Cancelling the PAG IBIG housing loan is a big decision and involves the official guide on the cancellation process. Knowing the guidebook for cancelling the housing loan under PAG IBIG Company is essential. It’s an excellent approach for loaners to follow the entire instructions while implementing this loan cancellation process.

You’re a successful qualified member of the Housing loan program at PAG IBIG; now you’re concerned about cancelling the housing loan. However, you have to learn the cancelling process offered by PAG IBIG. You can explain the reason behind this big decision and offer your payments to your companion.

Contents

How to Cancel PAG IBIG Housing Loan?

If you are cancelling your house loan or membership from PAG IBIG, you must coordinate with our PAG IBIG representatives. They will ask about your legal Agreement for this cancellation. Or they refer you to go through the PAG IBIG’s cancellation procedures.

Guide on PAG IBIG Housing Loan Cancellation

Accomplish your written request Agreement.

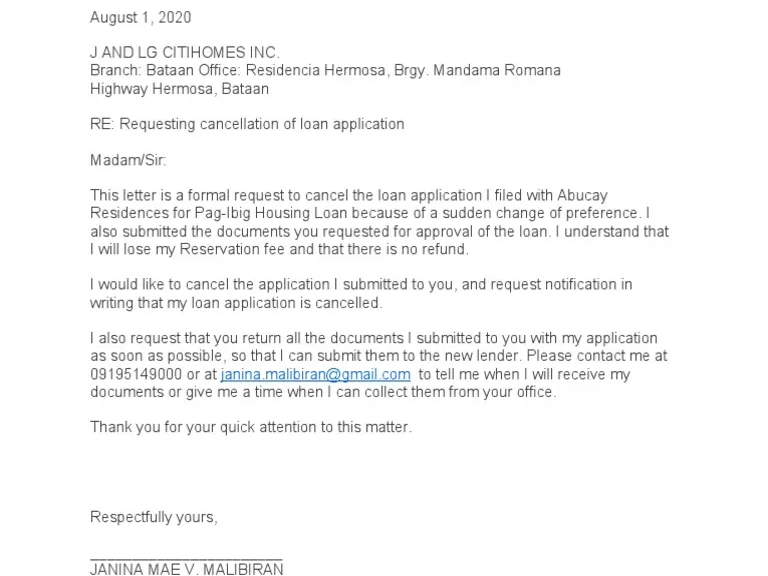

Prepare an agreement letter to the PAG agency introducing your request to cancel your loan membership. You have got a housing loan to construct your home, but now for genuine reasons want to eliminate your housing loan membership. You may provide the following:

Valid Reason Letter

Cancelling the housing loan from a government-launched organization must be due to certain reasons. Though prepare your valid letter of the main reason behind this cancellation.

These reasons can be a change of plans, your financial situation, migration, or related other valid causes. These situations can be accepted while countering during membership with PAG IBIG.

Make any excellent Balance

Suppose you’ve got your loan payments before your cancelling request. Then you must settle any of your desired outstanding amounts. This amount may include penalties, interest, principal, and other proceeds.

Pay your Cancelation Fee

Though joining the PAG IBIG is quite favourable and user-friendly. Meanwhile, when transferring your loan payments to your companion or cancelling your loan, you have to pay its fee.

PAG IBIG has assigned a specific cancellation fee that all members must pay to cancel their housing loans. These fee charges are directly proportional to your stage of loan assortment and loan amount. The notable point is that when you submit your loan cancelling application, your fee charges will be according to this.

Follow the instruction of PAG

Once your cancellation agreement is ready, take a view whether you’ve accomplished all PAG IBIG instructions. Your request submission follows up on all the PAG IBIG statuses. It’s the key step for approval. After that loan cancellation letter will be released for your housing loan.

Causes of PAG IBIG Housing Loan Cancelation

Sometimes, members encounter changes in their plans, some other acquires a better opportunity, and it ends in the cancellation of their loan. These conditions may cause a challenge for you to continue your loan agreement. Along with your causes, you also need to evaluate your loan status as well. Consider all the consequences and then confirm your decision to cancel your loan.

However, your financial consequences are reported as one major reason for cancelling your loan membership. The indisputable fact is financial crises such as losing your processing paid fee, relinquishing your payments from the loan, and facing additional penalties for your termination are major problems. So, you must make satisfactory and conscious decisions while cancelling your house loan from PAG. You must take the advice of our financial advisor or our real estate professional.

Plan Alteration

It’s also considered the most prevalent reason for loan cancellation. Members may relocate their properties or decide to buy some different housing property. Due to such reasons, PAG IBIG has offered strict rules, criteria and requirements to acquire housing loans. The pro tip is to ensure your plans and get the housing loan from PAG IBIG funding plans.

Better chance

Filipino workers acquire this housing loan when they want to construct their dream house for their families. So, you’ve got another best option or heavy earning source (it can be your business).

Senior Management may also consider the critical illness of the main loaner of his family members. Moreover, unemployed borrowers may go for loan cancellation via CTS cancellation.

Steps to Cancel your Housing Loan from PAG IBIG

Firstly, you should contact your lender while cancelling your loan. Share your plan to cancel your loan and ask for the required documents to complete your termination process. When your documentation is prepared, the lender starts the rest of cancelling request process.

You can email your documents and cancellation letter to your certified lender. He will respond to your request. This request receipt is essential to accomplish your cancellation process.

The next phase comes with submitting your cancellation documents and verifying the receipt of your lender to the office. This request letter comprises all your loan terms, payments you need to repay, penalties, and cancellation fee details. Once your documents are ready, you should sign these paper-lets after viewing them clearly. Also, attach the additional documents for PAG IBIG verification with your cancellation forms.

Lastly, your loan payment must be made in 30 days if your cancellation letter is approved. You may contact your lender if you have any problem making these payouts. Ultimately your legal action is completed for cancelling your loan.

Final Thoughts

PAG IBIG housing loan can be cancelled by following up on the official terms. Hence, you’re a trustworthy housing loan membership owner of PAG IBIG. Now you’re facing financial trouble or got a better opportunity and deciding to cancel your loan. You must follow the PAG IBIG instructions to clear your required amortizations of this period, penalties and other requirements. Afterwards, your cancellation process is guaranteed smoothly to close your membership.

What if I consumed the 60 days extension after giving 90 days to submit the required documents in an approved HOUSING LOAN due to some personal matters. Can I ask for additional one month extension?