often meet with higher per-month payments with low rates of interest. So, paying off our loan in the short term may result in overall less interest paid as compared to longer-term loans.

Conclusion

PAG IBIG Short-Term Loans are worthy for all active members. Those individuals who have a minimum of 24 monthly contributions can apply for this loan. The short-term loan (MPL or calamity loan) meets the PAG IBIG commitment to aid its members during diverse circumstances. So this loan ensures financial flexibility for your essential needs.

Therefore, STL aims to offer individuals timely assistance when required. That’s why it’s convenient to apply with your documents, MID confirmation, and fresh photos and get your amount within two (2) days.