When you consistently make your monthly contributions throughout your PAG IBIG membership career. It’s crucial to note that you’ve got the great option to withdraw your contributions. You must be aware of how you can withdraw your payments. Occasionally, loaners ask for their withdrawal until they reach retirement or sooner. Suppose you’re eager to withdraw your payment; you can resolve your queries while staying here.

CHECK: How to Claim PAG IBIG Contribution?

Contents

Can I Withdraw my PAG IBIG Contribution?

However, for successful withdrawal of your PAG IBIG contributions, you must go through this withdrawing guide:

Determine your Eligibility

Whether you’re eligible to withdraw your contribution depends on your membership venture. Though you can claim to get your payments when:

Documents Preparation

When you’re meeting the eligibility standards of PAG IBIG, now prepare these documents:

CHECK: How to Compute PAG IBIG Contribution?

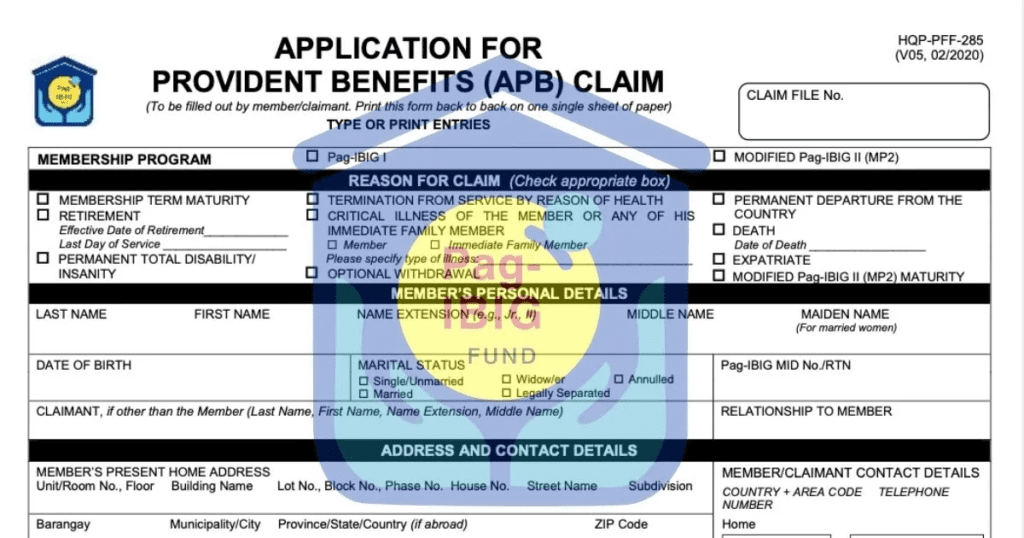

Withdrawal form and documents submission

In applying for the PAG IBIG contribution withdrawal, Submitting your completed withdrawal form either by email or in person is the crucial step. Follow these straightforward steps to do so:

Withdrawal Application Processing

When your documents and form are submitted, the next step is to wait for your application verification. After the complete evaluation of your application, you may get a response from the PAG IBIG funding office. This procedure may take 20-30 days, depending on the official site’s business routine or workload.

Receiving the Withdrawal Amount

After verification of your application, your withdrawal is transferred into your account or in the form of a check. Here you have to know that:

How to withdraw my PAG IBIG Saving and Contributions?

Walk-in (in-person) PAG IBIG Contribution Withdrawal

Prepare all the required documents for your withdrawal and submit them to the PAG IBIG branch. Ensure that this branch occupies your membership record or not. Although you’re submitting your entire membership file, including your unique MID, that makes evaluation becomes quite feasible. So, when your provident beneficial claim undergoes the official evaluation according to your loan record. Then your withdrawal application may approve officially. You are able to receive the claim stub for your retrieval.

Furthermore, suppose you’re withdrawing your payments as only an employer; your claiming procedure takes only 3-5 business days. On the other hand, when you have several employers with you, the procedure may go longer. Now you have to wait for 20 business days almost. This longer time is essential to ensure the comprehensive validation of all employers at first.

However, the PAG IBIG organization delivers the Provident Benefits Claim to its members through any of the following ways:

Online PAG IBIG Contribution Withdrawal

Virtual access to PAG IBIG enables the members to process their payments’ withdrawals. This payment-receiving option is accessible to your account for the following reason:

How can you withdraw your PAG payments online?

Members must prepare PAG IBIG paperwork. It includes scanned copies of the accomplished provident benefits form, fresh photo, valid ID, MID, supportive employment source, and other documents. Remember all the withdrawal documents must be accomplished.

MP2 Savings Withdrawal Process

After your maturity period (5 years)

You can claim your savings when your Modified PAG IBIG 2 account is opened after five years. Suppose you want to stay consistent with your MP2 savings, withdraw your amount, and then renew your account.

Sometimes, members never withdraw their payments on reaching maturity age. In such cases, their amount will earn additional dividends annually according to their savings for more than 2-years. When these additional two years are completed, your contribution cannot get the annual dividends. Though, it must be claimed immediately.

MP2 Pre-termination savings

If a member has faced serious concerns, then PAG IBIG offers to withdraw your payments before completing the 5-year maturity. These concerns might be:

How to claim your MP2 Contributions/Savings?

When your MP2 savings account reaches maturity, our representative notifies you of the instructions for claiming your savings. Remember that your management may take three months to check your MP2 payments after maturity.

You can withdraw your MP2 savings by Walk-in or using your Online access.

Walk-In Process includes the following:

The online Withdrawing process includes the:

MP2 savings can be claimed via the Virtual PAG site. You can follow the steps:

Final Thoughts

PAG IBIG permits the members to withdraw their contributions by following trustworthy ways. Hence it’s a convenient and reliable source of accessing the payments that you’ve contributed to the PAF IBIG funds. All your regular and optional savings payments can be achieved by accomplishing the qualifying criteria. Ultimately, The excellent source of withdrawing your contribution is by BancNet ATMs or POS.