PAG IBIG MP2 savings are the low-risk investment and affordable opportunity of our PAG IBIG organization. This investment plan attracts those members who are willing to acquire savings schemes other than typical salary deduction programs and regular savings. However, we’ve disclosed a guide on how you can invest in this great savings plan MP2.

Various young adults prioritize bills, travel, and socializing but neglect investment plans. We recommend you to invest in your 20’s. So, this guide is to deal with you for providing value in your investment process. Although you’re going to invest in MP2 savings, you should know if it is safe to invest, if you qualify for this opportunity, how it works, and whether this process is straightforward or not.

MUST Follow: Pag ibig mp2 computation

Contents

- 1 What is the MP2 Investment Savings plan of PAG IBIG?

- 2 How to Invest and get Enrollment in MP2 Savings?

- 3 How does the MP2 investment program work?

- 4 Is the investment in MP2 secured or not?

- 5 Risk factors of PAG IBIGMP2 Investment

- 6 How to maximize MP2 Investment for achieving life goals?

- 7 How can you deposit your Investments into your Account?

- 8 FAQs

- 9 Final Verdict

- 10 Author

What is the MP2 Investment Savings plan of PAG IBIG?

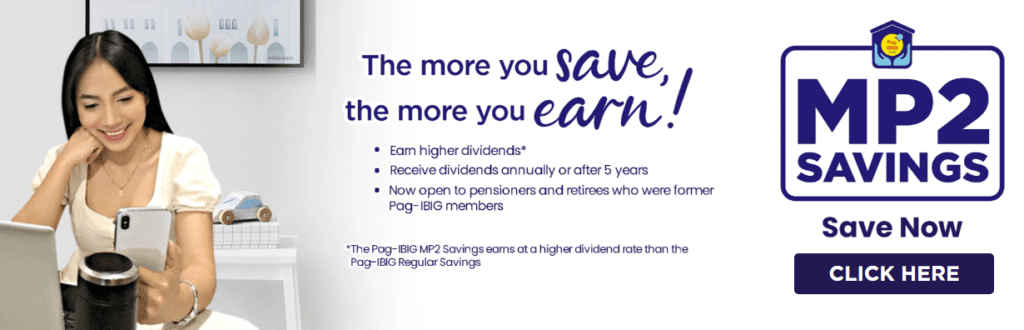

MP2 is a specialized savings scheme that’s designed for former and current PAG members who are looking to enhance their return amounts through investment. However, this plan allows you to earn 70% dividends from your annual net income.

Therefore, this investment and saving plan gets attention due to its high-rated flexibility for contributing to it by just PHP500 charges.

Meanwhile, you should never bear any maximum limit, which encourages you to enter this plan conveniently. You’re proficient in attaining and opening multiple accounts simultaneously. Well, you can withdraw your tax-free dividends annually or on your account maturity.

LEARN: What is MP2 PAG IBIG?

There are no complicated requirements for investing and qualifying for your MP2 savings. You must be an existing MP1 member with a mandatory PHP100.00 salary deduction. Likewise, your gross monthly income exceeding PHP5,000.00 makes this saving accessible even for minimum salary earners.

So, you can contribute to this investment plan with a minimum of PHP500 and a maximum contribution of around PHP5,000.

A remarkable aspect of PAG IBIG MP2 is it offers hassle-free contributions and the convenience of salary deductions. However, you can convey this offer to your company, and companies can facilitate their employee enrollment in this investment program.

Quick view: To Apply for Account

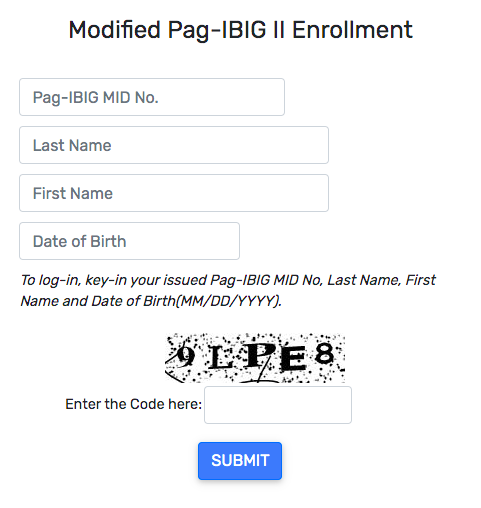

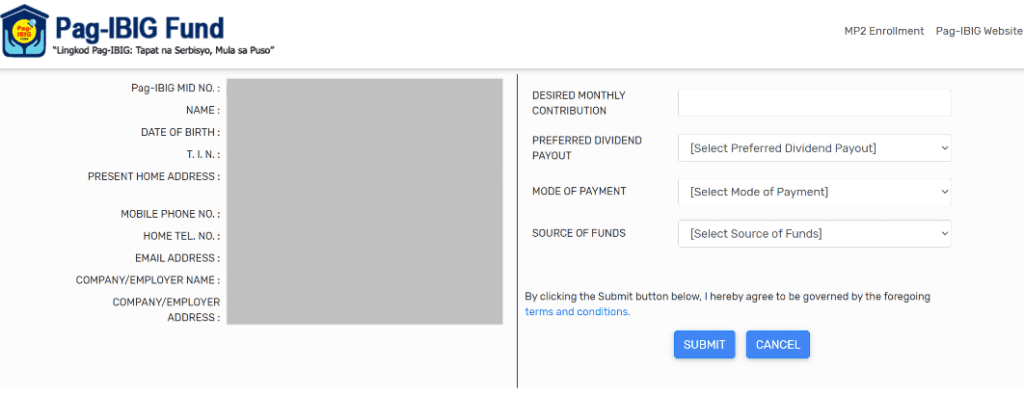

To apply this plan, you may go for online registration:

ALSO SEE: Pag-ibig mp2 online application

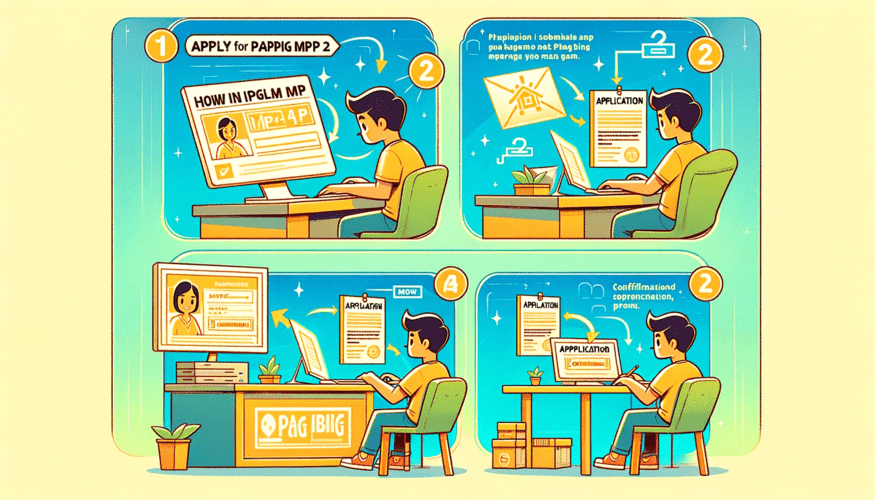

How to Invest and get Enrollment in MP2 Savings?

Enrollment Online Process of MP2

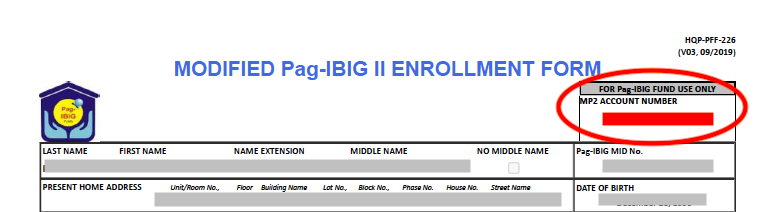

Manual Enrollment Process of MP2

Remember you must get your investment and contribution form’s confirmed copy according to branch-assigned requirements.

How does the MP2 investment program work?

PAG IBIG savings process involves the funds for housing loans and other funding terms in financial needs. The organization engages in investments according to government bonds and ensures secured savings.

It offers more attractive Mp2 dividend rates for savers. So you can participate in this savings program easily.

To qualify for MP2, you just maintain active membership and complete the consistent contributions for the preceding six months.

Is the investment in MP2 secured or not?

Well, investing in the PAG IBIG MP2 program is entirely secure. Government guarantees assist these savings and ensure the safety of your payments.

Meanwhile, dividends may fluctuate based on annual returns, but it remains one of the most reliable investments in the Philippines.

There is only a conceivable risk scenario if the entire Philippine government goes bankrupt, but it’s an extremely unlikely event.

Risk factors of PAG IBIGMP2 Investment

How to maximize MP2 Investment for achieving life goals?

You can choose your required investment strategy:

Major ways to accomplish high investments under MP2

How can you deposit your Investments into your Account?

If you’re an active member of PAG IBIG and want to choose the salary deductions for PAG-MP2 savings, you can coordinate this arrangement with your employers. On the other hand, you can acquire the convenience of digital transactions by allowing remittances through popular digital wallets, including:

FAQs

Is investing in PAG IBIG MP2 a wise choice for passive income?

Yes, investing in the MP2 program is quite a low-risk option with promising returns. It’s perfect for diversification, a versatile and safe investment, and offers relatively fewer restrictions (like PAG IBIG membership) compared to other investment options.

How much amount can I invest in the MP2 scheme?

Minimum PHP500 per remittance amount you can invest. Furthermore, there’s no maximum limit for investment. So you can enjoy the flexibility of MP2 contributions.

You should know that for one-time deposits exceeding PHP 500,000, payment must be made via Manager’s or personal Check. So, your income proof is also required for investments over PHP100,000.

Who is capable of becoming a member of the investment program under PAG IBIG MP2?

This investment plan is open for active PAGIBIG loaners. It’s also accessible to former PAG members (retirees and pensioners) with additional monthly income. It’s not associated with age restrictions while applying.

Additionally, those who have at least 24 monthly savings before retirement and OFWs with MID access can invest in savings plans as well.

On the other hand, those Filipinos who were naturally born in the Philippines, reacquired their citizenship, and had at least 24 monthly savings before migrating permanently to another country are also eligible for it.

Final Verdict

PAG IBIG MP2 brings the optimal chance to contribute to an investment program with minimal PHP500 investment. On your account maturity, you may obtain a substantial return on MP2 savings. To become a contributor to this investment plan, you may enroll online or in-branch ways. Then, you can select your preferred investment way and achieve your goals with your high-rated investments.