How Much First Loan In Pag IBig? PAG IBIG offers cash loans to borrowers with extended loan terms of up to two to three years. Well, loaners get the benefit of a PAG loan to cover their urgent expenses and financial emergencies. The salient feature of our PAG IBIG organization is that you can avail of your first loan through the online portal without leaving your home.

Moreover, your first loan purpose is to get your multi-purposes such as;

VISIT: Calculate Your Loan Amount with Interest

Contents

How Much First Loan In Pag IBig?

Check the eligibility criteria for PAG IBIG Loan.

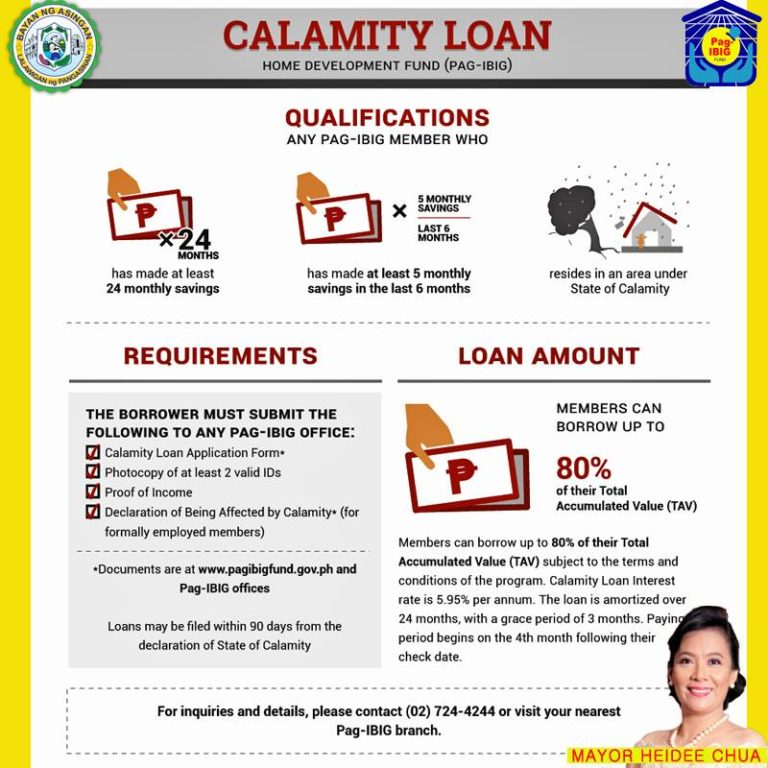

However, applicants who desire to achieve the Calamity or Multi-Purpose Loan can receive the difference amount between their loan balance and 80% of total PAG regular savings.

First Loan Payment Computational Method of PAG IBIG

The loan calculation is made according to your applied terms (might be your housing loan, calamity loan, or multi-purpose loan), multiplied by your monthly contribution. PAG IBIG accepts the fundamental contribution, especially 60% of your loan factors.

For an instant, for two years loan membership, PAG IBIG gives the amount of ₱2,880. It’s computed as:

24 months × ₱200 × .60

24 months = Total membership contribution

₱200 = your monthly contribution

Meanwhile, you can increase your loan amount as your monthly contribution grows. Employees who have made the PAG loan contribution for 120 months can get a loan factor of 80%.

Likewise, if you have already gotten your loan amount or got the PAG membership, what is your loan amount in this aspect? You can apply for a multi-purpose loan with the existing loan amount, like a calamity loan from PAG. In this scenario, your payment is the difference between the existing loan amount and 80% of your TAV. However, your contributed total accumulated value TAV is convenient for receiving your interest rates. For your healthy experience, you must confirm your loan amortization.

CHECK: Pag ibig Home Loan Calculator

Who can get the first Calamity loan from PAG IBIG?

Thus, for your loan contribution must prepare the required documents:

Landbank, Loyalty Card Plus, and DBP cash cards are not needed for the first loan owner. Thus, you can further complete your documents with the contact to the PAG office. Borrowers need to confirm their existence for loan achievement within 90 days.

Eventually, PAG IBIG members are qualified to achieve more than 80% of their first regular savings from the PAG organization. This amount is composed of your employer’s/ developer’s contribution, your monthly contribution, and the accumulated dividend earned.