PAG IBIG guarantees you to provide expedited funding services from the moment of your membership joining. However, this prompt payment delivery service accomplishes its whole Process within a few business days.

It’s the most advanced and efficient system for applying for a housing loan. How many days approval of pag ibig loan? You can apply for and approve your loan within 17 working days. These 17 days are counted after the exact date when you submit your required documents to PAG IBIG.

Contents

Quick view on the PAG Housing Loan Process

While the loan proceeds, you’re proficient at claiming three days later from your post-approval compliance. However, we’ve revealed the time involved in your housing loan approval process in PAG IBIG. So, in how much time your PAG IBIG loan application is processed:

However, it’s quite an interesting thing when applying and qualifying for your housing loan. You may wonder about how much time is required for this Process. We’ve introduced a comprehensive guide on the entire period of PAG IBIG.

How is the loan Period required to process Housing Loan?

PAG IBIG loan process usually takes two to three months for the loan proceeds. This processing time may alter, as said by additional factors. These factors can be:

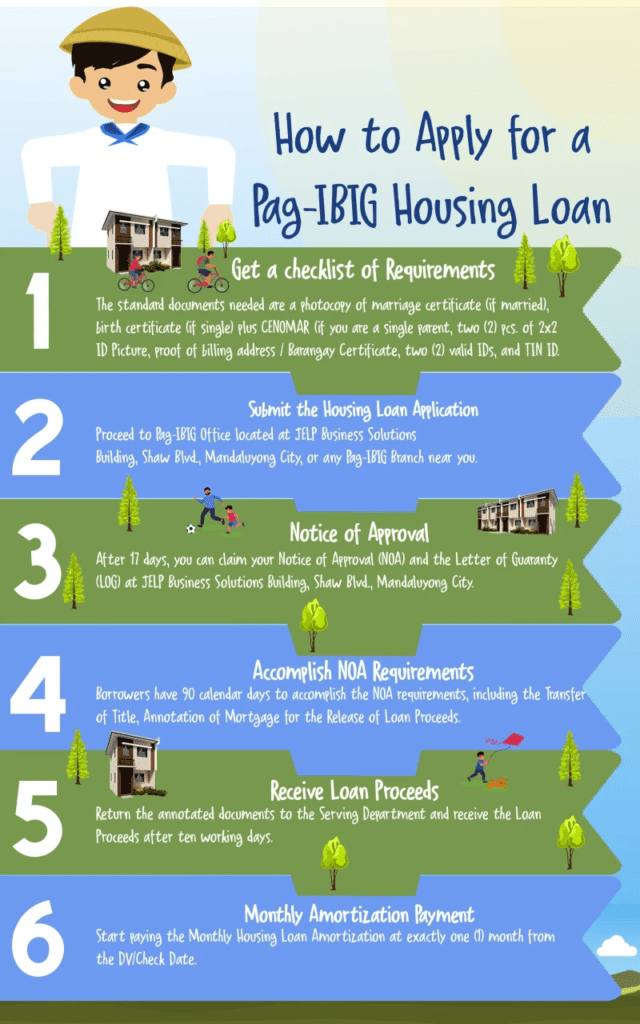

There are the following usual steps for measuring the whole process of a housing loan:

Registration and Prequalification

The first and foremost step is the preparation for qualifying for a housing loan. Though, borrowers have to be ready for prequalification and registration. We recommend you visit the nearest PAG IBIG office or check the loan details via virtual access. Your application usually takes 3-5 days for a successful process.

Therefore, keep in your mind that this timeline can vary on account of your documents and further applications. When your loan application is approved officially, then your account number is allotted. Afterward, the remaining verifications are accomplished.

Loan Requirements Submission

When membership registration is confirmed, the next step is to submit your valid documents, which are compulsory for acquiring the house loan. These documents must include the borrower’sborrower’s income pay slip, Identification Card (government-issued), address, and utility bill details.

You’reYou’re proficient in submitting these documents, whether offline or online, as long as you’ve initiated your prequalification process. Moreover, this step takes 7-10 working days to process your documents, verify them and finally approve your loan application.

HLA Processing and Release

Once your housing loan application has been accepted and verified, your application is transferred to the next department. Now PAG representatives review your requirements and documents entirely. When your loan is entirely reviewed, and there’s no need for further borrower paperwork, your loan is confirmed.

However, the process may take two weeks to a few months for approval of your loan to be granted. You have to decide your requirements.

When your loan application is approved officially, your payment is released in one to two days. You can enjoy your loan check via remotely accessible electronic means or from your nearby office.

What is the time frame of the Housing Loan Process in PAG IBIG?

The whole house loan process can be completed in 20 business days.

Once you’ve submitted your prequalification and loan application.

Then, your loan amount can be processed and provided in 17 business days.

Final Verdict

The PAG IBIG Housing loan process usually depends on borrowers’ requirements and their time to complete the paperwork. Your dedication to your loan payment matters once the housing loan application is accepted. Officially the whole process can be accomplished within 3-5 weeks to accomplish the whole loan process. However, you can acquire your housing loan via a trustworthy approval process as quickly as you want.