To pay your PAG IBIG contributions as an employer, you’ve to complete the Membership Contributions Remittance Form (MCRF) and submit it at a PAG branch. You can learn how you can compute your employer’s contributions, and complete your payments. You just ensure timely submission of the MCRF to meet payment deadlines and fulfill PAG IBIG regulations.

Contents

How to Pay Employer PAG IBIG Contributions?

There are several ways to pay PAG IBIG contributions. Employers must remit both their share and the deducted amount to PAG IBIG within the due date to avoid penalties. Meanwhile, employed individuals are to pay their contributions that are automatically deducted from their salaries.

CHECK ALSO: How to Pay PAG IBIG Payment Thru Gcash?

Likewise, membership owners with additional savings accounts (MP2) are able to select their employer and deduct the relevant amounts. They can also make separate payments as well. This approach provides flexibility for employers in managing their contributions.

PAG IBIG Contributions Online Payment Access for Employers

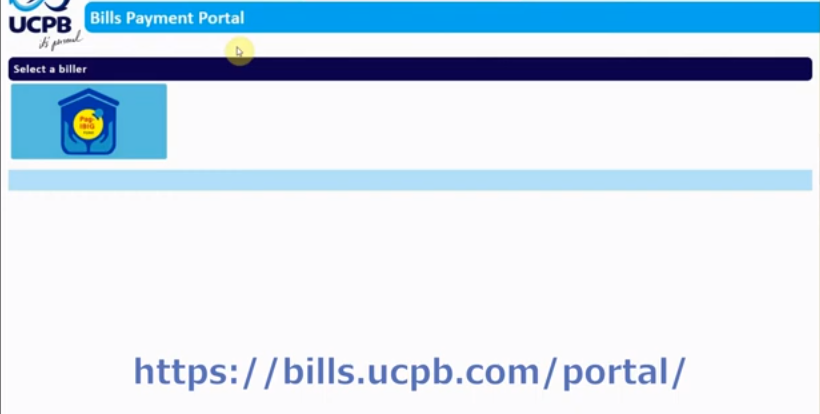

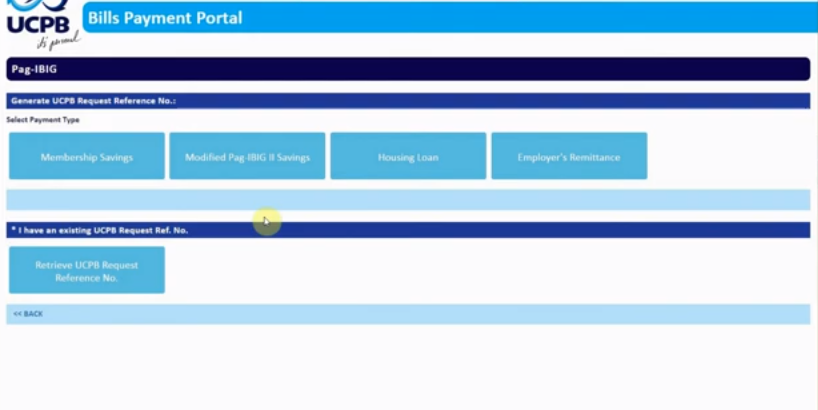

Employers are able to remit employees’ payments via online banking facilities efficiently. It comes with a convenient alternative to the over-the-counter (OTC) payment method at the PAGIBIG office. The virtual banking corporations for employers’ contributions are:

To complete your contributions in these banks, you need to enroll in your preferred bank’s electronic payment facility. You can complete your enrollment form and fulfill the bank’s specified requirements. When your application is approved, you achieve a user ID and password for your bank’s online system that assists you in paying contributions.

This is for YOU: How to Pay PAG IBIG Online?

PAG IBIG Employer’s Contributions Payment Process

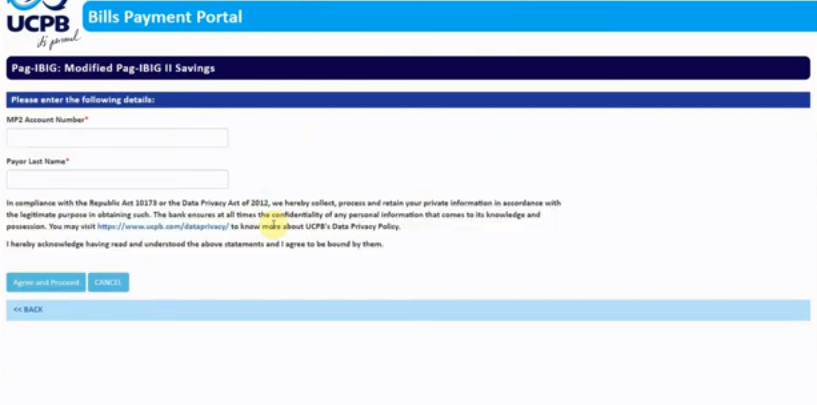

PAG IBIG Contributions payment via UCPB Connects

CHECK HERE: How to Pay PAG IBIG Contribution thru SM?

Furthermore, employers have various hassle-free methods to remit PAG-IBIG contributions on behalf of their employees. These are:

Virtual PAG IBIG

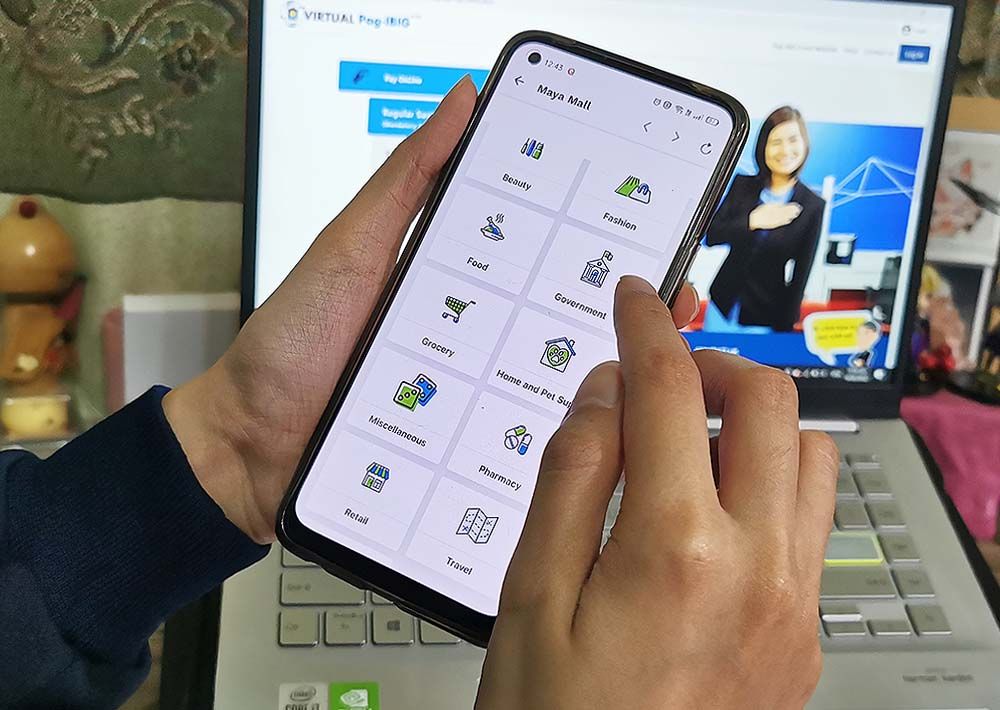

You must take advantage of the Virtual PAGIBIG platform, which enables you to make online payments. Moreover, you can ensure your registration in your selected payment method, including E-wallets (Paymaya and GCash) or debit/credit card payments.

E-Wallets – GCash, Paymaya, and others

You may utilize the e-wallet convenience for completing your contribution payments. This process is also possible with your accurate MID or MP2 number.

Associated PaymentCenters

You can also go to PAG IBIG-authorized payment centers. These are SM Bills, M Lhuiller, and Bayad Center counters. By presenting your MID number, you can accomplish your contributions.

SEE THIS: How to pay PAG IBIG Housing Loan in Metrobank?

Overseas Remittance Channels for OFWs

Employers with overseas members can handle their contributions independently. They can access Overseas Remittance Channels as a secure of their payment options.

ECPay Online Portal for 7-Eleven Payment

You can register your mobile number for ECPay-Eleven methods of Payment. Then fill out your relevant sections with your valid MID and confirm your contributions. Then, you must present the resulting notification to the to-Eleven counter within 24 hours, along with the amount, to validate your contribution.

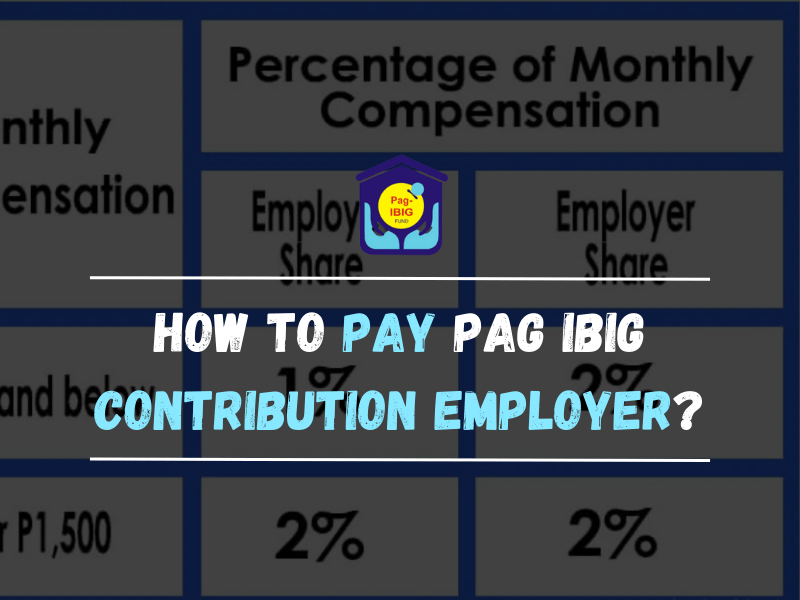

How to Compute PAG IBIG Employer’s Contributions?

You can calculate your contributions straightforwardly. Regarding this, you may determine your gross monthly salary. Then, locate your salary range in the provided table. You may identify both employer and employee contribution amounts. Now, add these two figures to find your total monthly PAGIBIG contribution.

You must note down the upgraded contribution table for your monthly savings. It usually depends on your present employment status or absence thereof.

Employers & Employees PAG IBIG Contributions

| Monthly Salary | Employee’s Rate | Employer’s Rates | Total |

| P1,000 – P1,500 | 1% | 2% | 3% |

| Over P1,500 | 2% | 2% | 4% |

PAG contributions for employed members involve a shared responsibility with employers. Though, employee’s contribution is deducted from their salary and varies according to income (1% to 2%). Meanwhile, the employer amount is fixed at 2%, and it’s not deducted from the employee’s wages.

So, to calculate the accurate amount, you may utilize this formula:

Basic Salary per Month x Employer’s or Employee’s Contributions Rate

For instance,

Worker’s share with a P3,000 monthly salary

P60 = (P3,000 x 0.02)

Therefore, every month, a worker’s P3,000 has a P60 amount deducted from the Employer’s contribution. The Employer contributes an additional P60, and monthly savings become PHP120.

Members with a monthly salary of P5,000 or more. Both the Employer and worker contribute P100 each, which makes the entire monthly savings PHP200. Furthermore, if the monthly salary remains P5,000+, the worker’s amount remains P100, with the Employer remitting the same amount.

Employers of OFWs Contributions

PAG IBIG emphasizes that OFWs must pay their PAG-IBIG contributions. This approach is considered by POEA and associated with their MID to POEA e-Registration accounts access. So:

OFWs with mandatory Employers’ Contributions

| Salary | OFW’s Rate | Foreign Employer’s Rates | Total |

| P1,500 | 1% | 2% | 3% |

| More than P1,500 | 2% | 2% | 4% |

OFWs with exempted Employer’s Contributions

| Salary | Contribution Rate |

| Over ₱1,500 | 2% |

Kasambahays PAG IBIG Contributions and Employers Rates

| Salary | Kasambahay’s Rate | Employer’s Rate | Total |

| < P1,500 | 0% | 3% | 3% |

| P1,500 – P4,999 | 0% | 4% | 4% |

| >P5,000 | 2% | 2% | 4% |

However, PAG IBIG’s monthly contributions remittance for employers varies. It usually depends on the initial letter of the business name:

| Employer’s Name 1st letter | Payment Deadlines |

| A – D | 10th – 14th day of the subsequent month |

| E – L | 15th – 19th day of the subsequent month |

| M – Q | 20th – 24th day of the next month |

| 0 – 9, R – Z | 25th to the last day of the next month |

Final Verdict

PAG IBIG permits employers to accomplish their contribution remittance by online banking and OTC methods. They can fill out the Membership Contributions Remittance Form and submit it to their banks or branches. After paying their contributions, the relevant bank provides the reference number that they must print out and save as their contribution proof.