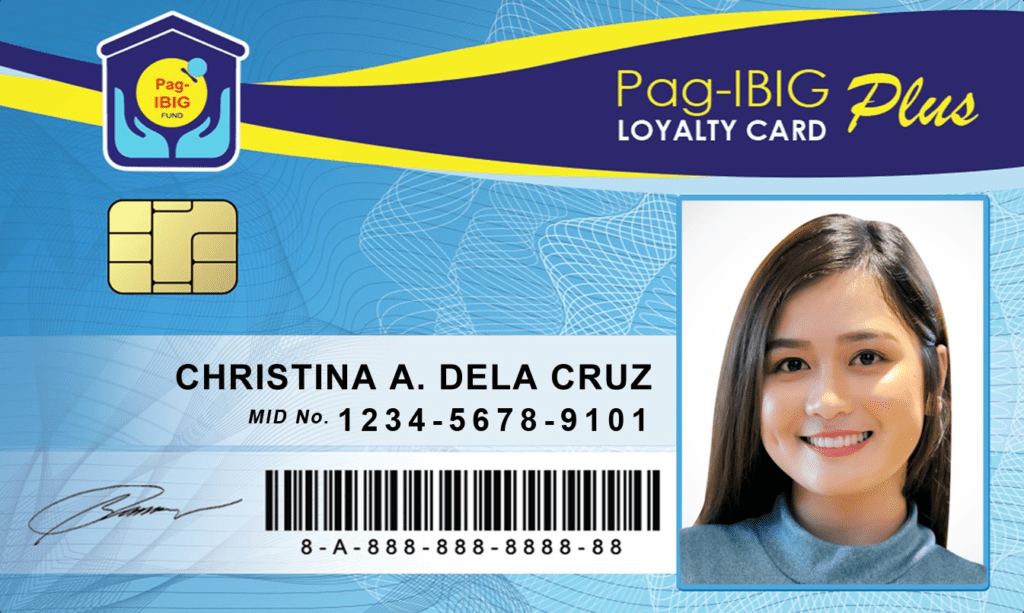

The loyalty card of PAG IBIG serves as a cash card and debit card for cashless transactions. It allows you to acquire calamity loan proceeds, multi-purpose loans (MPL), Provident claims, and MP2 savings dividends. Additionally, it offers discounts and rewards ranging from 5% to 25% with up to 350 merchant partners.

Union Bank and Asia United Bank issued the cash Card of PAGIBIG that’s equipped with an EMV chip for security. However, Borrowers can get their loyalty cards from these affiliated Banking services (AUB, Unionbank). Regarding this, you need to accomplish the easily accessible criteria, obtain this card, and enjoy it to complete your life goals.

CHECK THIS: How to get PAG IBIG Loyalty Card?

Contents

What are the Requirements for getting a PAG IBIG Cash Card?

If you don’t have your MID number, it may be possible when you’re not yet a PAG-IBIG membership owner. No worries, to get your PAG IBIG Cash card, the process is quite simple, and you can obtain its registration via our PAG official page. Well, for obtaining your cash card the key requirement is obtaining your permanent MID number first.

How to Get a Cash Card of PAG IBIG?

SEE FULL Process here: Pag ibig Loyalty Card Online Application

However, if you’re applying for this card first, our PAG IBIG system provides you with our latest version of the cash card. Meanwhile, if you’re an old card user, you must upgrade your card to acquire the entire valid discounts.

What is the key reason to get the PAG IBIG Cash Card?

FAQs

Does PAG IBIG permit members to acquire loan amounts without work?

Suppose you’re a self-employed individual and have a PAG IBIG membership with PAG IBIG cash card access. You’re capable of obtaining your loan amount from the PAG IBIG agency. Our organization allows self-employed members to acquire their needed loan funding in certain circumstances.

However, self-employed individuals with cash card access can apply and win the loan by providing relevant requirements. Once all your documents and requirements are completed in the presence of your PAGIBIG cash card, you can go for your required salary and other short-term loans.

How do you acquire a Cash card for PAG IBIG from Union Bank?

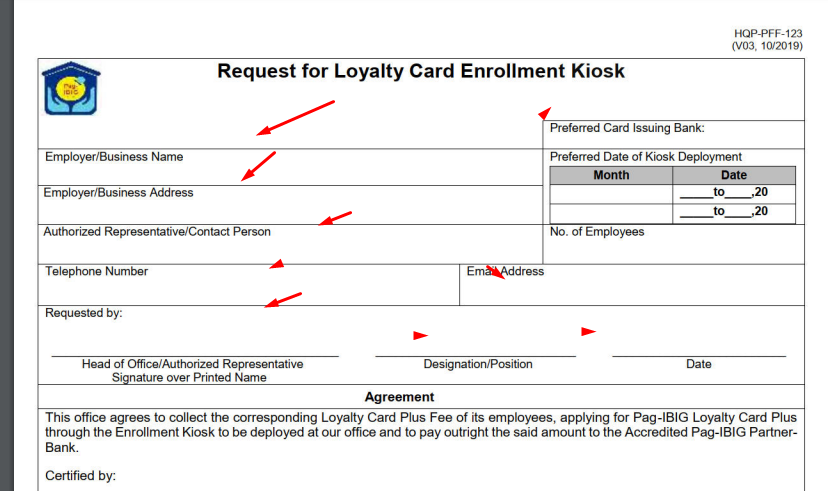

PAG IBIG members are able to obtain the cash card by applying and opening an account at Employer Deployment events or UnionBank Kiosks in PAG-IBIG branches.

They can accomplish the process by simply filling out the form and submitting it to the UnionBank Kiosk Operator. Their cash card is issued on approval of your application and they can process their transactions.

How does PAG IBIG permit the member to get their cash card?

Once you’ve achieved your PAG IBIG membership and MID number. PAG IBIG allows you to apply for your cash card to enjoy the additional benefits along with membership.

However, you can secure your cash card by filling out your application form and paying the P125 card activation processing charges. Afterward, you may become one of the cardholder individuals who can utilize it for a lifetime without renewal.

Final words

The cash card of PAG IBIG is a worthwhile investment that comes with substantial monthly savings on various expenses. You can obtain the dedicated discounts of cash withdrawal option.

You are capable of linking your card with your banking mobile application, and it may ease your lifestyle as well.

You only need to be a PAG IBIG membership holder and then pay its P125 affordable charges and fill up the form. Apply and get your card and ease your transactions.