PAG IBIG is a government-based funding agency and is the core of the Urban Development and Human Settlement sector. Since its establishment in 1978, it has worked as a non-profit organization. Philippines inhabitants can proficiently obtain flexible housing financing with cherry pack nationwide savings. Here you’re able to view how PAG works, and borrowers can get their required loanable amount.

CHECK: Pag-Ibig Housing Loan Calculator

Contents

Key Facts of Housing Loan in PAG IBIG

PAG IBIG Housing Loan

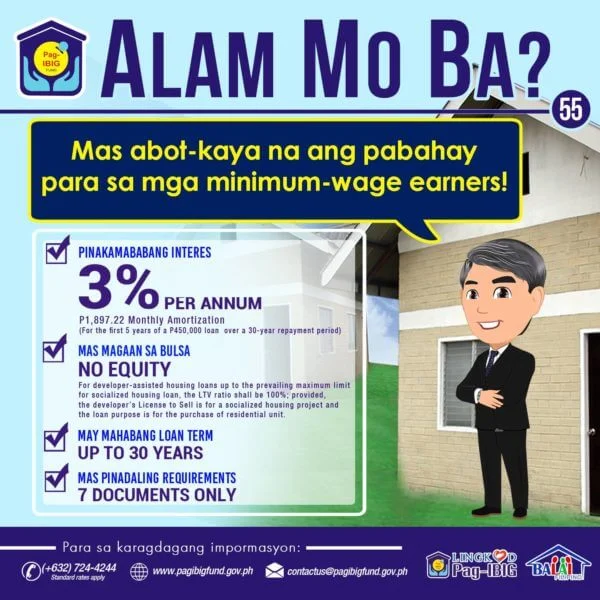

Borrowers are capable of achieving the PHP 6 million in housing loan plan. This amount may vary on account of each loan. However, PAG IBIG works in a well-organized manner. That’s why your loan amount is determined by certain factors, including your desired property’s appraised ratio, your paying capacity, your income source, and further loan entitlements.

Afterward, all these approaches relate to the interest rates of PAG loans. Remember, you can get your loan according to the precise framework of interest rates. PAG management can re-priced these interest rates occasionally. It depends on your selected time and loan interest. Your contract can be for 3, 5, 10, or 15 years, and it’d be re-priced according to your plan.

| 1 Year | 5.750% |

| 3 Year | 6.375% |

| 5 Year | 6.625% |

| 10 Year | 7.375% |

| 15 Year | 8.000% |

| 20 Year | 8.625% |

| 25 Year | 9.375% |

| 30 Year | 10.000% |

However, you can get the actual framework of our funding organization as to how it works for turning the borrowers dream into reality. Thus, this interest rate may increase by 2%, that’s considered lower and favorable. You may go for the succeeding re-pricing time. This succeeding re-pricing rate of interest can be accessible for the preceding re-pricing period.

Furthermore, you can see the interest rate for individuals and developers as well.

House Loan Interest Rates for Developers

House Loan’s Interest Rates for Individual Applicants (with Loanable amount of 6,000,000.00)

Note: Rates may change, so you must check with the Pag IBIG website.

How PAG IBIG works?

The genuine well-reputed loan type of PAG IBIG is the housing loan. It allows the loaners to acquire the house loan by qualifying for it officially. Besides purchasing your house property, you can obtain loan payments for refinancing, improving your home, reconstructing or renovating your existing home, etc.

Therefore, firstly you have to know the accurate work plan of our organization. Select your required house loan and then prepare your documents. While you make an acceptable loan according to PAG IBIG, apply for your housing loan. After official verification, you can qualify for your loan payment.

Furthermore, PAG IBIG also works efficiently for managing the afterward activities as well. So you’ve to follow the PAG allotted terms for getting your loan and then repaying this amount in your selected time. Although PAG comes with user-friendly amortizations, you still need to work for your payouts within the allotted time period.

There is the following Quick Guide on PAG housing loan working:

Acquire the PAG IBIG’s Membership

To get your house loan, you have to obtain the membership successfully. So, if you’ve paid your 24 months’ contributions, you qualify for the housing loan proficiently.

For this purpose, you need to register your account in the PAG office. Nowadays, various loaners confirm their membership via online access.

Borrower’s Eligibility

To get your trusted experience, you must possess the capacity to pay taxes (loan), your property confirmation, and at the age of 65 while applying for your home loan (70 for loan maturity date). Hence, you need to establish your loan accomplishing account before moving to obtain your payments.

Make Pre-approval Requirements

When you’ve analyzed that you’re fulfilling the PAG criteria, you need to make and submit the requirements. Regarding this, you can accomplish the requirements:

Receive your NOA and LOG

When your documentary process is completed, wait until your house loan application is approved. This time can be for one week to 20 days.

After approval of your housing loan, you’re officially able to claim your Letter of Guarantee and Notice of Approval.

Documentation for Notice of Approval

PAG IBIG grants you the payment after the entire paperwork and verification. However, your NOA relies on additional requirements that you must accomplish.

Then your payment will be released. Your NOA form (HQP-HLF-735) will be completed along with these checklists.

Claim for your Housing Loan Fund

When your NOA checklist is submitted, PAG IBIG grants your loan payments within ten business days.

We also provide notice of how you can claim loan amounts conveniently and safely.

Pay your PAG House Loan

Once you receive your loanable amount, you are eligible to repay your payments a month later from your loan release. Thus, PAG works effectively for your payouts. You can accomplish your repayments by your salary deduction (for employed), Post-dated checks, PAG-associated Apps, or via bank payments (cash, debit, credit card’s auto arrangements).

FAQs

What is the maximum limit for paying PAG IBIG House Loan?

Borrowers have a maximum of thirty (30) years to clear repayments.

How do PAG loan terms work for Applicants?

Applicants must fulfill PAG criteria according to interest rates for applying for the loan. The principal borrower’s age must be 65-70 and repay the loan amount in a maximum of 30 years.

Final Statement

PAG IBIG Housing Loan program aims to attain the milestone dream of owning your home. Thus, this organization provides:

It works effectively for Filipinos to accomplish them financially.

(Although for 2023, interest rates are 6.375% and 5.375%. Furthermore, a novel rate is accessible, that’s 5.375% and 4.985%, making the housing loan remarkable.)