The Philippine Government has offered convenient and easily accessible online payment methods. These online options are organized for all classes, employers, self-employers, and OFWs; all communities are capable of accessing them.

Metrobank is among the Philippines’ oldest and most admirable banks. This bank has partial ownership by the Government if my memory serves me rightly. However, Since 2018, all house loaners were said to pay their amortizations via their desired payment receiving channels. When the official community refuses to accept in-person payments. Cebu and Bayad Center were out of my range and inaccessible to me.

Firstly, I opened my personal account on this bank with the intention of saving my payments. At that time, I had little intention of whether you would be able to pay my PAG IBIG Amortizations. This monthly payment was not my purpose for opening my account, but later it proved fruitful for me. However, my figured-out service Metrobanking follows quite different payment methods. I found it more appropriate, managed, and reliable.

CHECK: How to Pay PAG IBIG Housing Loan in 7/11?

Contents

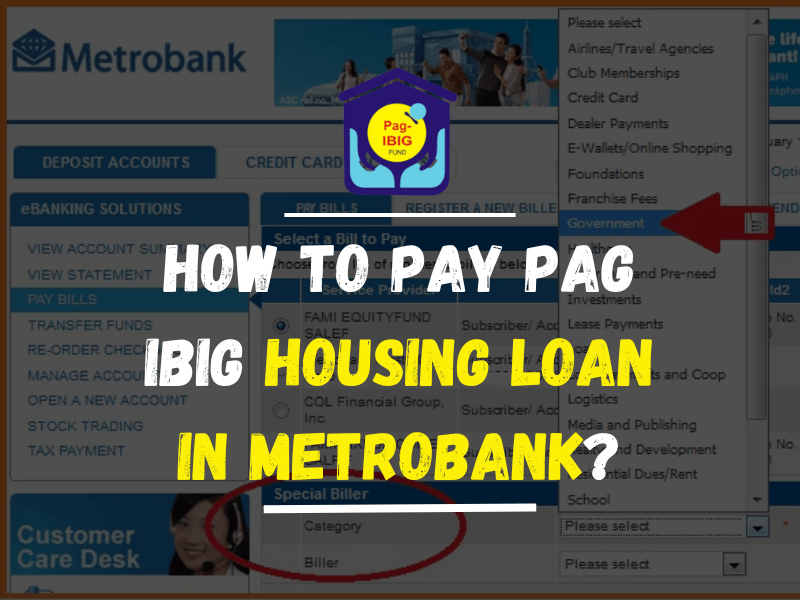

PAG IBIG Loan Payment via Metrobank

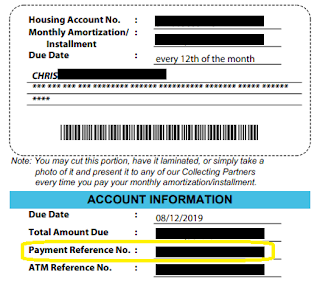

Therefore, I used to save my paid transactions record on my PAG IBIG membership file. To save it, I go for an e-bills statement; it’s a more efficient way or take a screenshot of the final page. It works the same as your paid payment receipt.

CHECK: Where to Pay PAG IBIG Housing Loan?

Moreover, Metro banking service is straightforward and trusted instead of Bayad Center. I paid PHP8 for my loan payment process. As per my recommendation, being a housing loan member, you must pay your amortizations via Metrobank.

Benefits of Metrobank Access for Paying PAG Housing Loan

CHECK: How to Pay PAG IBIG Housing Loan Thru Gcash?

FAQs

What is the official way to make Metro Bank PAG Loan payments by Phone?

Metrobank allows the borrowers to pay their payments to PAG IBIG via Mobile phone contact or an App other than the website. Though you may call at 0345 08 08 508 if you’re paying your loan payments as a business customer. Or 0345 08 08 500 as a personal customer on the bank

Can I Pay my housing mortgage in PAG organization through the online facility of Metrobank?

Yes, Metro Bank allows online access to pay your loan payments or acquire your MP2 savings on your account from PAG IBIG. For this purpose, you have to insert your contributions detail on the online website access to PAG IBIG. Following the relevant steps, you are able to pay your home loan payments via the online site of Metrobank.

Conclusion

Being a Housing loaner, you should pay your PAG housing loans in Metro-bank. It’s a secure, supportive and user-friendly method, among others. One main feature is its extensive networking that allows you to access your desired payment method by Metrobank. I personally use this bank due to its managed and smooth services and paying my amortizations ideally.

Hi Ms. Marina,

We are intending to buy a house & lot worth 6.5 Mn from a seller/ owner. Are the basic requirements & process the same as those with housing developers?