Unravel the complexities of PAG-IBIG MP2 computation and learn how to maximize your savings with this comprehensive guide. Explore strategies, expert tips, and the benefits of this government-guaranteed investment program.

PAG IBIG has brought the optional saving program, Modified PAG IBIG II (MP2). This program is launched for PAG IBIG’s former and current users. However, they can enhance their amount savings along with their regular savings from the PAG IBIG loan.

CHECK: Pag-IBIG MP2 Calculator

However, PAG IBIG MP2 computation comprises two types;

This funds-saving program of PAG IBIG saves around 70% of the net profits of yearly income as credits and dividends. It is usually proportional to your deposits. It represents that the more income you save, the biggest the profit on your deposit you will achieve. PAG IBIG has provided the MP2 Saving Dividend Rates since 2011:

| Year | MP2 Saving Rates |

| 2011 | 4.63% |

| 2012 | 4.67% |

| 2013 | 4.58% |

| 2014 | 4.69% |

| 2015 | 5.34% |

| 2016 | 7.43% |

| 2017 | 8.11% |

| 2018 | 7.41% |

| 2019 | 7.23% |

| 2020 | 6.12% |

| 2021 | 6.00% |

| 2022 | 7.03% |

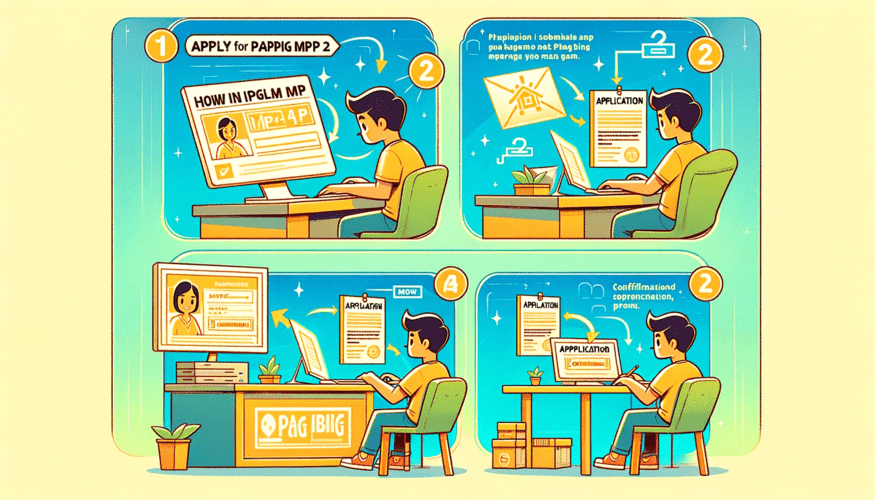

Create your Account: How to Apply for PAG IBIG MP2?

Contents

- 1 End-Year Dividend PAG IBIG Payout MP2 Computations

- 1.1 Complete year Dividend Payout Amount per Month

- 1.2 1 Year computation

- 1.3 2 Year Computation

- 1.4 3 Year Computation

- 1.5 4 Year Computation

- 1.6 5 Year Computation

- 1.7 End-Year Dividend Payout for One-Time Payment

- 1.8 1st Year Computation

- 1.9 2nd Year Computation

- 1.10 3rd Year Computation

- 1.11 4th Year Computation

- 1.12 5th Year Computation

- 2 Annual Dividend Payout PAG IBIG MP2 Computations

- 3 FAQs

- 4 Author

End-Year Dividend PAG IBIG Payout MP2 Computations

For yearly dividend payouts, you can withdraw your savings after 5 years (maturity date). Suppose your MP2 Savings dividend is 6.0% for 2021.

Furthermore, for your better understanding of our PAG IBIG MP2 computations, we have prepared the monthly table; let’s suppose:

| Months | 1 # Year | 2 # Year | 3 # Year | 4 # Year | 5 # Year |

| Jan | 500 | 6,500 | 12,500 | 18,500 | 24,500 |

| Feb | 1,000 | 7,000 | 13,000 | 19,000 | 25,000 |

| Mar | 1,500 | 7,500 | 13,500 | 19,500 | 25,500 |

| Apr | 2,000 | 8,000 | 14,000 | 20,000 | 26,000 |

| May | 2,500 | 8,500 | 14,500 | 20,500 | 26,500 |

| Jun | 3,000 | 9,000 | 15,000 | 21,000 | 27,000 |

| Jul | 3,500 | 9,500 | 15,500 | 21,500 | 27,500 |

| Aug | 4,000 | 10,000 | 16,000 | 22,000 | 28,000 |

| Sept | 4,500 | 10,500 | 16,500 | 22,500 | 28, 500 |

| Oct | 5,000 | 11,000 | 17,000 | 23,000 | 29,000 |

| Nov | 5,500 | 11,500 | 17,500 | 23,500 | 29,500 |

| Dec | 6,000 | 12,000 | 18,000 | 24,000 | 30,000 |

| Total | 39,000 | 111,000 | 183,000 | 255,000 | 327,000 |

| Average | 3,250 | 9,250 | 15,250 | 21,250 | 27,250 |

| Dividend | 243.75 | 693.75 | 1,143.75 | 1,593.75 | 2,043.75 |

It’s usually the first step for computing your every year’s Average Accumulative per Month savings (AAMS). Then you can apply the simple formula of interest to achieve your dividends.

Complete year Dividend Payout Amount per Month

Thus, in this scenario, your monthly MP 2 saving is PHP 500.

| Monthly Cover | Per Month Savings (MS) | Accumulated MS yearly | Cumulative Savings | Dividend Payment | TAV |

| Year 1 | PHP 500 | PHP 6,000 | PHP 6,000 | PHP 150 | PHP 6,150 |

| Year 2 | 500 | 6,000 | 12,000 | 519 | 12,669 |

| Year 3 | 500 | 6,000 | 18,000 | 910.14 | 19,429.14 |

| Year 4 | 500 | 6,000 | 24,000 | 1,315.75 | 26,744.89 |

| Year 5 | 500 | 6,000 | 30,0000 | 1,754.69 | 34,499.58 |

| Total | 30,000 | 4,499.58 | 34,499.58 |

TAV: Total Accumulative Value

TAA: Total Accumulated Amount

AAA: Average Accumulated Amount

DR: Dividend Rates

1 Year computation

Suppose in your first year, the monthly payment is PHP500 for the whole year is 6,000. Now you must know your average cumulative payment to calculate the dividend. Therefore, the dividend amount equals the accumulated amount and the current amount.

TAA: per Monthly Payment x I year x 5 (6,000 x 12 x 5) = PHP30,000

AAA: TAV / 12 (30,000/12) = 2,500

DR: 6.0% (2021)

While computing your amounts; 6.0/100 = 0.06

Year 1 Dividend Earned: AAA (2500) x DR (0.06) = PHP150

TAV: Cumulated Saving (6,000) + Year 1Dividend Earned (150) = PHP 6,150

You should know: PAG IBIG MP2 Risks

2 Year Computation

Once computing for the second year, since now monthly saving is 500 and dividend is for 2nd year 150. Here is the whole computation for 2nd year:

Dividend = TAV (6,150) x DR converted (0.06) = PHP369

Total earned Dividends = Earned Dividend (150) + Dividend Accumulate Value for Year 1 (369) = PHP519

Cumulative Saving for Year 2 = TAV Year 1 (6,150) + Yearly Saving (6000) = PHP12,150

TAV for 2nd Year = Cumulative Saving (12,150) + Earned Dividend (Year 2) (519) = PHP12,669

CHECK: PAG IBIG MP2 Enrollment

3 Year Computation

You can generate the exact dividend of PHP150 in 3rd year, just like in Year 2. Meanwhile, the year 2 total accumulated value is PHP971.68. For year 3 the entire dividend will PHP1,215.43. Hence, here is proof that the total accumulated value would be 19,429.14 for Year 3:

Accumulated Value Dividend (year 2) = TAV (12,669) x DR (0.06) = 760.14

Entire Earned Dividend (year 3) = Earned Dividend (150) + Accumulate Value of Dividend Year 2 (369) = PHP910.14

Year 2 Cumulated Savings = TAV Year 2 (12,669) + Yearly Savings (6000) = 18,669

Year 3 TAV = Cumulative Savings (18,669) + Year 3 Earned Dividends (910.14) = PHP19,429.14

4 Year Computation

You can enjoy the PHP 26,744.89 entire cumulative value at the end of 4th year.

Year 3 Accumulated Value Dividend = TAV (19,429.14) x DR (0.06) = 1,165.75

Year 4 Earned Dividend = Dividend Earned (150) + Year 3 Dividend Accumulative Value (1,165.75) = PHP1,315.75

Year 3 Cumulated Saving = Year 3 TAV (19,429.14) + Yearly Savings (6,000) = PHP25,429.14

Year 4 TAV = Cumulated Saving (25,429.14) + Year 4 Earned Dividend (1,315.75) = PHP 26,744.89

5 Year Computation

Year 4 Accumulated Dividend Value = TAV (26,744.89) x DR (0.06) = 1,604.69

Year 5 Entirely Earned Dividend = Earned Dividend (150) + Year 4 Dividend Accumulative Value (1,604. 69) = 1,754.69

Year 4 Cumulated Saving = Year 4 TAV (26,744.89) + Per Year Savings (6,000) = PHP32,744.89.

Year 5 Total Accumulated Value= Cumulative Savings (Php 32,744.89) + Year 5Dividend Earned (1,754.69) = PHP34,499.58

Ultimately your entire withdrawable payment is PHP 34,499.58 for MP2 monthly payment (PHP 500).

End-Year Dividend Payout for One-Time Payment

This payment comprises diverse computations, including accumulated value and dividends. Suppose your one-time total amount is PHP 30,000.

| Monthly Covered | Monthly Saving (MS) | Accumulated MS yearly | Cumulative Saving | Dividend Amounts | TAV |

| Year 1 | 30,000 | 30,000 | 30,000 | 1,800 | 31,800 |

| 2 | – | – | 31,800 | 1,908 | 33,708 |

| 3 | – | – | 33,708 | 2,022.48 | 35,730.48 |

| 4 | – | – | 35,730.48 | 2,143.83 | 37,874.31 |

| 5 | – | – | 37,874.31 | 2,272.46 | 40,146.77 |

| Total | – | PHP30,000 | – | PHP10,146.77 | PHP40,146.77 |

1st Year Computation

Year 1 Dividend= PHP 30,000 x 6% = 1,800

Accumulated Value for Year 1 = 30,000 + 1,800 = PHP 31,800

2nd Year Computation

Year 2 Dividend= TAV of Year 1 (31,800) x 6% = 1,908

Accumulated Value for Year 2 = 31,800 + 1,908 = PHP 33,708

3rd Year Computation

Year 3 Dividend= TAV for Year 2 (33,708) x 6% = 2,022.48

Accumulated Value for Year 3= 33,708 + 2,022.48 = PHP 35,730.48

4th Year Computation

Year 4 Dividend= TAV of Year 3 (35,730.48) x 6% = 2,143.83

Accumulated Value for Year 4 = 35,730.48 + 2,143.83 = PHP 37,874.31

5th Year Computation

Year 5 Dividend = TAV of Year 4 (37,874.31) x 6% = 2,272.46

Accumulated Value for Year 5 = 37,874.31 + 2,272.46 = PHP 40,146.77

Hence, when your dividend charges are 6%, the one-time amount payout in PAG MP2 computation is about PHP 30,000. It produces revenue of about PHP 10,146.7. Your total MP2 Savings after 5 years will become PHP 40,146.77.

Annual Dividend Payout PAG IBIG MP2 Computations

Suppose you want to get your dividend after each year according to the annual dividend payout. In this regard, you have to get some lower profit of your entire accumulated value. Various PAG IBIG loan members love to acquire this approach for their dividend rates. You can compute your MP2 dividend savings according to 6.0%.

Monthly Rates with Dividend Payouts per Year

You have your monthly savings amount of PHP 500;

| Monthly Covered | MS | Accumulated MS yearly | Cumulative Savings | Dividend Charges | TAV |

| 1st Year | 500 | 6,000 | 6,000 | 150 | 6,000 |

| 2nd Year | 500 | 6,000 | 12,000 | 510 | 12,000 |

| 3rd Year | 500 | 6,000 | 18,000 | 870 | 18,000 |

| 4th Year | 500 | 6,000 | 24,000 | 1,230 | 24,000 |

| 5th Year | 500 | 6,000 | 30,0000 | 1,590 | 30,0000 |

| Total | – | 30,000 | 4,350 | – | 30,000 |

1st Year Computation

You can calculate your average amount of cumulative. Then divide it by 12 months and achieve your yearly accumulated amount.

TAA: per Month Payment x 12 months x 5 (6,000 x 12 x 5) = 30,000

AAA: TAA/12 (Php 30,000/12) = 2,500

DR: 6.0% (2021) > (6.0/100 = 0.06)

Year 1 Earned Dividend: AAA (2,500) x DR (0.06) = PHP 150

Your earned dividend is 150 and is 1 year withdrawable. Thus cumulative savings become PHP 6000 because your dividend is not added to TAV.

2nd Year Computation

When year 2 initiates, your dividend rates are 150. Your 6,000 accumulative savings generated a dividend of around 6,000 x 0.06. it results in PHP 360.

Year 2 total paid Dividends = 150 + 360 = PHP 510

It is the entire earned dividend of year 2. You can withdraw your payment when you want.

The earned dividend sum is 510 for year 2. You can add the entire amount of 12,000 now. Suppose your savings are 6000; your 2-year saving sum will be PHP 12,000.

3rd Year Computation

Year 2 Accumulated Dividend Value: 12,000 x 0.06 = 720

Earned Dividend for Year 3: Average Dividend (150) + Accumulated Dividend Value of Year 2 (720) = 870

Year 3 TAV: 6,000 x 3 years = PHP 18,000

Though, The accumulative profit for year 3 is 18,000.

4th Year Computation

Year 4 payout, as it was in years 2 & 3, is 150. It will end in a dividend of around 1230.

Year 3 dividend: 18,000 x 0.06 = 1,080

Year 4 entire dividend= Php 150 + Php 1,080 = Php 1,230

Well, in 4th year last, your entire cumulative amount will become PHP 24,000.

5th Year Computation

It’s your final 5th year with your monthly savings500 and 12-month dividend of 150. You may add your last year accumulated payment as;24,000 x 0.06 = Php 1,440

Year 5 entire Earned dividend = 150 + 1,440 = PHP 1,590

After 5 years, your total accumulated value is PHP 30,000.

Annual Dividend Payout Single Payment

Suppose you are interested in the one-time payment computation with a 30,000 value.

| Monthly Covered | MS | Accumulated MS Yearly | Cumulative Savings | Dividend Charges | TAV |

| Year # 1 | 30,000 | 30,000 | 30,000 | 1,800 | 30,000 |

| Year # 2 | > | > | 30,000 | 1,800 | 30,000 |

| Year # 3 | > | > | 30,000 | 1,800 | 30,000 |

| Year # 4 | > | > | 30,000 | 1,800 | 30,000 |

| Year # 5 | > | > | 30,000 | 1,800 | 30,000 |

| Total | > | 30,000 | > | 9,000 | 30,000 |

1 – 5 Years

Each Year Dividend = 30,000 x 6% x 1 = PHP 1,800

Here you are watching the single dividend payment, and you are withdrawing PHP 1,800. Thus your cumulative savings are Php 30,000. So you can achieve the same amount for one to five years.

FAQs

What is the PAG IBIG Saving Program?

MP2 is the voluntary saving plan of PAG IBIG. It offers all members a five-year maturity plan. For those members who want to earn hefty profits and save their incomes, this regular dividend saving program is the appropriate offer for them.

Can PAG IBIG members pay their MP2 twice per month?

Yes, PAG IBIG provides the option to save your payment anytime, even if you can annually, weekly, two times per month or lump sum deposition.

Who is capable of saving income under the MP2 program?

This program is usable for all PAG IBIG active members. Furthermore, it’s open for Former members (retirees and pensioners) and for natural Filipino inhabitants as well.

What happens when I don’t pay my MP2 payment?

Although the MP2 program is open for all members of PAG funding, even if you’re not contributing to saving payments, you can get your dividends in 5-year maturity. If you’ve stopped your payment, there is no additional penalty from PAG IBIG’s end. You’re free to add your payments without penalties.

Conclusion

You’ve achieved the PAG IBIG membership for your loan assessment. We are offering you to save your money and get more payment simultaneously. In this regard, we’ve evaluated the 6.0% dividend rates. It seems attractive interest rates that provide enhancing profits. It’s the sample computation with your monthly MP2 saving program. You can compute your fiver year-saving plans.