The Philippines government declared a State of Calamity during Typhoon and the COVID-19 pandemic. The majority of Filipinos face financial challenges.

Fortunately, our PAG IBIG agency has introduced the Calamity Loan online application system.

It allows you to file convenient funding during natural disasters and community quarantines. You’re capable of knowing how you can file your calamity funds in PAG IBIG.

How to Apply Calamity Loan in PAG IBIG?

Contents

- 1 What is Calamity PAG IBIG Loan?

- 2 What are vital Requirements to File the PAG Calamity or Short-term Loan?

- 3 PAG IBIG Calamity Loanable Amount

- 4 How can you File for a Calamity Loan Amount in PAG IBIG?

- 5 How to Sign Calamity Loan PAG IBIG Online Quickly?

- 6 How do I request or claim for my PAGIBIG Calamity Loan?

- 7 Final Words

- 8 Author

What is Calamity PAG IBIG Loan?

PAG IBIG Calamity loan amount is accessible to all members who are inhabitants under a State of Calamity region. It’s officially announced for all formally employed PAG IBIB, SSS, or GSIS members, self-employed, and all voluntary individuals.

However, the authorized community for this loan is the local counterpart LDRRMC, NDRRMC, or the President. This loan amount is accessible in the following disastrous situations:

When a region is acknowledged under the State of Calamity, then Republic Act No. 10121 orders the appropriate funds and cash amount for affected people. Furthermore, it’s Section 17(d) of the Act directs government financial institutions to extend loans to affected residents.

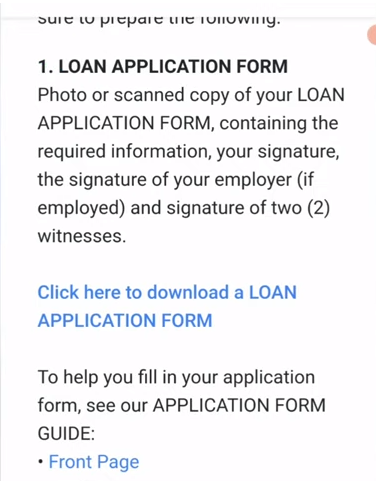

What are vital Requirements to File the PAG Calamity or Short-term Loan?

The qualified individuals must ensure this payment within 90 days (3 months) of the State of Calamity declaration. The applicant’s required documents include the following:

PAG IBIG Calamity Loanable Amount

How Much Is PAG IBIG Calamity Loan? You can acquire around 80% of your Total Accumulated Value (TAV)

You can avail of your calamity loan while actively contributing to the PAG IBIG agency. So, if you’ve accomplished one month’s contribution in the last six months, you can qualify to file for this loan.

How can you File for a Calamity Loan Amount in PAG IBIG?

File up your Calamity Loan Application Virtually

You’re able to complete your calamity loan file through our dedicated virtual way. Fortunately, your virtual PAG IBIG account isn’t essential to filing your application.

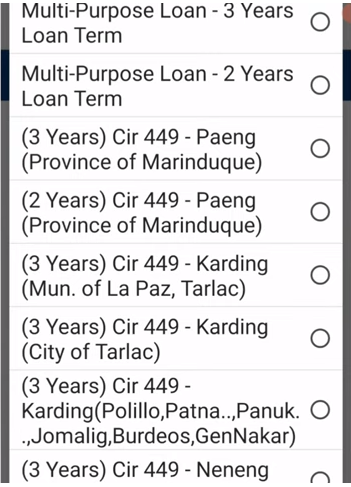

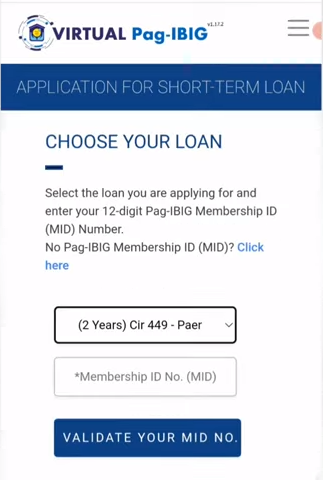

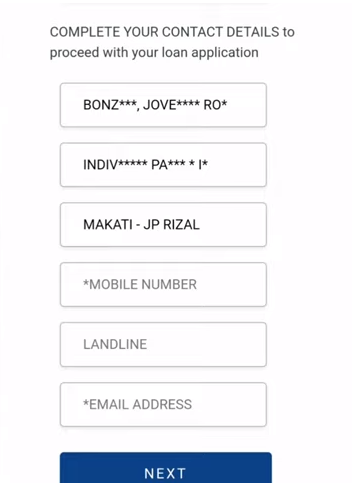

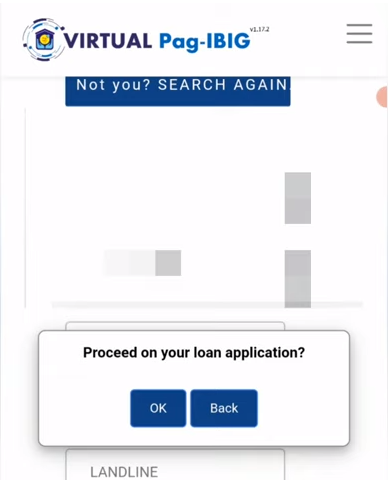

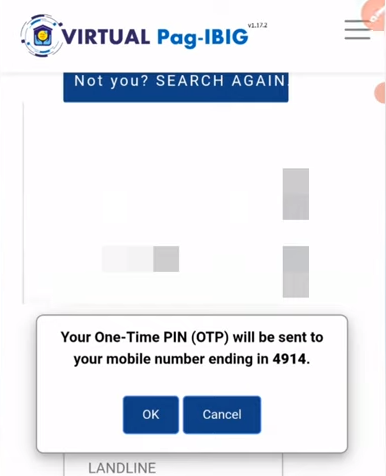

You will need: How to Apply Short Term Loan in PAG IBIG?

Online Application to File Calamity Loan

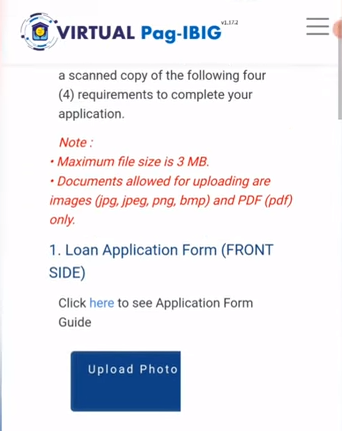

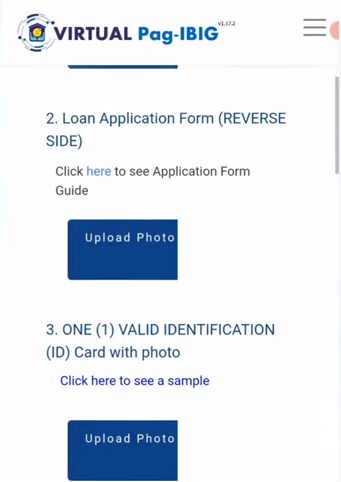

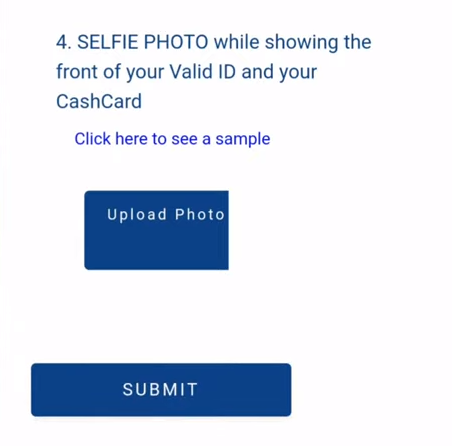

PAG IBIG members have excellent access to submitting their loan files online. However, you don’t have to go for office timing (office closure) or nationwide calamities. Online loan processing access encourages our loaners to file up their contributions quickly and conveniently. You need to submit these documents:

You are capable of entirely filling up your form virtually. Your authorized signatory or employer may sign the Application Agreement portion separately.

Calamity Loan File Submission via Email

In-Person Application

Pag-IBIG Funding branches are open from 9:00 am to 3:00 pm to process calamity or MPL loans (short-term loans).

To file your calamity loan Application, you must know this process:

How to Sign Calamity Loan PAG IBIG Online Quickly?

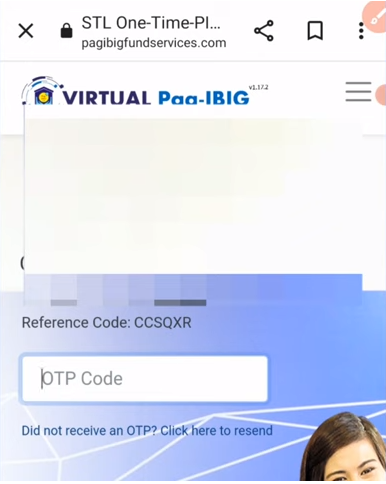

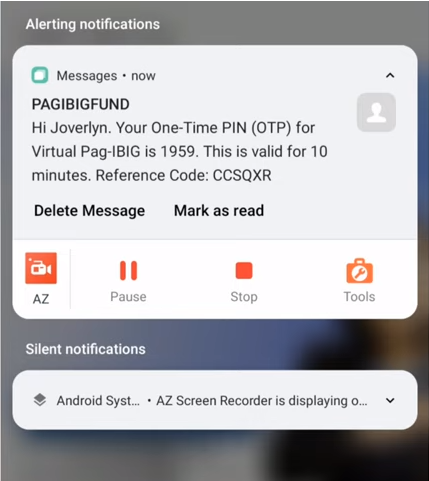

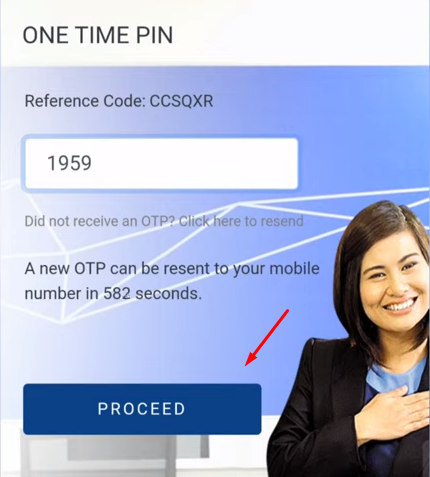

You can easily file your calamity loan under PAG IBIG, the eSignature system.

How do I request or claim for my PAGIBIG Calamity Loan?

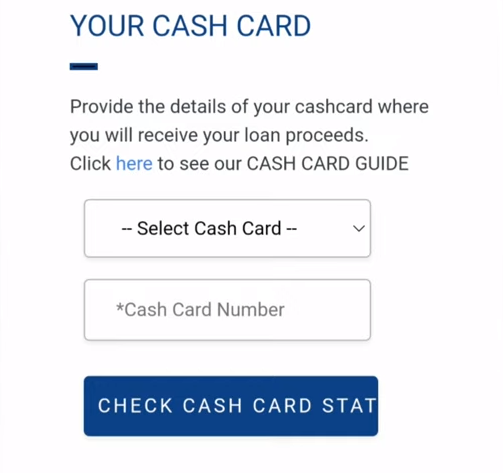

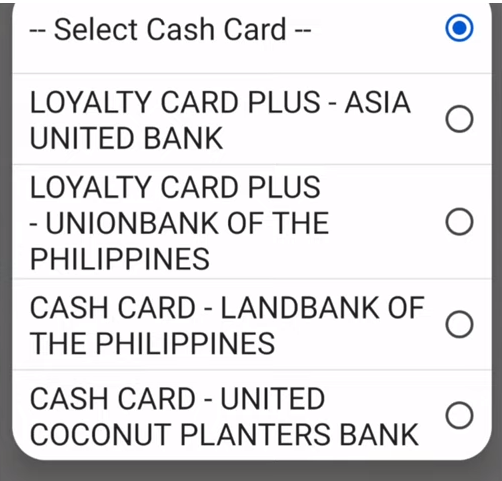

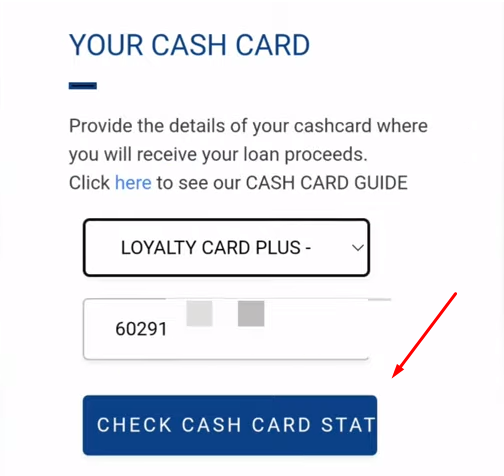

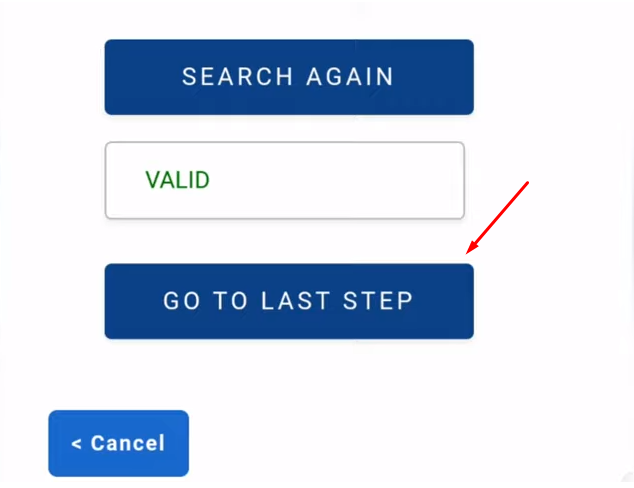

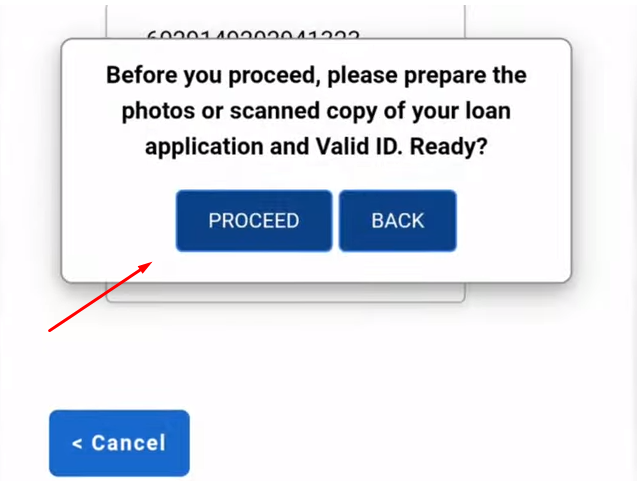

When your calamity loan file is approved, you can receive your amount by various methods, including:

Final Words

To file for your PAG IBIG Calamity loan you may get it form from our PAG IBIG offices or virtual pagibigfund.gov.ph source. Then you must complete your loan with documents within 90 days of declaration from the State of Calamity.

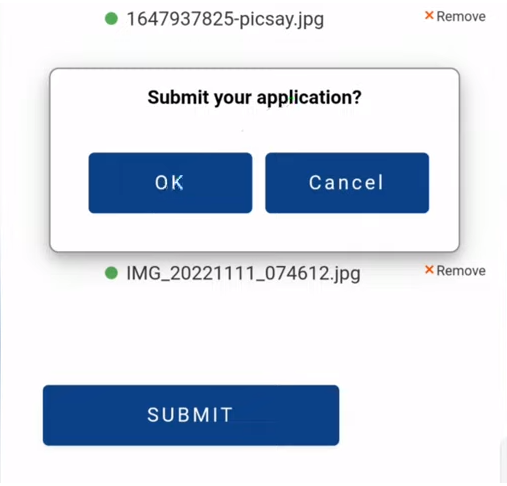

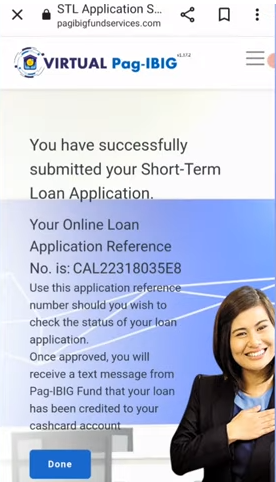

Once your application file is submitted, you may receive an STL acknowledgment receipt that comprises your application number. This receipt is vital for the scheduled release of loan proceeds. You can conveniently obtain 80% of the entire TAV for this loan.