Everyone wants a great future ahead, especially after retirement. The most exciting part is the calculation of the rewards and your contribution value at the time of retirement after getting a Pag-IBIG loan. Undoubtedly, it’s sad to get a cut from your salary, but you appreciate it in the end. The salary deduction and all these things involve Pag IBIG contribution table 2024. Yeah, it belongs to your future to calculate how much money you have saved for the future.

News: The monthly contribution for employed Pag-IBIG members has doubled from P100 to P200, marking a 100% increase, and resulting in an additional P100 contribution each month.

If you want to clear all your concepts about Pag-IBIG savings, contributions, calculations, and other important terms, keep reading this blog. The most important is to learn distinctive ways to check your contribution. So, let’s dive deeper into the details!

Contents

- 1 What Is A Pag-IBIG Contribution Table?

- 2 Pag IBIG Contribution Table 2024 For Employed and Employers

- 3 HDMF Contribution 2024 For OFW Members (Subjected To Mandatory Coverage)

- 4 HDMF Monthly Contribution 2024 For OFW Members (Employers Exempted To mandatory Coverage)

- 5 Pag IBIG Monthly Payment 2024 For Non-Working Spouse

- 6 Pag IBIG Contribution 2024 For Kasambahay Members and Household Employers

- 7 Pag-IBIG Contribution Online

- 8 Pag IBIG Contribution For OFW

- 9 Pag IBIG Contribution Calculator

- 10 Pag-IBIG Contribution Table Self Employed

- 11 Pag IBIG Contribution Rate

- 12 Pag IBIG Contribution Payment

- 13 Pag IBIG Contribution Computation

- 14 Pag IBIG Contribution Withdrawal

- 15 How To Check Pag IBIG Contribution?

- 16 Can I Withdraw My Pag-IBIG Contribution After 10 Years?

- 17 Can I Withdraw My Pag IBIG Contribution?

- 18 How To Verify Pag IBIG Contribution?

- 19 Final Words

- 20 Author

What Is A Pag-IBIG Contribution Table?

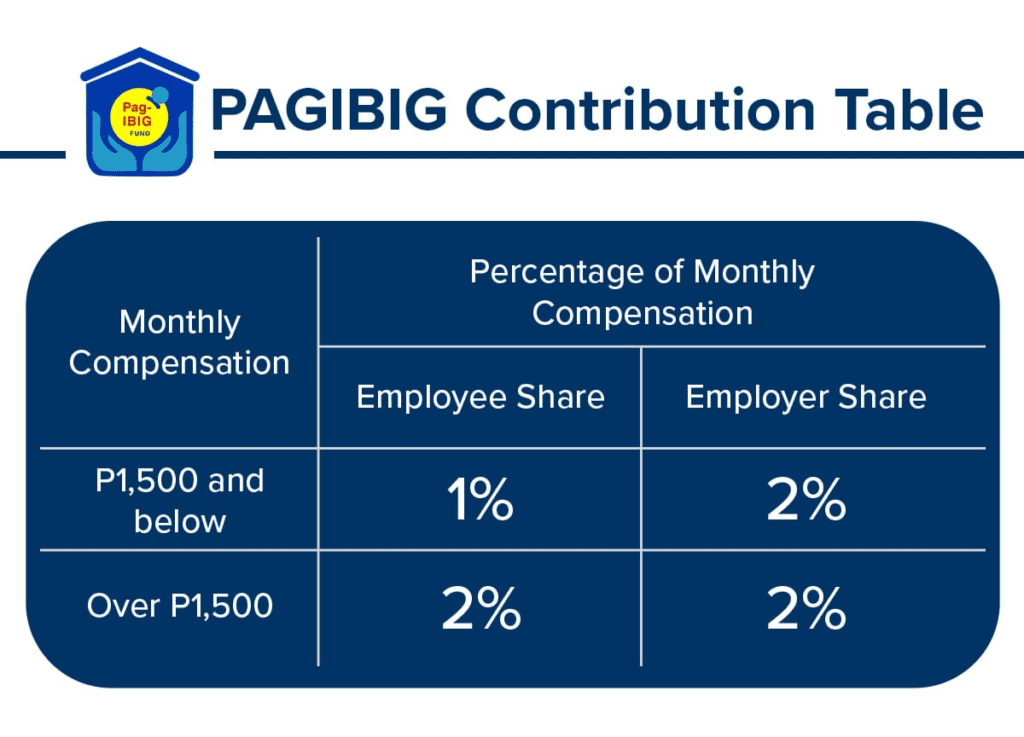

When a person actively pays a certain amount for years, it’s called a monthly contribution. This contribution is updated in a certain table known as the Pag IBIG table. In particular, it consists of data with the monthly compensation bracket of the person along with the contribution amount.

Do you know for which person it’s important? It’s a key for self-employed, employed, and a person working voluntarily. For example, an Overseas Filipino worker can track his contribution easily with the help of this specific table and know the final benefits.

It’s also named Pag-IBIG fund or Home Development Mutual Fund (HDMG) in the Philippines and many other states. It’s primarily given as a loan for a home and collected by the monthly contribution from Filipino citizens. Further tracking can be done through the contribution table. In short, it plays a key role in tracking everything about your contribution and benefits.

CHECK: Pag ibig housing loan calculator

Pag IBIG Contribution Table 2024 For Employed and Employers

| Monthly Payout | Employee’s Contribution | Employer’s Contribution | Total Contribution |

| 1000-1500 | 1% | 2% | 3% |

| 1500-4999 | 2% | 2% | 4% |

| 5000 or above | 3% | 3% | 6% |

CHECK: PAG IBIG Housing Loan Requirements for Employed

CHECK: Virtual PAG IBIG Employer

HDMF Contribution 2024 For OFW Members (Subjected To Mandatory Coverage)

| Monthly Payout | OFW’s Share | Foreign Employer’s Share | Total Contribution |

| 1500 or less | 1% | 2% | 3% |

| 1500-4999 | 2% | 2% | 4% |

| 5000 or above | 3% | 3% | 6% |

CHECK: List of PAG IBIG Loans for OFWs

HDMF Monthly Contribution 2024 For OFW Members (Employers Exempted To mandatory Coverage)

| Monthly Payout | Contribution Rate |

| 1500 or above | 2% |

Pag IBIG Monthly Payment 2024 For Non-Working Spouse

| Half Monthly Salary of Working Spouse | Contribution Rate |

| 1500 or less | 1% |

| More than 1500 | 2% |

Pag IBIG Contribution 2024 For Kasambahay Members and Household Employers

| Monthly Payout | Employer’s Share | Kasambahay’s Share | Total Contribution |

| 1500 or less | 3% | 0% | 3% |

| 1500-4999 | 4% | 0% | 4% |

| 5000 or above | 3% | 3% | 6% |

Pag-IBIG Contribution Online

The Internet has made life easier, and now the Pag IBIG contribution table can be checked online. The online facility has been launched officially with complete safety. It can be accessed conveniently through your browser or even your mobile phone; only an active internet connection is required.

The checking procedure is pretty simple; you only need to visit the official website, www.pagibigfund.gov.ph. When the website opens, navigate to the IBIG option from the main menu. Go to the directory to get virtual access. Congrats! You will be able to see your Contribution table and other records online without any issues. Check out the steps below for the members of this fund:

CHECK: PAG IBIG Online Verification

Pag IBIG Contribution For OFW

After the rule of 2022, the OFW must pay the contribution. It was released by the two authorities, i.e., POEA and Pag-IBIG. Further instructions are given to encoding the personal Pag IBIG number, which can now be done by registering on the POEA e-Registration account portal.

In particular, the regulator has made it easy to pay funds through the POEA website. Make sure you fall in the category of these overseas by getting the overseas Employment certificate or OEC.

| Monthly Salary | OFW’s Share | Foreign Employer’s Contribution Rate | Total Contribution |

| 1500 or less | 1% | 2% | 3% |

| Above 1500 | 2% | 2% | 4% |

CHECK: PAG IBIG Housing Loan Requirements for OFW

Pag IBIG Contribution Calculator

It’s easier to perform calculations for IBIG contributions but not everyone has enough capabilities to dive deeper into the details. Yeah, it sometimes looks impossible to calculate contributions over a certain period. Another problem is that the chances of error increase with lengthy calculations.

CHECK: Pag-IBIG Multi-Purpose Loan Calculator

Don’t worry if you are unable to calculate your contribution, as the Pag IBIG contribution calculator helps you out. It has made the calculation a breeze. Just open the calculator, and you will see two spaces there. One space is for entering the monthly salary; the bottom space will show the Pag IBIG monthly contribution.

It takes no time to calculate. First, enter your monthly salary in the “Monthly salary” tab and press the Calculate button. The monthly contribution will be shown below against the Pag IBIG monthly contribution tab.

This fantastic tool has all the formulas previously entered. Moreover, some contribution calculators allow the user to connect the Excel file for bulk contribution calculations. In short, it’s the best tool to use and utilize in a daily routine for contribution-related calculations.

Pag-IBIG Contribution Table Self Employed

Usually, a self-employed contribution is 70%, but it depends on several factors. This percentage is the net yearly income. It means if a member has more savings, he can earn more. Here is the Pag IBIG contribution table for self-employed:

| Monthly Payout | Contribution Rate |

| 1000-1500 | 1% |

| 1500-4999 | 2% |

| 5000 or above | 3% |

Pag IBIG Contribution Rate

It’s a commonly asked question. It’s said that the IBIG authorities set the contribution rates. At least 70% of a person’s annual income should be given so that he can earn proportionality. It’s called Pag IBIG dividends or savings. A person can invest this fund in housing finance and many other options. Here are the regular IBIG Dividend rates:

| Year | Divided Rate |

| 2022 | 6.53% |

| 2021 | 5.50% |

| 2020 | 5.62% |

| 2019 | 6.73% |

| 2018 | 6.91% |

| 2017 | 7.61% |

| 2016 | 6.93% |

| 2015 | 4.84% |

| 2014 | 4.19% |

| 2013 | 4.08% |

| 2012 | 4.17% |

| 2011 | 4.13% |

Pag IBIG Contribution Payment

Where to pay Pag IBIG contribution? Suppose you are enrolled in a Pag-IBIG contribution. Sometimes, the authority does not cut the payment from the salary, but you have to pay it separately. Previously, there were limited sources of payment. Nowadays, a person can pay to utilize any of the five payment methods such as:

Are you curious and want to know more about these payment methods? No worries, check out the procedure below for each method.

Over-the-counter payment

A few bank partners collect this fund and its remittance from other countries.

Check the procedure and how it works in the following:

Online Payment Facility Through Debit/Credit Card & Pay by Maya (PayMaya)

Digital Online and Mobile Banking

Employer’s Online Payment Facility

Overseas Remittance

Pag IBIG Contribution Computation

Pag IBIG fund calculation is very easy to calculate. There are two types of computation involved, i.e., fixed amount as a monthly contribution and prorated amount depending on a person’s salary. Here the computation of both is described in the following:

Fixed Deduction For Pag IBIG Fund

Pag IBIG Contribution Option 2

Pag IBIG Contribution Withdrawal

How to claim or withdraw my Pag IBIG contribution? Pag IBIG is not only about submitting contributions, but people also benefit from the withdrawals. You can get contribution withdrawal at a certain ground level. Remember that it’s only possible if you are regularly saving in an IBIG contribution.

Usually, your membership matures after 20 years after paying approximately 240 contributions. So you get Pag IBIG contribution withdrawal after 20 years. Here the optional thing is your retirement age, whether you like to retire at 60 years of age or 65 years of age.

How To Check Pag IBIG Contribution?

Sometimes a person wants to check their contribution but doesn’t know how. Here you will get the right procedure to check your contribution at whatever stage. Here are the straightforward instructions to check contribution:

Can I Withdraw My Pag-IBIG Contribution After 10 Years?

You need to accept their terms and conditions when you want to join the IBIG membership. Besides all the terms, it’s mentioned in the form that you can only get your contribution after 20 years of membership. Usually, you can’t claim your Pag-IBIG contribution after 10 years, but certain laws give you flexibility.

Can I Withdraw My Pag IBIG Contribution?

Suppose you have completed the duration and want to claim your contribution. No worries, it’s easy to get by fulfilling some requirements. Yes, you can even withdraw it online. Following are some types you should know for getting a withdrawal.

Optional Contribution Withdrawal

If you have the following requirements, you are eligible for the optional withdrawal:

Retirement

If you have done with your requirement, you are eligible for withdrawal.

Membership Maturity

Your contribution has matured if you have completed 12 months multiplied by 20 = 240 months. If you are eligible, here are the requirements:

Withdrawal Due To Health

Health issues can occur anytime and if you feel you can’t work more due to bad health, this option is for you. For separation from the service, you need the following documents:

Withdrawal Due To Permanent Disability or Insanity

You are eligible for the withdrawal if you get permanent disability or mental disability due to any reasons such as injury etc. prepare the following documents for withdrawal:

Withdrawal Due to Permanent Immigration From the Philippines

When you get a permanent visa from any country, it’s time to leave the Philippines permanently. You need to get the following documents for withdrawal:

Death

When a person dies, he automatically gets eligibility for Pag-IBIG contribution withdrawal. There are certain scenarios you must know to make things ready for withdrawal.

Death Claim Eligibility For Married With Children

Death Claim Eligibility For Married Without Children

Death Claim Eligibility of A Single With Children

Note: If you fall into any category,

How To Verify Pag IBIG Contribution?

For Pag-IBIG contribution, enrollment is necessary. After that, you can verify it and join this fund. So, check out the instructions below to successfully contribute to this Philippines fund:

Note: Don’t forget to take necessary documents such as your ID and others with you to show in the branch.

Final Words

The Pag-IBIG contribution fund is useful for those who want to save for 20 years or at retirement. You pay from your salary every month, known as a contribution. Once you register as a member, Pag IBIG contribution table 2024 allows you to check everything in the form of a table. Moreover, there are certain conditions and contribution policies according to your monthly salary.

Similarly, you can quit the membership and claim the contribution after 20 years. Certain conditions apply and give your contribution earliest such as death, disability, no more business, etc. We have covered everything in this blog about Pag IBIG contribution, contribution table, payment methods, online verification, withdrawals, payments, and more. Read this blog and clarify every confusion in your mind.