The Housing loan computation in PAG IBIG is quite straightforward. Although, buying your own home is a significant milestone achievement in everybody’s life. PAG IBIG funding agency is here to assist you in achieving your house. Providing handsome contributions, it’s a vital source of owning your dream house.

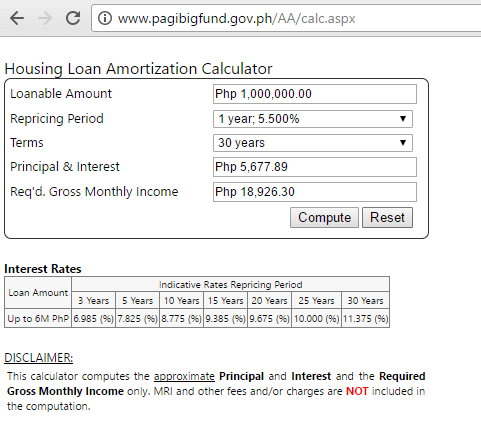

Meanwhile, it’s crucial to check your loan payments appropriately. Though, PAG IBIG has brought the computational aspects for your housing loan calculations, making your computations more manageable. Hence, PAG software (calculator) is a relatively favorable approach while computing housing loan payments.

CHECK: Pag-ibig Housing Loan Calculator

| 50% Monthly compensation for Members | Saving Rates |

| Below and PHP 1,500 | 1.0% |

| More than PHP 1,500 | 2.0% |

Contents

How to Compute Housing Loan (Step-by-Step Guide)

Well, you’re a successful membership owner of PAG IBIG. You’re well-known for the smart facilities of the PAG Organization. You can compute your housing loan payments individually or use the PAG-provided calculator. Both these methods allow you to compute your housing loan. Therefore, you’ve to go through the following steps consciously while computing your affordable housing loans.

Though you can get your computed amount on your bank amount or compute by your salary deduction as well, the PAG computing system needs your input instruction about the loan. Then, your whole computations are provided within no time. Eventually, it’s the relatively more convenient way to compute your loan amount.

PAG IBIG Housing Loan Computation

PAG IBIG has designed a specific housing loan calculator that can swiftly compute the affordability of your contributions. Thus, this computed amount depends on your salary, the estimated cost of your housing property, and your selected mode of loan terms, or you’ve to follow the fixed price period.

However, we’ve delivered the following computing guide: PAG House Loan Rates Guidebook (PHP 1,000 loan) for a fixed period.

| Term | 3 Years | 5 Years | 10 Years | 15 Years | 30 Years |

| Yearly | 7.985% | 8.985% | 10.000% | 10.750% | 12.250% |

| 3 | 31.32945 | 31.79275 | 32.26791 | 32.62045 | 33.33384 |

| 5 | 20.26922 | 20.75108 | 21.24704 | 21.61795 | 22.37099 |

| 10 | 12.12483 | 12.65946 | 13.21507 | 13.63387 | 14.49199 |

| 15 | 9.54786 | 10.13374 | 10.74605 | 11.20948 | 12.16299 |

| 20 | 8.35507 | 8.98761 | 9.65022 | 10.15229 | 11.18565 |

| 25 | 7.70823 | 8.38169 | 9.08701 | 9.62083 | 10.71744 |

The interest rate is exposed in percentage that remains fixed for whole computations.

How can you compute your Housing Loan?

Suppose:

Here, you can see the payable down payment charges are 20%. Usually, this down payment %age (10% or 20%) is related to your assigned and verified house or developers project.

House Project Computation

Remember that you can enjoy a discount on your down payments when you pay your charges within 30 days. Hence, your Computation would be as follows:

Down Payments = Member’s Property Cost x 20%

Down Payouts = 1,100,000 x 0.20

Down Payouts = PHP 220,000

Computation with Reservation Charges

PAG IBIG has assigned the explicit reservation fee of PHP 10,000; your Down Payment is as follows:

The net amount of the Down Payment = PHP 210,000

Your reservation charges will be deducted from the total amount or down payments.

Computations with payable 20% Down Payments (in 12 or 15 months)

Though 20% down payments are applicable for 12 months or 15 months:

Your stretched down Payment is directly associated with your developer’s standard payments.

80% Loanable payouts to PAG Financing

Net Balance 80% = Property Price x .80

Net Balance 80% = PHP 880,000

This 880,000 is the net loanable charge with an 80% balance. However, it’s the entire Computation regarding monthly housing contributions.

PAG IBIG Amortization Computation Monthly

The factor pricing table is the best solution while computing the monthly housing loan charges. However, you can estimate your monthly amortizations as well. Suppose we’re elaborating the amortization payouts using the 7.32719 amount for 30 years. Your repricing charges may remain fixed for three years after that, and these will be repriced and divided by 1,000. It’s computed as:

Loan Amortization monthly = Loan contributions x 7.32719 / 1,000

Loan Amortization monthly = 880,000 x 7.32719 / 1,000

Loan Amortization monthly = PHP 6,448 Monthly

Thus, this PHP 6,448 amortization value per month remains fixed for initiated three years. Afterward, this amount will be repriced after every three years.

What is the maximum duration of PAG IBIG Housing Loan Amortizations?

Borrowers are capable of repaying their layout loan payment to PAG in 30 years. It’s the maximum repaying period of the PAG agency.

Conclusion

Computation of the PAG IBIG Housing Loan is a valuable process to bring the confidential loan membership. However, you can acquire your loan, enjoy the easy-to-compute, and repay your payments. You need to remember that as you’re making more and more payments, your overall payments will reduce. Meanwhile, your paid interest rates will also reduce.

Thus whole calculations of your housing loan rely on Computations of interest rate, loan amount and individual repayment terms. Fortunately, after going through this computation guide, you’re proficient at making informed decisions about owning your housing loans.