The Philippines government established the HDMF (PAG IBIG) organization to ensure housing for all in the 1970s. Nowadays, PAG IBIG funding loans offer versatile financial support in the form of short-term and long-term loan contributions.

PAG IBIG agency aims to enhance savings by providing funds to Filipinos. For this purpose, the agency gained support from the Philippines Federation for this savings plan fulfillment.

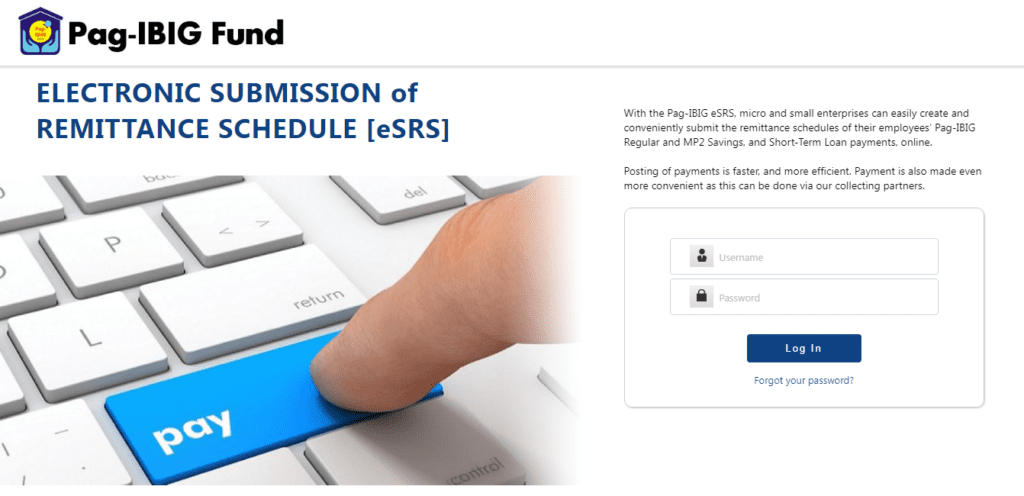

Therefore, PAG IBIG has launched eSRS services for its membership owners to generate their contributions conveniently. You can also generate your loan funding through collecting partners on account of the regulations of PAG IBIG. You can select your accessible approach to accomplish your contributions.

CHECK: Pag IBIG Contribution Table 2024

Contents

- 1 What is the Minimum Monthly PAG IBIG Contributions you can Generate?

- 2 PAG IBIG’s Online Facility to Generate Contributions

- 3 How can you Generate your PAG Contributions?

- 4 How can you summarize your PAG IBIG Contributions generation?

- 5 What are the benefits of PAG IBIG Contributions?

- 6 What is the PAG IBIG’s Contribution Duration and Circumstances to Withdrawal?

- 7 Final Words

- 8 Author

What is the Minimum Monthly PAG IBIG Contributions you can Generate?

You must ensure that your monthly contribution to the PAG IBIG Fund is no less than 1% of your salary. At the same time, your employer’s contribution should be equivalent to 2% of your contribution.

For those who earn below Php1,500, then 1% contribution is fixed for them. If your salary exceeds Php1,500, then your mandatory contribution is 2% and never exceeds Php100.

However, in case your salary is more than Php5,000, your deduction remains fixed at Php100. It’s only you who can select the option for an increase in your contributions. Likewise, your employer must continue contributing 2% of your monthly earnings.

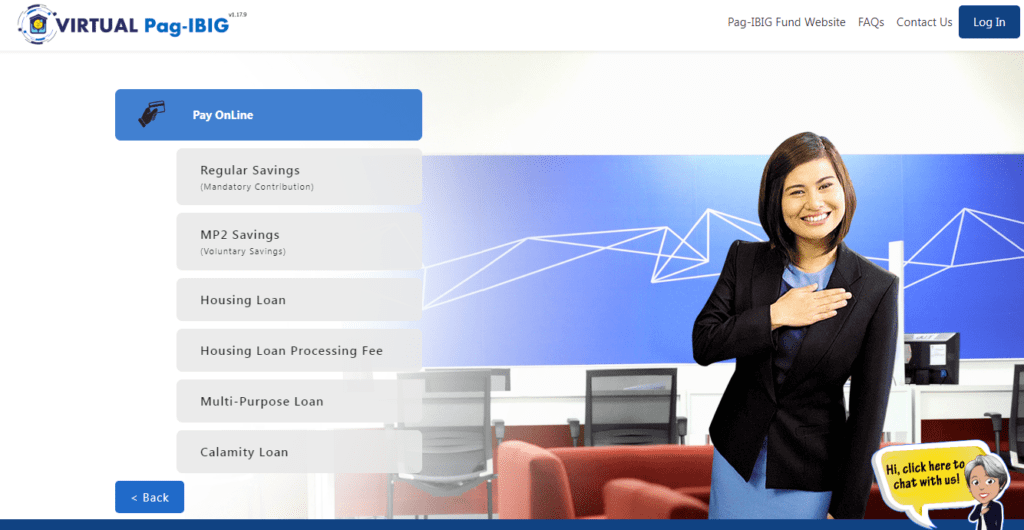

PAG IBIG’s Online Facility to Generate Contributions

How can you Generate your PAG Contributions?

It’s the whole step-by-step guide to generating your contributions under the PAG agency:

Generate your Contribution via UCPB Connection

1st Method

2nd Method

CHECK: How to Merg/Consolidate PAG IBIG Contributions Online?

How can you summarize your PAG IBIG Contributions generation?

Well, you’re proficient in checking and generating your payments while having a PAG IBIG membership. Regarding this, you may select this method:

What are the benefits of PAG IBIG Contributions?

Down saving on a home Loan

The significant aim of PAG IBIG is to bring the opportunity for a down payment on house savings for Filipinos. This aspect has helped to acquire the dreams houses of millions of people.

Furthermore, this down payment offers the perfect interest rates to individuals and makes it easy for them to qualify for this loan amount.

CHECK THIS: How to check pag ibig contributions online?

Funds for House Related Additional Expenses

PAG IBIG’s regular contributions also provide payments for additional home-related expenses such as repair and renovation.

Meanwhile, you can also obtain short-term MPL or calamity loans as well. This MPL amount can be used for your additional tasks.

Finance Assistance during Calamity

The contributions of PAG IBIG are the best source of finance during calamity or hardship situations. Those who are going through difficulties due to finance and natural disasters can protect their families with the assistance of PAG IBIG’s short-term loan.

This loan amount is available within three days in cash amount for three years of repayments according to specific criteria of the PAG agency.

Low-Interest Rates Loans

You can acquire our low-interest rates loan amounts for multiple purposes. This amount is a convenient source to finance your maximum financial needs.

Additional Benefits of PAG IBIG Contributions

Well, all the workers and self-employed are able to achieve their required loan amount by completing the PAG agency’s eligibility criteria for loans. They can become a member of this loan and saving program for a wide range of benefits, including:

What is the PAG IBIG’s Contribution Duration and Circumstances to Withdrawal?

There can be different scenarios if your PAG contribution has been ceased. However, it may exhibit that you’ve withdrawn or claimed all your accumulated contributions. So, these are the actual circumstances and duration for your contributions:

Final Words

PAG IBIG organization brings a positive shift in members’ financial well-being. The entire contributions of PAG IBIG have proved most beneficial for all membership owners.

If you’re willing to know how you can generate your contributions, you can analyze our official electronic Submission of Remittances Schedule (e-SRS) and official services. By just following the process of contribution assessment, you can generate your amount.