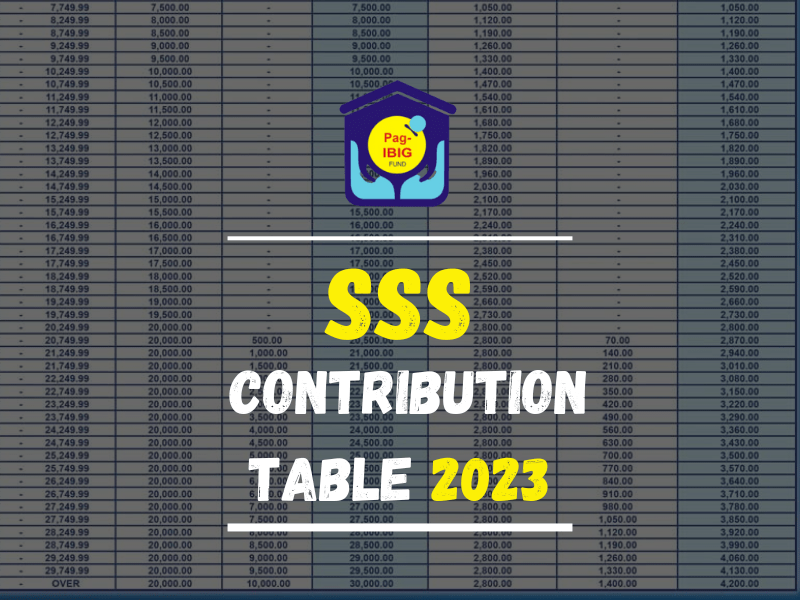

Explore the updated SSS Contribution Table 2023 to understand how monthly contributions are calculated based on salary brackets. A vital reference for employees and employers in the Philippines to ensure compliance with the Social Security System.

In the Philippines, SSS is a government-owned corporation that aims to provide social security protection for workers. Though, it ensures that all employees and their families are financially secure during serious concerns such as times of sickness, disability, maternity, retirement, and death.

This insurance program, Social Security System (SSS), is entirely operated by Government management. In 2018, the Social Security Act stated that SSS Contribution rates had been increased. Social Security Act also introduced that its charges must be enhanced by 1% after every two years, and its process remains the same until 2025. However, the SSS-Contribution table comprises a precisely updated list of contributions. These premium payments are specifically assigned to members of the social security system.

SSS contributions are an excellent resource that comes with a lot of benefits for beneficiaries, such as maternity leave, retirement, pension, sickness, death, permanent disability, unemployment, funeral, involuntary separation, etc.

However, it’s a convenient act, and various companies utilize it to determine the deducted payments from their workers’ salaries (on each cut-off). So, this deducted amount may vary on account of your income status. You have to know all the terms about the category to which you belong.

Contents

- 1 Eligibility Criteria for paying SSS Contributions

- 2 Reasons for Paying Regular SSS Contribution

- 3 Basics of SSS Contribution Computation

- 4 Updated Contribution Schedule of SSS

- 5 What is the actual SSS Contribution Table of 2023?

- 6 Contributions’ Deadline

- 7 How to check my sss contribution?

- 8 FAQs

- 9 Final Statement

- 10 Author

Eligibility Criteria for paying SSS Contributions

Therefore, all OFWs, self-employed inhabitants, Employees, and non-workers with more than 60 age and already existing their explicit SSS codes can pay. However, all these individuals may initiate their coverage and contributions, which are entitled to them as social security benefits on retirement, miscarriage/ childbirth, illness, disability, unemployment, or death.

Suppose you’re an unemployed member; you’re capable of paying your payments as a voluntary individual. Suppose you’ve covered the previous membership as an OFW self-employed or employed worker with a minimum one-month contribution. It’s because SSS never permits me to contribute voluntarily for the first time. So you can’t contribute since you’ve got registration of OFW, self-employed, or employed workers previously. Moreover, here you’re proficient in paying your contribution and keep going through this process only when you’ve registered and even after separating from your employment.

Self-employed communities of informal corporations like fishermen and farmers are also allowed to contribute to SSS as voluntary members. Fortunately, you’re lying in the vulnerable worker category. SSS must grant you a more flexible and convenient contribution schedule.

SSS allows you to pay your overall contributions whenever you want (within) the last 12 months. Though you just need to ensure your contributions before your official payment schedule. Suppose your contributions are due on October 2023; you can accomplish your payments from October 2022 – September 2023. So, it offers a more lenient payment window and exceeds the repeated three-month interval prior to your scheduled payments.

Reasons for Paying Regular SSS Contribution

When you’re an employer with a shorter wage and a limited budget, your contribution looks like an additional expense on your employment status. It seems a burden until you may know its actual worth at the time of your life’s serious troubles, employment shortage, or retirement.

Nevertheless, your SSS contributions ensure a secure future. When you are earning a good income and contributing to the SSS agency. It’s a great opportunity to establish your net amount for retirement consistently.

SSS entirely depends on the total number of contributions and paid contributed amount. These contributions are essential to note for calculating and granting your benefits.

You need to qualify for the following requirements to acquire your SSS loan or benefit:

Basics of SSS Contribution Computation

Your remitting amount usually depends on the following two factors:

Type of Membership:

All members must pay their different payments according to categories. As OFW, employed, non-working partners, self-employed, and Kasambahay are voluntary, they have separate amounts for SSS contributions.

Suppose the payments of OFWs, Kasambahays, and employees are deducted from salaries and payout for SSS contributions. So when you’re paying your contributions, it’s transacted from your wage. Although, other members need to remit whole contributions.

MSC – Monthly Salary Credits:

Regarding Social Security Law, this MSC is stated as the ‘payments based on benefits and contributions. MSC is a great source of computing your SSS benefits on the basis of your monthly income. The greater your monthly salary is, the greater your MSC. Higher MSC leads to higher contributions. So, MSC represents with member’s salary range on the SSS contribution table.

Updated Contribution Schedule of SSS

The SSS Act is referred to as Republic Act 11199. It was established to broaden the duties and authorities of the Social Security Commissioner. It also streamlines them and ensures the sustainability of the Social Security System for a long-time.

Besides this amendment, SSS has offered guaranteed services to its members. As a member of this contribution, you have a better future regardless of current or upcoming inflation. Though, you can maintain your lifestyle and membership status with this opportunity.

However, before computing your SSS payouts, you need to go through the key alterations to the SSS Schedule based on Social Security Act. that happened in 2018 and then followed for 2025.

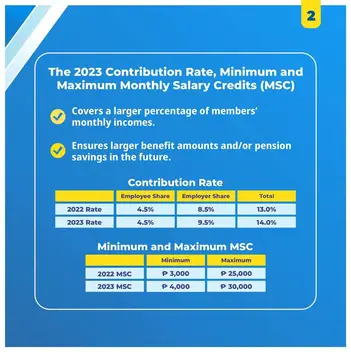

The contribution rates are increased up to 14% from MSC. Now it’ll keep rising by 1% after every single year till 2025, and it will become 15%. Though, this updated regulation has enhanced the MSC. It was PHP 3,000 in 2021 and boosted to up to PHP 4,000 in 2023. This updated amount is effective for SSS contributors except OFWs and Kasambahay, whose lower MSC goes to PHP 8,000 and PHP 1,000, respectively.

Meanwhile, you may know that a maximum amount of MSC will enhance

From 2021 > PHP 25,000

To 2023 > PHP 30,000

Remember, with an increase in MSC, your SSS contribution will increase. So now, if you have to go for higher payments, your SSS benefits will be increased automatically.

What is the actual SSS Contribution Table of 2023?

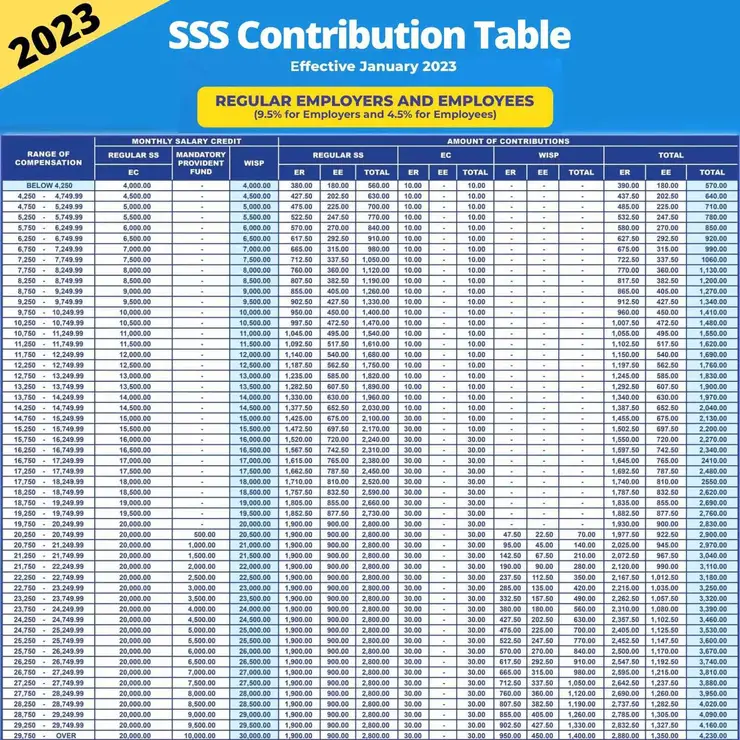

Employed Workers

However, contribution rates are 14%, where employees pay 4.5% of their monthly salary, and employers contribute 9.5%.

Furthermore, the Employees’ Compensation (EC) Program runs on the monthly payouts of employers. Here per employee earning of PHP 10 will be below PHP 15,000 (Likewise, per employee earning of PHP 30 will be around PHP 15,000 or above). Thus, employers are essential to compensate all these payments within the due date in SSS.

How can you Determine your Monthly Contribution? (For employees and Employers)

For an instant, the upgraded table exposes employees earning between PHP 19,750 – PHP 20,249.99. Likewise, your MSC is PHP 20,000.

Employee’s contribution PHP 900 + Employer’s Contribution PHP 1,900 with EC = PHP 2,830

Hence, this amount is paid from the employer’s side.

You can also Compute it by (MSC = PHP 20,000)

Contribution formula x MSC

Employee’s Contribution: PHP 20,000 x 0.045 = PHP900

Employer’s Contribution: PHP 20,000 x 0.095 = PHP1,900

+ PHP 30 of EC

Entire Contributed Amount:

PHP900 + PHP1,930 = PHP2,830

Private employee with

MSC – PHP25,000

Remits – PHP 700 Payment for WISP account

While his salary is – PHP 225

The employer would pay the remaining PHP475

Self- Employed Contributors

When you’re contributing as self-employed after registration, your payouts are revealed on the E-1 or E-4 form. If you are a member of an occupation, business, or trade where you’re your own head officer, then SSS introduces you as a self-employed worker.

How can you Determine your Monthly Contribution? (For self-employed)

MSC x Contributing Payouts = Monthly Contribution Charges

PHP20,000 x 0.14 = PHP2,800

According to updated laws of SSS, self-employed people can also register their accounts for the EC program. Though with EC charges of this plan, the entire contribution may become PHP2830. Moreover, with a similar WISP payments count of PHP 20,000

Non-working Partners and Voluntary Members

You’re contributing as a voluntary member; the computation of updating contributed payments of SSS would be a bit complicated for you. It’s because your salary isn’t fixed. So, SSS depends on your first contributions and then your selected MSC. It’s usually unrelated to your last MSC (as I was for OFWs, self and former employed members).

So your MSC is related to how much you receive in a certain month. Your affordable amount per month is considered here.

Likewise, for a non-working partner, monthly payouts depend on 50% of their partner’s MSC. However, for non-working members:

Partner’s MSC > PHP 20,000 and a half would become PHP 10,000

Monthly payout rates > PHP 1,400

PHP 10,000 x 0.14

1st partner’s salary > PHP 3,500 monthly

50% will become > PHP 1,750 (it’s lower to a minimal amount of MSC PHP 4,000)

Thus, the entire contribution may become PHP560 (for 14% of the entire PHP 4,000)

However, your WISP payment is counted similarly to the mentioned members’ manners. The only difference would be for the absence of an employer, and you have to pay the entire charge of PHP 20,000.

OFW Members

The lowermost MSC in 2023 is PHP 8,000 for OFWs. Though you’re proficient in computing your entire contributed payments as an OFW:

PHP 2,800 = PHP 20,000 x 0.14

WISP comes with similar payouts for PHP 20,000 on account of a novel provident fund.

For Kasambahay and Household Employers

Kasambahay regulations are needed for household workers to make whole contributions. Your home helpers come with a wage of lower than PHP 5,000. Kasambahays obtains PHP5,000 and more of 4.5% MSC. And now your employer goes for 9.5% + EC amount is PHP 10 for below PHP 15,000 and PHP 30 for PHP 15,000 and above.

How can you Determine your Monthly Contribution? (For Kasambahay)

Employee’s Contribution > PHP 6,000 x 0.045 = PHP 270

Employer’s Contribution > PHP 6,000 x 0.095 = PHP 570 + PHP 10

Total Payout in SSS > PHP 270 + PHP 10 = PHP 850

Contributions’ Deadline

How to check my sss contribution?

To check your Social Security System (SSS) contributions, you can follow these steps:

- Online via the SSS Website:

- Visit the official SSS website (www.sss.gov.ph) and log in to your account.

- Navigate to the Contributions tab or section.

- You should be able to view your contribution history, including the details of your past payments and contributions.

- SSS Mobile App:

- Visit an SSS Branch:

- If you prefer an in-person inquiry, you can visit any SSS branch.

- Approach the customer service or information desk and request assistance in checking your contribution records.

- Be sure to bring valid identification for verification purposes.

- Call SSS Hotline: 1-800-10-2255-777

- You can also inquire about your contributions by calling the SSS hotline.

- Prepare your SSS number and other relevant identification details for verification.

- Email Inquiry: [email protected]

- Send an email inquiry to the official SSS email address, requesting information about your contribution records.

- Include your full name, SSS number, and any other details that may be required for verification.

By following these methods, you can easily check your SSS contribution records and stay updated on your social security savings.

FAQs

How can you calculate your SSS contributions in 2023?

> Add your Employer’s Contribution (ER) + Employee (EE) contribution + WISP (optional). For an instant,

> Monthly salary is 10,000

> Employer’s > 950 ER + 10 EC = 960

> You can pay > 450

> Your entire monthly SSS contribution is PHP 1,410

What is the quick way to check my SSS contribution table Online?

> You have to log in to the registered My SSS account

> Click on the inquiry option from ‘Menu.’

> After that, select the option ‘Membership status.’

> Go for Actual Benefit Premiums

> Get your Benefits per month

Am I able to enhance my SSS-contributed payments?

Yes, SSS allows the contributors to increase their contributions while their salaries are increased. It also allows you to accumulate extra savings. You can boost your future benefits as you want.

Final Statement

SSS Contribution Table 2023 is the vital source of making the beneficial contributed savings for both of you (as employers and employees). You need to stay connected to the updated table of SSS contributions. You can enjoy the financial securing plans of the SSS agency.

REF: https://www.sss.gov.ph/sss/DownloadContent?fileName=2023-Schedule-of-Contributions.pdf