PAG offers ready-made form templates to apply for housing loans. This form template is a more convenient way that is accessible in PDF format.

Users have a swift and step-by-step guide to complete their PAG IBIG Form. Luckily, you may forget to visit the offices or find out the printing/scanning forms for your Houses. Here is the comprehensive instruction for managing and completing your documents online.

You will need this: How to Fill up PAG IBIG Loan Form?

CHECK: How To Apply For PAG IBIG Housing Loan?

Online form accessibility has simplified the customers’ workflow and heightened the process of managing documents. Employers can ideally check their documents and data while applying for their loans. Moreover, the online application system adds more accuracy and trustworthiness to PAG Housing Loan management.

Contents

Instructions about filling out the PAG IBIG Form

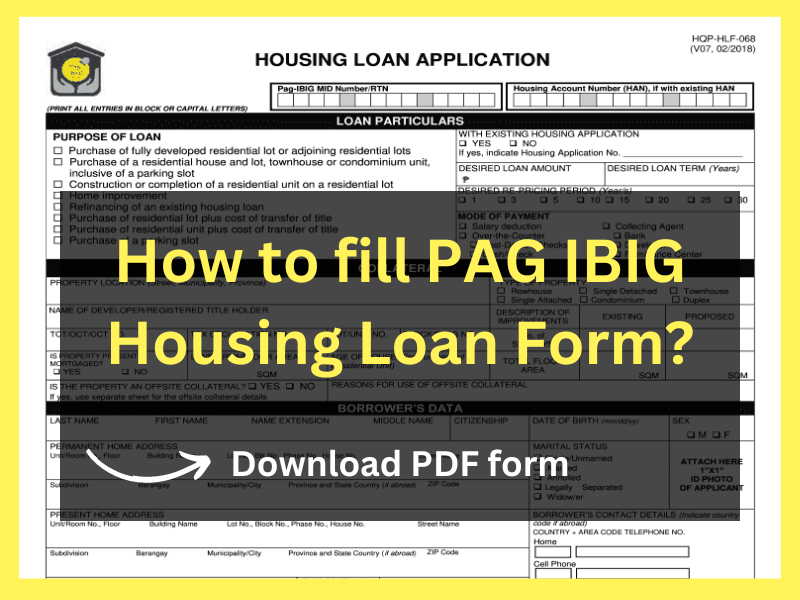

Before opening your loan application fill-up journey, you must ensure that you’ve prepared all these important documents.

CHECK: Pag Ibig Housing Loan Requirements

PAG IBIG Housing Loan Form Filling Guide

These steps lead you to fill out your form. After carefully filling out the housing loan form, you can earn your money.

CHECK: Pag IBIG Housing Loan Verification

Therefore, you have completely filled out your loan application form from our official form software. You have an excellent function to edit your updated details. Enjoy your digital signature facility to generate advanced ID signs. It’s the whole workflow; you must follow it step-by-step for your superb experience.

How does Form Software work?

Quick view:

Well, you are proficient in finding an error-free document. It’s best to sign in to the proper PDF form. You may select your desired version of the editable Loan form. You have various forms, including:

| Form Versions | Popularity | Fillable | Edit/Printable |

| PAG IBIG 2012 | 4.7 Gratified (38Votes) | Yes | Yes |

| PAG IBIG 2012 | 4.8 Gratified (91Votes) | Yes | Yes |

| PAG IBIG 2018 | 4.7 Gratified (65Votes) | Yes | Yes |

| PAG IBIG 2020 | 4.8 Gratified (146Votes) | Yes | Yes |

Creating e-Signatures for the PAG-IBIG form

Borrowers have a quick and straightforward pathway to complete their online forms. This system has made their competence more reliable. Various beginners are confused about how to generate their legal signatures using an online platform.

Hence, PAG IBIG has offered a legit, affordable, simple system to facilitate you for making signatures online. Your electronic signature would be precisely valid for processing our application. Ensure that your device is linked to Wi-Fi or stable internet data.

There is a guideline for your appropriate signatures:

Form for Multiple-Purposes Loan

You have the guidance of filling out your loan form, and you can also get the format for different purposes loan. This loan is accessible for diverse requirements.

Note: Self-employing borrowers can obtain a substantial amount as well.

How many times is the PAG-Loan Form available the whole life?

It depends on the user’s experience and as many payments as you want to achieve.

Final Verdict

Thus, customers have a price guidebook about how and where to find the PAG IBIG Form. It requires minimum input; your internet speed matters, so select your form, fill it out, download it, or submit it.

You are notified via email. Moreover, you have additional features of this form system, document merging, a fascinating PDF configuring facility, digital editing, field addition, and various others.

You can also fill out any other form of a different category by following the exact steps.