Are you interested in getting two housing loans from PAG IBIG? If you’re updating your monthly mortgage within the due date, you can apply for the additional house loan If you are a qualified membership holder, you can avail of a second housing loan. This payment may use for the following purposes:

Contents

PAG IBIG House Funding

The Philippine government establishes this saving scheme to help Filipinos finance. This home development agency allows you to renovate your home, buy housing properties, start your business, participate in individual savings, and various other services.

Here, we’re focusing on whether you can activate two Housing loan Accounts at once. What are the specific requirements?

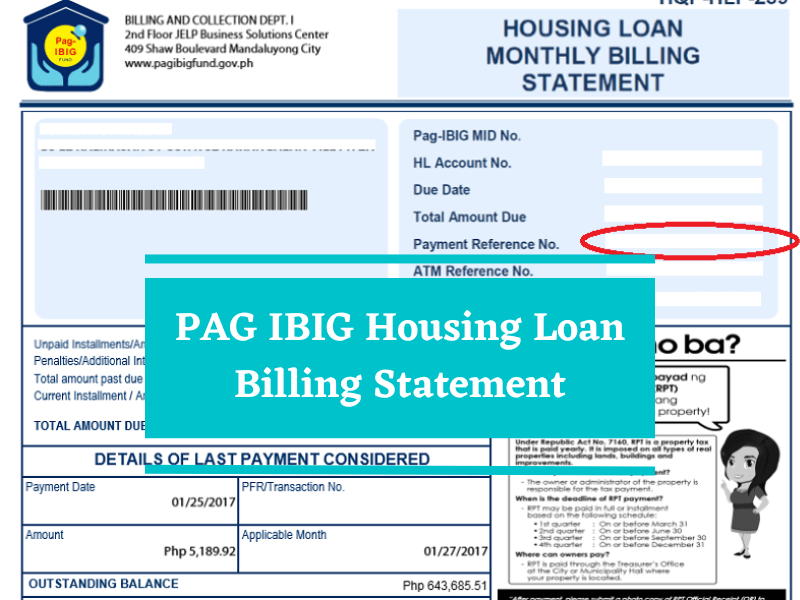

However, the qualified person allowed to get another house loan must fulfill the PAG IBIG monthly contributions on official instructions. For example, while consolidating the loan (original & another house loan), your entire repayment shouldn’t exceed PHP 1,250,000 for 35% of your income. And collective loan may exceed PHP 1,250,000 for thirty percent of your gross monthly salary.

Suppose your first loan was verified before 23 Nov 2006; now, your second loan can be considered distinct and separate from the previous one. Though this additional loan will be consolidated with your previous loan on these accounts:

Eligibility Requirements to acquire two Loans at once

Remember, PAG IBIG allows a single loan payment for buying real estate property. It represents that if you’ve got a real estate purchasing loan, then you’re unable to utilize your second loan payment in this regard.

Meanwhile, if your existing loan is entirely settled, you can easily qualify for the other real estate property purchasing loan. When discussing MPL, loaners must make satisfactory contributions for almost 24 months before applying for the first home loan amount. Ultimately, PAG IBIG ensures that you may obtain 80% payment of your accumulated savings, whether you’re applying and qualifying for one or multiple house loans.

PAG IBIG loaners are proficient in achieving their additional loan single time during their whole loan term process.

Vital Aspects to Note

Eligibility Requirements:

Borrowers must have 24 months’ contributions to qualifying for the other Housing loan in PAG IBIG. Furthermore, they shouldn’t be above 65 age while applying for a loan. A stable source of earnings is also a valid point to ensure your eligibility for more loans.

Loan Entitlement:

Your loan amount depends on numerous factors, including your capacity to pay, membership status, the appraised value of the property, and the actual need for an extra loan.

Loan Purpose:

You are obtaining a loan basically for house construction. Additionally, PAG IBIG permits you to purchase other residential property, home improvement or renovation, lot only, construction of existing or new homes, or refinance your existing loan amount. Thus, you’re eligible for an additional housing loan as well.

Capacity to Pay:

Whether you’ve got the original loan and paying its amortizations within the due date and PAG demands. You are eligible for multiple house loans by ensuring your income statement. You have the capacity to pay your multiple loans easily, in your monthly salary is sufficient to acquire your additional loan. You can pay your extra amortization as well.

However, you must settle your original loan by timely paying your amortizations for almost six months. Afterward, you have to ensure your additional requirements for applying for the second house loan. These necessities can be enhanced employment records or overall income source contracts. Eventually, you must consult our PAG licensed real estate professional or representative for consolidating your housing loans.

Final Verdict

PAG IBIG allows you to enjoy the double housing loan at once in your entire loan membership experience. However, you have to accomplish your qualifying criteria and accept the PAG regulations for applying for the additional loan along with the existing housing loan. Eventually, getting many housing loans is a favorable point that comes with lower interest rates than other banks’ programs. It’s the entire book about the official issuance of two housing loans or one additional home loan with an existing house loan.