We are going to guide you about pag ibig house construction loan, its requirements, how to get the form, and what is the whole process to apply.

Everybody yearns to construct a house for his family at a time in his family. You may dream of protecting your loved ones in your home. Somehow banks are not eligible to fulfill everyone’s dream by supporting them. In such circumstances, the Philippines government has established an agency PAG IBIG that provides the House Construction loan to Filipino workers.

CHECK: PAG IBIG House Renovation Loan

Contents

PAG IBIG assists you in sponsoring required projects

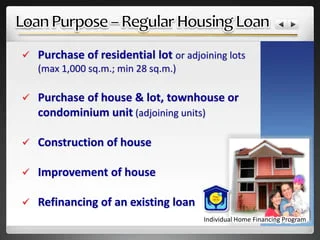

We discuss the house managing loan, which includes all the basic needs essential to building a home. PAG IBIG loan is availed for fundamental renovation requirements.

Why is a Home Construction Loan a bit Tricky?

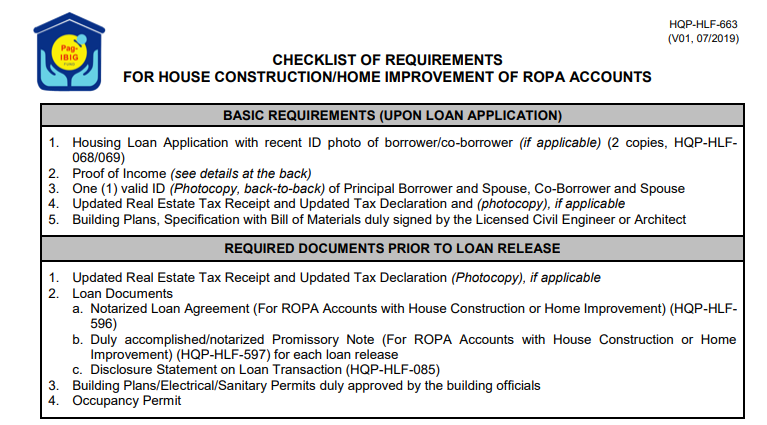

Likewise, you are familiar with our PAG loan preferences. Here you must go through its necessities before submitting your application. You can follow similar prerequisites of loan criteria. The quite different documents necessary to accomplish before attempting your loan letter are mentioned here;

Specifications of materials, including bills of each, this letter must be assigned by an architect or official civil engineer.

CHECK: Pag ibig House Construction Loan Calculator

How to Apply for PAG IBIG House Construction Loan?

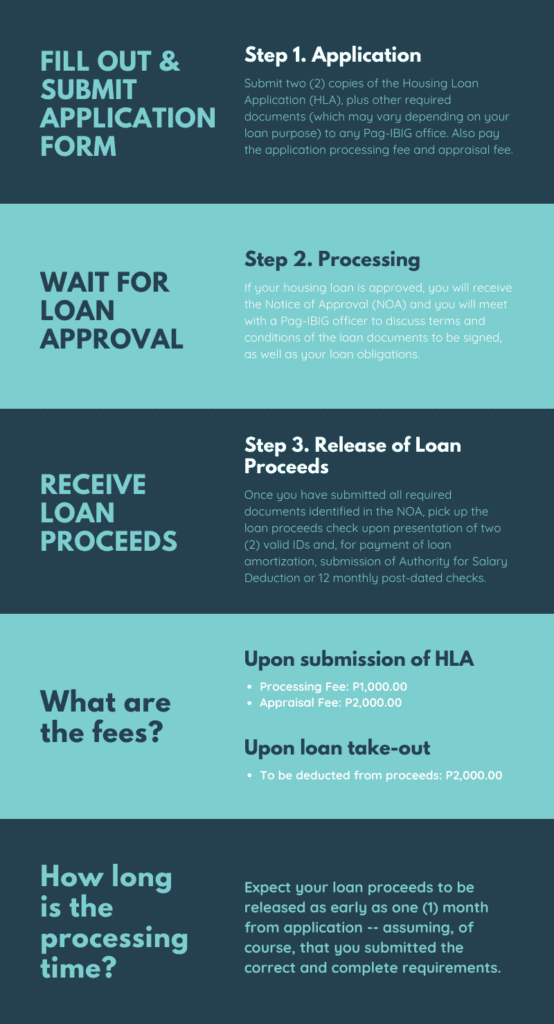

Before your construction loan application, make sure you have prepared your official documents. Moreover, follow these steps to obtain your loan;

Major tips to Apply for PAG Home Construction Loan

In the Philippines, the application and approval of the PAG home construction loan application are pretty complicated. Meanwhile, it’s not impossible for PAG borrowers to get their loans. There are some vital tips to ease your loan approval.

Prequalified for a construction loan

Let’s know about your financial capacity before acquiring any loan, either home or another purpose. Make your assets, liabilities, monthly income, and further payslips for borrowing. Prequalified doesn’t represent your loan’s pre-approval, but it’s related to preparing yourself for enhancing your loan acceptance chances.

Pre-approval for Loan

Once you have managed your latest income tax returns, recent bank statements, employment certification, and additional bank slips. You have ultimately achieved the opportunity to apply for your desired loan. Thus your loan application can be preapproved now.

PAG IBIG Housing Loan

In the Philippines, you can get a housing construction loan for your standard of living. Hence, PAG IBIG brings the series of payments of your loan. There are minimal necessities and affordable interest rates, so every worker can quickly get a loan and construct a home. Various organizations, applications, and even banks are associated with PAG IBIG’s official center. All these PAG centers aim to assist and make straightforward ways for your loan achievement.

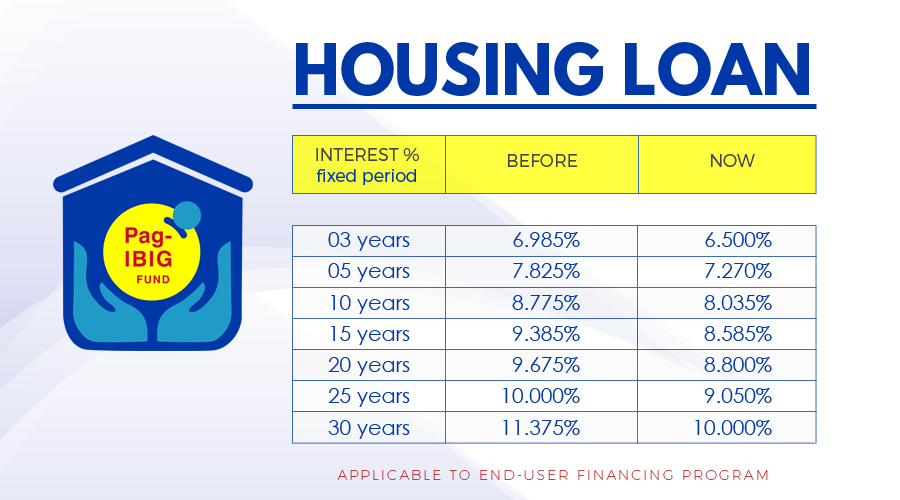

Interest Rates for loan

You have the whole guide of interest rates, and now you can pick your suitable interest rate according to your loan. Consider your monthly amortization, title transfer fees, taxes, and related housing loan fees.

Customers must need to know the House Construction Loan

One of our borrowers shared his experience acquiring the home construction loan specifics. We inquire about various banks and estimate our requirements and income source. There were multiple banks, such as East West Bank and many other organizations, but we found the most reliable is PAG IBIG. Besides, more documentation is required for PAG loan acceptance, but it provides customer-friendly packages. Finally, we pursue the PAG for our housing construction.

We prepare and provide our papers, such as identification cards, vicinity maps, employment certificates, tax declarations, proof of income, bank statements, income tax returns, and other pay slips mentioned on the PAG IBIG form.

The official site informed us to wait for our loan approval letter, and we got a confirmation letter after 2 months. Then official managers visited our home locality and verified our documents. Then get our installment of about P6 Million with 30 years of relaxing loan amortizations. We borrow that amount and construct our furnished home at a well-suited location.

At that time, we realized other organizations offer the payments after watching your work progress. For this purpose must initiate your construction before your loan application. Meanwhile, by assigning our application to PAG IBIG, I got the payment slips at once and stayed linked with the official counter for additional instructions. Within some time, we shifted to our equipped and newly constructed house. We love to discuss with our friends acquiring a housing loan from PAG and leading your dreamy life.

FAQs

How many days are required to process a house construction loan?

The PAG IBIG loan process takes a minimum of two days to a few months to process your loan applications. Thus after your loan approval, you may get more than 80% of your regular savings.

Can you get your house construction loan easily from PAG IBIG?

Yes, whether you are a beginner or a loan member of PAG, you may apply for a PAG IBIG House Construction loan anytime. After fulfilling the eligibility criteria for getting your loan, attempt your construction loan form.

Conclusion

Getting a housing Construction loan from PAG IBIG is the best decision for Filipinos. Thus the PAG membership means future securing offers accessibility. It’s the perfect time to eliminate the headaches from your life and put your energy into constructing a shelter for your family. You can accomplish your pretty challenge to comply with your dream and home construction.

I tried to apply for housing Construction loan from PAG IBIG, i think you can only avail of this type of loan if you are already rich.

the house should be 90% complete before you get the full amount of loan.

What if the land is inheretance? What is the requirements?

What if the land is still under pagibig loan acquired from bidding and you wanted to apply for a house construction loan to build a house on it.

If the land you acquired through a Pag-IBIG loan from bidding is still under loan and you wish to apply for a house construction loan to build on it, here’s what you generally need to know:

Consolidation of Loans: Pag-IBIG allows the consolidation of your existing land loan with a new house construction loan, subject to their evaluation and approval. This means you can apply for additional financing to construct a house on the land you’re currently paying for through Pag-IBIG.

Eligibility and Requirements:

Application Process:

Approval and Loan Release: If approved, Pag-IBIG will provide guidelines on the loan release, which often happens in tranches based on the construction progress.

Considerations:

Given the complexity of consolidating loans and applying for new financing, it’s best to directly consult with Pag-IBIG. They can offer personalized advice and guidance based on your specific situation and the current policies for house construction loans on land still under a Pag-IBIG loan.

Gusto kopo sana magloan Ng housing renovation for residential loan

Upang mag-apply para sa Pag-IBIG Home Renovation Loan, dapat mong matugunan ang mga sumusunod na pamantayan sa pagiging karapat-dapat:

Ang proseso ng aplikasyon ay nangangailangan sa iyo na maghanda at magsumite ng ilang partikular na dokumento, kabilang ang:

Kasama sa mga layuning sakop ng Pag-IBIG Housing Loan ang pagbili ng residential lot o house and lot, pagpapatayo ng bahay, pagpapaganda ng bahay, muling pagpopondo ng isang umiiral na home loan, at pinagsamang layunin ng pautang. Ang halaga ng pautang at ang termino para sa pagbabayad ay sasailalim sa pag-apruba ng Pag-IBIG, batay sa iba’t ibang salik. Maaari mong bayaran ang utang sa loob ng hanggang 30 taon, na nagbibigay-daan para sa mas magaan na buwanang installment.

Para sa detalyadong impormasyon sa proseso ng aplikasyon, mga kinakailangang dokumento, at iba pang nauugnay na detalye, isaalang-alang ang pagbisita sa opisyal na website ng Pag-IBIG o direktang makipag-ugnayan sa kanilang customer service.

Pano nga mag aapply sa house construction loan kung klngan mo rin gumastos para maapprove loan requirements. Kaya nga magloloan kase wala full badget para magpagawa ng bahay.

TINGNAN: ROGIEMAR MADRIAGA BUGUINA: Comment, ibinahagi lahat ng detalye.