Navigate the process of applying for a Pag-IBIG calamity loan with our comprehensive guide, featuring eligibility criteria, application steps, required documents, and repayment terms. Get the financial assistance you need during difficult times with ease and clarity.

The geographic location of the Philippines makes this region vulnerable to natural calamities. These can be landslides, flooding, drought, storm surges, and volcanic eruptions. Though, it represents that the Filipino community is usually facing severe distress, tragic incidents, and losses.

CHECK: How to Apply for PAG IBIG Salary Loan?

However, the calamities affected communities are ethically qualified for assistance. In this respect, we’ve brought the relief operations in PAG IBIG funding as calamity loans, SSS loans, and other funding schemes. The authorized PAG IBIG calamity loan can alleviate the financial burden for affected families.

If you want to be a loan member at PAG schemes, move forward to learn about how you can apply for Calamity Loan. Remember, for acquiring a Calamity loan, you are eligible for it, fulfilling the requirements as well.

Contents

PAG IBIG Calamity Loan

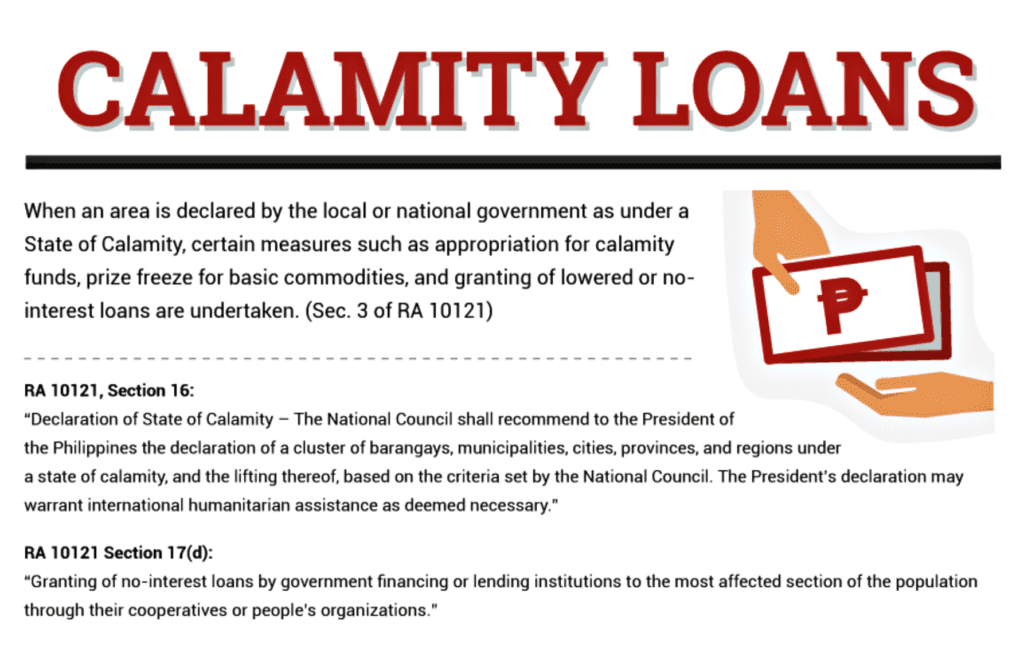

Fortunately, a Calamity loan is a specific offer that is accessible in cash. This calamity loan declares by the official center of the President/ Sangguniang Bayan. When this loan is accessible, the funding counter makes a professional call for a calamity loan to all affected people. You are capable of applying for it within 90 days.

It may assist deadly affected members who get suffer from recent calamities. There are vital facts and fees of this fund:

State of Calamity

The region where the whole population is severely impacted, terribly lost, or distressed due to artificial situations or natural disasters. The same case happens in various areas of the world. PAG IBIG assists the Philippines in overcoming its effects and stabilizing its health and financial conditions. That’s why PAG governors declare the dedicated calamity loan on the bases of these factors:

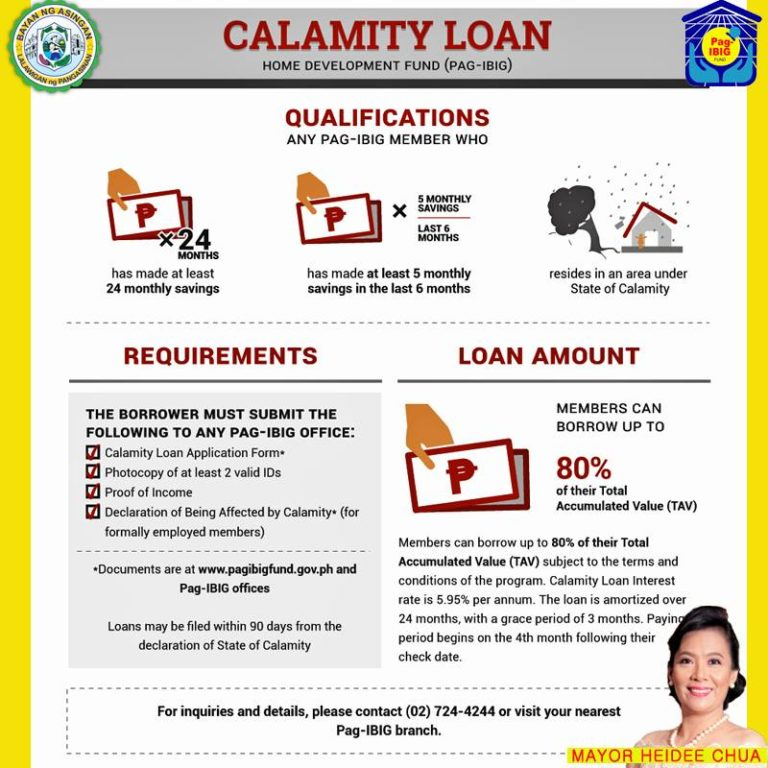

Who is able to avail PAG Calamity loan?

To obtain this loan, you need to complete these requirements:

Requirements for Calamity Loan Pag-IBIG Fund

When applying for the Calamity loan, eligibility criteria, and required documents are core elements.

CHECK: PAG IBIG Salary Loan Calculator

How to Apply Calamity Loan in PAG IBIG?

Although we’ve brought numerous ways to apply for a loan. These ways depend on varying circumstances and their control aspects:

Apply for Calamity Loan via Representative

People are capable of applying by the company’s HR representative officer. So, there are the following steps of this process:

Calamity Loan Applying method in Main Branch during Quarantine

During COVID-19, when the universe was clocked, still, then PAG-IBIG was working for Filipinos. Hence, the official branches in MECQ and ECQ region; were opened at 9 a.m. and closed at 3 p.m. Likewise, in MGCQ and GCQ areas, the office timing was 8 a.m. – 5 p.m. Remember this time is mentioned for working days. During quarantine, only specific transactions were processed, such as:

You may know if you want to join and submit a loan letter to a nearby branch. Prepare all the loan necessaries and place your letter in drop-box of our branch. Drop-boxes are placed for short-term loans. So, please put it in your required box and let it verify.

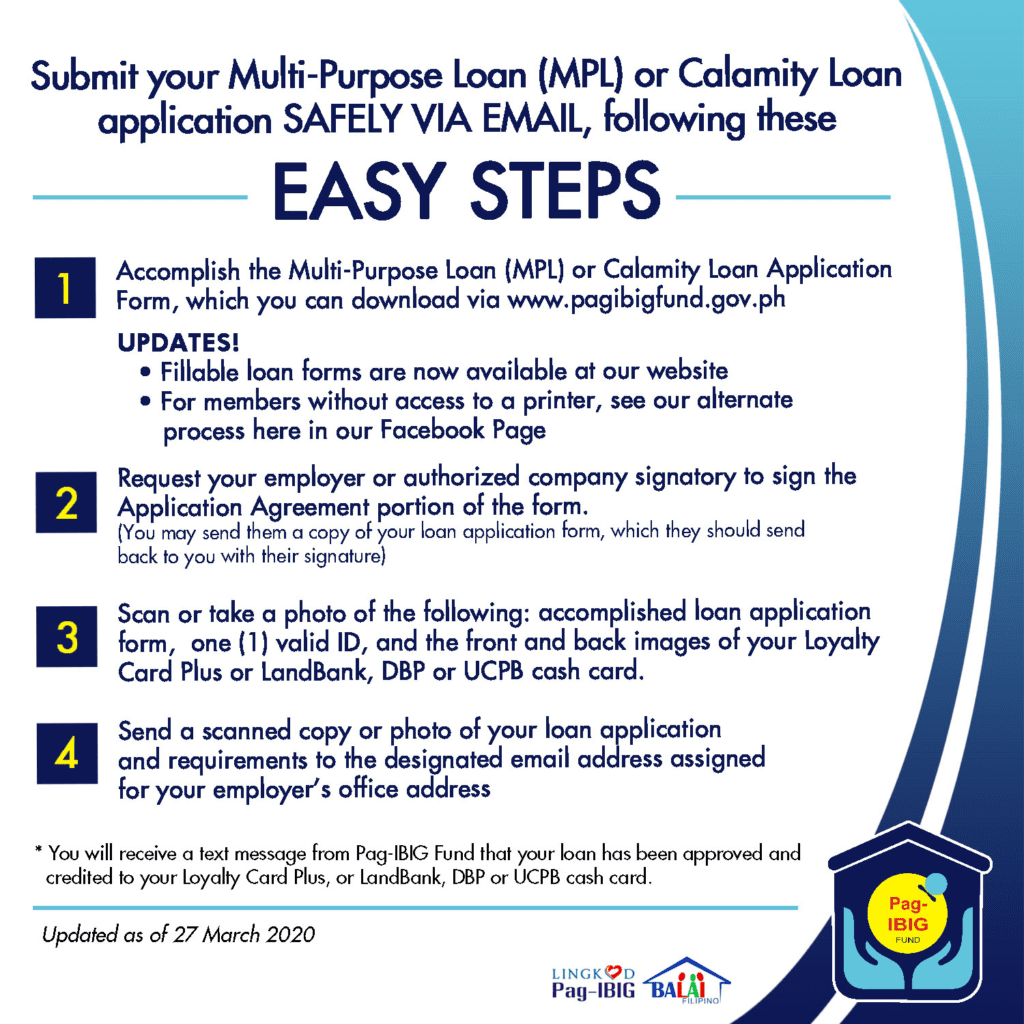

How to apply for Calamity Loan Online?

Calamity Loan Application via Virtual PAG Account

PAG Organization grants online account access to its loan members. You can proficiently access your calamity short-term loan via your online account creation. Thus, you ought to follow the steps:

Calamity Loan Apply via Email

Thus, in 2021, PAG IBIG allowed the loan needy people to apply for a calamity loan using email. A calamity is a severe form, and members may avoid coming in contact with other people. That’s why this step was more beneficial at that time. Even now, people love to apply for their loans and save time.

Transfer your application for your employer’s information with PAG IBIG’s verified email. Now you and your employer can proceed (with all documents) to email the form to the PAG organization.

Important Factors to Remember

PAG IBIG loan wishers and users must know some of the important things for their successful and smooth calamity Application process. These factors are:

Analyze your eligibility:

While getting this loan, you must know its eligibility requirements. Hence, it’s also allowed for PAG IBIG’s current loan members.

Accomplish your requirements:

Prepare all the essential documents before applying for a calamity loan. Your residency in the affected region is the most important factor. Though, it’s paper, with proof of income and a Loyalty Card or ID.

Apply for a loan early:

Once you face any disaster and know your financial health is weak. You need to accept the PAG-IBIG relaying points. So go for it timely and manage your account profile. Sometimes, funds may fall after a long time and with more severity of the disease.

Follow PAG IBIG terms:

You need to secure all the added information about your calamity loan. You can utilize it during any delayed problem in the application process.

Use Calamity Loan consciously:

Although this loan is accessible in cash payment and utilized for affected people. You must use it carefully because sometimes, the pandemic era becomes prolonged. Then people face more crises and need financial support. So, the government has established this great source of assistance for you. Fortunately, this loan intends the best support during deprived conditions.

Therefore, when you follow these tips, your loan-achieving chances are enhanced. You can effectively manage your calamity loan and get aid to recover your troubles quickly.

FAQs

Can I restart and get the Calamity loan?

Suppose you’re living in a Philippines-affected area and get a calamity loan. PAG IBIG organization definitely provides you with this loan. If another calamity happens in your region, you can apply again for a loan. Meanwhile, PAG may deduct some balance of a member’s existing loan for the process of a new loan.

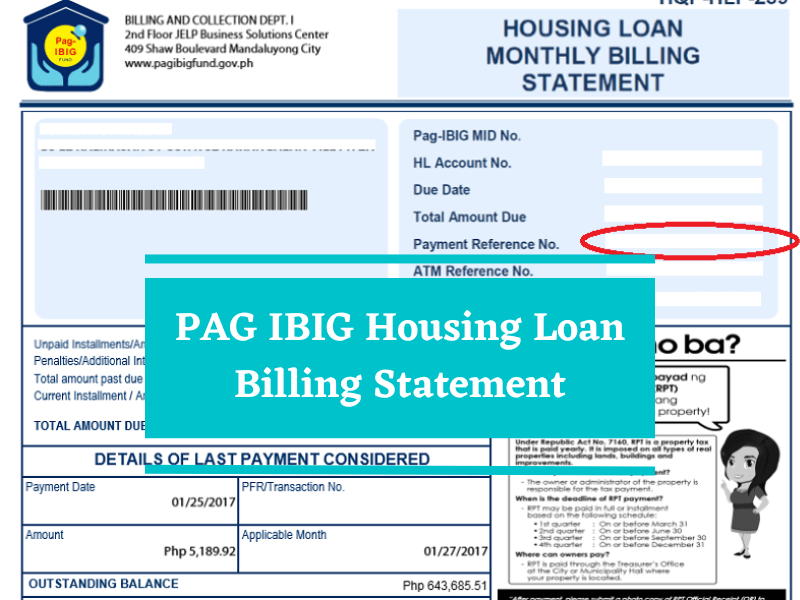

How much can I borrow in a calamity loan?

Calamity loan is available in cash, and applicants are able to get more than 80% of the total savings.

What is the interest rate for a calamity loan?

The interest rate is around 6% per annum, and for everyday delay (late fee) is 1%. Members must fulfill the prior requirements of 24 months of outstanding loan experience.

Conclusion

Calamity usually affects dreadfully on the suffering region. To regain and recover from the situation, PAG IBIG has offered a calamity loan to defective area inhabitants. You may acquire this loan by qualifying according to our criteria of application. Moreover, you can go for an online or offline application system; both are smooth and efficient. We have delivered some extra tips to get your calamity loan certainly. The notable point is you must repay your short-term calamity loan and avoid penalties.