Suppose you’re finding a passive income opportunity in the Philippines and focusing on savings and investment conveniently. You must understand that you alone can’t withstand this inflation. However, the Philippines government has now opened the doors for the public to participate in the economic gains through the PAG IBIG MP2 program. This modified saving program invests your money in the country’s market.

However, you need to protect your hard-earned money in current circumstances. Regarding this, our PAG IBIG program not only brings the loan offers, it also offers the saving programs to membership owners. So PAG MP2 Savings Program is designed to help your savings grow with competitive returns and proves an attractive option in uncertain times.

Contents

What is MP2 Savings in PAG IBIG?

Modified PAG IBIG 2 Savings scheme lets the PAG membership owners earn and save higher dividends in a shorter time. You can start your saving journey with just PHP500 and enjoy a better dividend rate. Meanwhile, you may follow the rapidly growing rates of your savings in five years.

Fortunately, our PAG IBIG organization has never set any limits on depositing your amount. You can even pay over PHP 1 million. Although it’s officially acceptable when your deposits exceed PHP 100,000, you must submit your income proof to PAG IBIG. Likewise, for a lump sum of PHP 500,000, you’ll need to prepare your personal or manager’s check.

After viewing the payable amounts for your savings, another important aspect of MP2 savings is how to save your amount. So you may choose to deposit your entire amount at once or monthly deposits. It usually depends on your income source and which method is affordable for you.

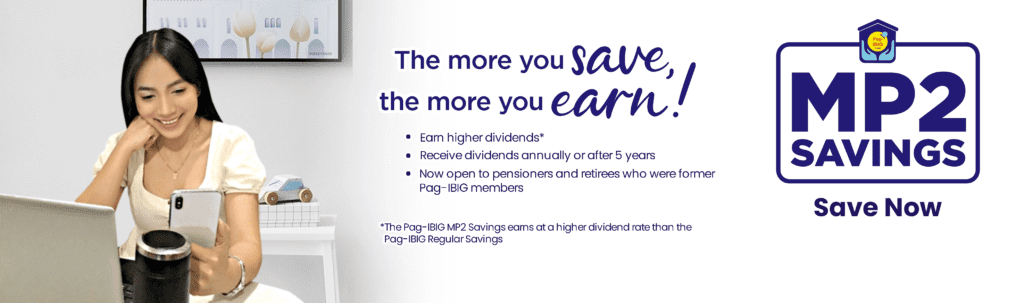

Well, MP2 is voluntary and offers higher earning potential with your savings invested and earning dividends. This program is similar to mutual funds and entirely different and more feasible from regular PAG IBIG saving.

| Years | Dividend Rates of MP2 | PAG IBIG Regular Savings |

| 2010 | 5.5% | 5.0% |

| 2011 | 4.63% | 4.13% |

| 2012 | 4.67% | 4.17% |

| 2013 | 4.59% | 4.08% |

| 2014 | 4.68% | 4.19% |

| 2015 | 5.33% | 4.84% |

| 2016 | 7.43% | 6.93% |

| 2017 | 8.11% | 7.61% |

| 2018 | 7.41% | 6.91% |

| 2019 | 7.23% | 6.73% |

| 2020 | 6.12% | 5.62% |

| 2021 | 5.66% | 5.50% |

| 2022 | 7.03% | 6.53% |

Since MP2 launched, it has consistently upgraded savings accounts and delivered tax-free dividends. In 2019, the dividend rate was 7.23% that’s historically increasing each year. So, our official PAG website announces the rates every March.

How can you Compute your MP2 Savings of PAG IBIG?

Although this MP2 Saving plan is tax-free, you’ll receive your entire amount of dividends without a 20% withholding tax.

Dividend = Dividend rates x Average monthly balance

Let’s multiply your annual dividend rate by your monthly income to calculate your MP2 savings. This method is to compute your dividends manually. Eventually, you can also check your dividends on the first or second quarter of each year from our official site as well.

Eligibility Criteria to Invest under PAG IBIG MP2

The eligibility for the PAG MP2 scheme is open to all active membership owners of PAG IBIG. So this program doesn’t depend on your monthly salaries.

Former pensioners, regardless of age, can also apply if they successfully have made at least 24 months (two years) of contributions before retirement.

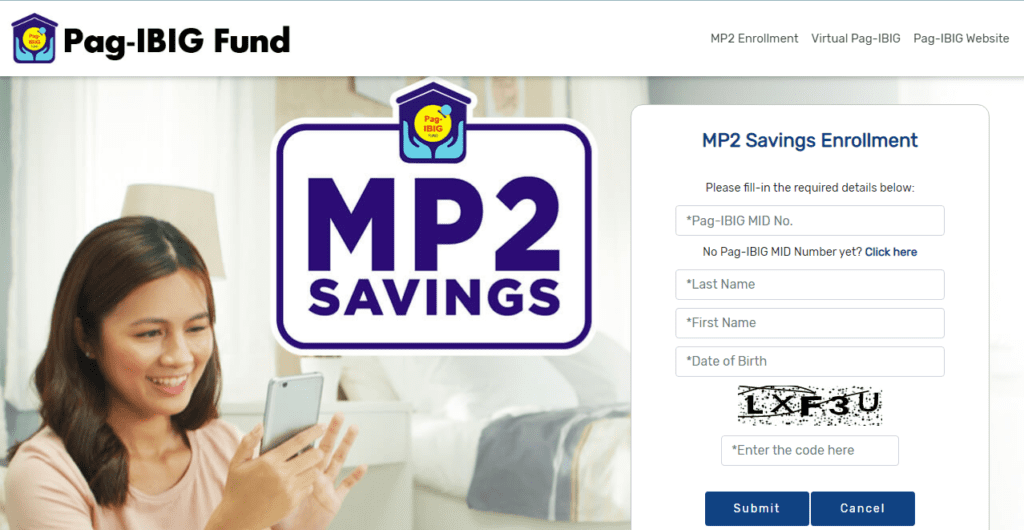

If you’re willing to become a member of the MP2 program, you must register and then make your monthly contributions.

APPLY HERE: pag-ibig mp2 online application

Why it’s beneficial to Invest in PAG MP2 Saving?

Suppose you want to achieve financial aims and expand your income, this government-owned plan proves more advantageous for you. The most effective aspect of this saving is its consistently above-market dividend rates that attract investors.

Hence, its dividends were at their peak in 2017 (8.11%), and then rates slightly varied in the following years. Despite this, investing in the MP2 program remains worthwhile due to its tax-free nature of dividend earnings. Furthermore, this process of MP2 saving is quite hassle-free and lets you secure your minimal PHP500 amount per remittance.

How to withdraw MP2 Savings in PAG IBIG?

However, the savings program of PAG IBIG was initiated by the government in 2011. It allows Filipino citizens who are members of HDMF to save money with appealing interest rates. If you’re willing to enroll in this savings plan, you can get its complete application form from our branch or online website. So, with your minimum PHP500 amount, you can start depositing your amount. When you’ve completed your 36 months, you can withdraw your savings along with the accumulated interest.

How can you withdraw PAG IBIG MP2 Savings before the 5-year Maturity?

Being an MP2 Saving investor, it’s a great offer of PAG IBIG that you can retrieve your savings prior to its maturity period. So you can withdraw your amount before five years, specifically in the following situations:

Summary

PAG IBIG MP2 savings plan brings a profitable and secure means for Filipinos. You can save your money and earn attractive returns on your investments. This program meets with no penalties for withdrawals, is tax-free, and is associated with low loan interest rates and attractive rewards. Ultimately, it stands as a rewarding option for saving money for your future.

Therefore, this MP2 savings scheme comes with top-notch dividend rates and tax-free dividends derived from your PAG Funds annual net income. If you’re a member of the PAG IBIG loan program, you can avail of this saving offer and obtain unbeatable benefits. It is because this saving plan needs to accomplish your 24 months’ contribution to the PAG organization before applying for this program.