When you’re excited to contribute to the PAG IBIG Housing loan scheme, the pivotal aspect is to know the savings regulations correctly. Though, are you contributing for ten years in PAG IBIG? Can you withdraw your funding?

It’s a wondering fact that you are a PAG IBIG membership owner. The government-owned organization allows you to get your funding whenever you need it. So, you can withdraw your payment after ten years.

Although we bring higher dividend rates for our contributors. You can earn a heavy tax-free bonus. You must know How our system runs for 10-year contribution plan.

Helpful: Can I Withdraw my PAG IBIG Contribution?

Contents

Withdrawal contributions after 10-Year Regulation

For your contribution to PAG IBIG, you need to verify your membership for 10 years. Usually, we provide savings for 5 years. In that case, members can get their payment yearly or after 5 years. They submit part of their salary, and their transactions are accumulated with higher dividends. At the end of their selected time, they can achieve their amount.

Meanwhile, once you’ve been looking for your worthy contribution for about 10 years. Notably, your final withdrawal is associated with your salary transaction. Suppose a big amount of money is deducted from your PAG IBIG contribution. After ten years, you elect all your deduction payments with the sum of dividends for the whole period.

Suppose your contributed amount is approximately PHP100 000. You are officially eligible to get your entire funds. On the other hand, if this amount is less than PHP 100,000. Then you can withdraw more than 20% of your entire earnings.

SEE THIS: How to Withdraw PAG IBIG Contribution?

Basic Requirement to fulfill for 10 Years contribution

when your savings plan is for 10 years. You must prove the certain requirements after 10 years for your successful withdrawal:

Note: We recommend going to your local branch instead of approaching any remote office or our official counter specifically. Now, clearly understand your payment nitty-gritty and the associated fee and then accomplish your withdrawal request.

Eligibility Criteria

For your profitable savings and soothing withdrawal, you must be qualified for a PAG IBIG membership and apply for your interest rate.

Account Maturity:

For PAG IBIG’s valuable account maturity, members must first accomplish at least 240 contributions. Your account is mature enough and ready to contribute to further loan plans.

Contrarily, OFWs can join the scheme for five (5), ten (10), and more years. It depends on the registered membership of them.

Retirement

A 10-year contribution plan is more useful for retirees. Such people are desired to acquire the home along with their regular dues.

So contributing to this plan makes them capable of achieving their house at the time of their retirement or after that. The ten-year plan is suited well for these PAG IBIG members. So, here you can join at 60 age of at the exact retirement age of 65.

Migration:

Oversea workers are applicable for long-term contributions. They can join the withdrawal systems very well.

Health Conditions:

People with permanent or disability, insanity, critically ill members or separated spouses are applicable to join the contribution plan. They have to submit their registered physicians’ verified documents about their desires with other documents.

PAG IBIG contributors are allowed to withdraw their payment before in some conditions, including death, retirement, separation from service, and permanent disability.

Therefore, one best practice is to apply for the 10-year plan at 60-65. A notable factor is if you’ve withdrawn whole payments from your contributions before 10 years of consistent membership. PAG IBIG charges the remaining amount with a fair amount of penalty.

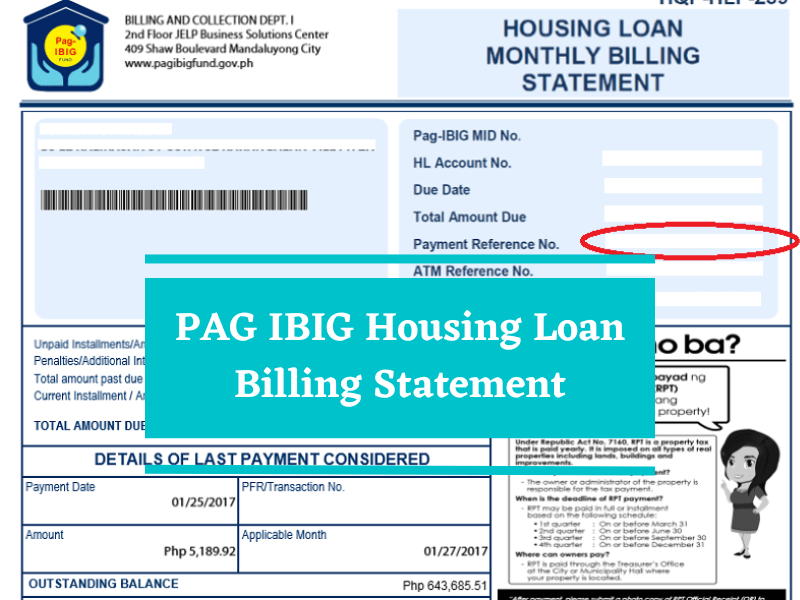

Important implementations of contribution after 10 years of withdrawal

Final Thoughts

PAG IBIG allows the members to withdraw their contributions after 10 years legally. So, after your appropriate time, you can get your money after completing the paperwork. You must know the whole managing idea about this long-term contribution. Get your contribution complete if contributing for PHP100,000. Meanwhile, acquire over 20% if your contribution is below PHP100,000.

Hi Im Chandrina Tan can i withdraw my savings ive started contributing last 2004 and im 46 years old is it possible i can withdraw my savings?

As Chandrina Tan, who started contributing to Pag-IBIG in 2004 and is now 46 years old, you might be eligible to withdraw your Pag-IBIG contributions under specific conditions. Pag-IBIG members are generally allowed to withdraw their total accumulated savings (TAV) under the following circumstances:

Membership Maturity: Pag-IBIG members can claim their savings upon the maturity of their membership, which is typically after 20 years of continuous contributions (or after making 240 monthly contributions).

Age: Members who reach the age of 60 years old (the mandatory retirement age), or optionally at the age of 65 (the optional retirement age), can withdraw their contributions.

Retirement: Under the laws of the Philippines (RA 8291, PD 1146, RA 660), members who retire under their company’s retirement plan, or who are separated from service due to health reasons, can also claim their savings.

Permanent Departure from the Country: Members who are moving permanently abroad can withdraw their contributions.

Total Permanent Disability or Insanity: Members who are found to be totally and permanently disabled or declared insane can claim their contributions.

Termination from Service by Reason of Health: If you’re separated from service due to health reasons, you may claim your savings.

Death: In the event of the member’s death, the legal heirs or beneficiaries are entitled to claim the member’s total accumulated savings, including the death benefit.

Given your specific situation, having started contributions in 2004 and now being 46 years old, you wouldn’t typically qualify for withdrawal based on age or the standard 20-year membership maturity since it hasn’t been 20 years yet. However, if there are other conditions met, such as retirement under your company’s retirement plan, permanent departure from the country, or other specified conditions, you may be eligible to withdraw your contributions.