Pag-IBIG MP2 Calculator

Want to get better ROI out of your savings? Try the Pag-IBIG MP2 calculator to give your dream a shot.

The world is advancing, and we are getting busy. There is hardly some time left to consider future planning after the hectic 9 to 5 cycle. Where to spend your savings? How to save more while spending less? And much more.

Many ordinary men don’t even get minutes to think quickly about their future. And if you are amongst those men who want to take the first step of saving your money for the kids.

CHECK: Pag Ibig Affordability Calculator

Or if you want to know how much you can earn from your savings without doing the tedious manual process, then this article is a treat for you.

This article is about the Pag-IBIG MP2 calculator that lets you seamlessly estimate how much money you can earn from your savings.

As the name suggests, the Philippines government PAG-IBIG fund offers this calculator, which stands for home mutual development fund.

The sole purpose of this calculator is to calculate the maximum income earned from your savings for the PAG-IBIG fund.

Seems complicated? Don’t worry. We will define the Pag-IBIG MP2 calculator below with more details.

Alongside the definition, we will also explain the benefits of this calculator. Moreover, you will also learn how to use the calculator to calculate your savings.

So whether you are planning for your children’s future education or setting up your retirement bread and butter, read till the end to find out how the Pag-IBIG MP2 has made things easier.

Contents

- 1 What is the Pag-IBIG MP2 calculator?

- 2 Five benefits of the Pag-IBIG MP2 calculator

- 3 How to use the Pag-IBIG MP2 calculator?

- 4 FAQs

- 4.1 Can I use the Pag-IBIG MP2 calculator to calculate my potential savings for different investment amounts or periods?

- 4.2 How accurate are the savings estimates generated by the Pag-IBIG MP2 calculator, and are there any factors that might affect my actual earnings?

- 4.3 Are there any fees or charges associated with using the Pag-IBIG MP2 calculator, and is it available to all Pag-IBIG MP2 program participants?

- 5 Wrapping Up

What is the Pag-IBIG MP2 calculator?

The Pag-IBIG MP2 calculator helps you calculate the amount of money you will get by saving your cash in the Pag-IBIG MP2 program.

Now, what is the Pag-IBIG MP2 program? Well, this program is a Philippines-based savings program that lets you earn interest on your savings.

The difference between this program and its competitors is that it boasts much higher interest rates that ultimately increase your return on investment.

And let’s face it, manually calculating your interest rates is not only daunting but tedious as well, and most importantly, the results can sometimes be inaccurate, which is so frustrating.

This is where the Pag-IBIG MP2 calculator jumps in. It makes calculation easy, effective, and accurate. Within minutes you can calculate your income out of savings and then plan any plans accordingly.

It seems easy peasy. But these calculators help more than calculate.With the pag-ibig m2 calculator at your disposal, you can plan your future goals.

Whether you want to strategize your retirement plans or buy a new home in the countryside, this calculator is like a crystal ball and shows you the possibility of fulfilling your dreams.

Now let’s jump onto some of the juicy benefits of the Pag-IBIG MP2 calculator. Then afterward, we will define the step-by-step working of this calculator. So make sure to stick to the end.

Five benefits of the Pag-IBIG MP2 calculator

The Pag-IBIG MP2 is an excellent tool that lets you efficiently calculate your income from savings in the Pag-IBIG MP2 program. But the scope of this calculator stands above that of just calculation.

Here are 5 top benefits of using the Pag-IBIG MP2 calculator.

1. Accurate estimates

One of the best benefits of the Pag-IBIG MP2 calculator is that it provides accurate estimates. The logarithm of this calculator gathers all the information needed and comes up with the on-spot calculation that doesn’t give you a second thought about calculating again.

Contrary to the tedious manual calculation, this calculator completes the job without messing things around and accurately estimates your return on investment.

Better investment decisions

The Pag-IBIG MP2 calculator lets you make more effective and informed investment decisions about your savings. The Pag-IBIG MP2 takes in various kinds of information to make accurate calculations.

This makes it easy to keep an eye on different investment strategies. For example, let’s say you have a financial goal of saving php 500000 in 10 years.

Now, using the Pag-IBIG MP2 calculator, you can determine how much you need to invest each month in reaching your ultimate goal.

And this will give you a broad idea of how much you can expect to earn from your investment.

Time-saving

One of the top benefits of using the pag-ibig calculator is its efficiency. Yes, this calculator is very time efficient.

Let’s put it this way when you calculate the earnings manually. You have to take each and every factor into account.

Compounding interest, inflation rates, the number of months for the investment, and the interest rate are just a few factors you need to write on the paper.

This whole process is quite complicated and time-consuming. Moreover, it’s very prone to human error.

One zero here and there can force you to start the calculation again. Seems quite lengthy and tedious, right? But by using the Pag-IBIG MP2 calculator, you put an end to all of the problems above.

The modern algorithm of the calculator already has sections for different factors like interest rates etc. This is a more professional and seamless way, as you have to write down the pre-information, and that’s it.

The calculator will take the job from here and come up with accurate calculations.

Easy to use

Compounding interests, inflation charges, interest rates, monthly installments. Every person with accounting know-how can easily understand the terminologies above.

But what about the laymen? Who doesn’t know these complex terminologies but also wants quick and easy calculations?

Well, this is where the Pag-IBIG MP2 calculator stands out. The interface is very user-friendly.

No matter if you are accounting savvy or just a common man.

The Pag-IBIG MP2 calculator will suit everyone. The options are well laid off; you must fill in the required information to calculate your answer.

Free to use

Last but not least, the Pag-IBIG MP2 calculator is free to use. You can perform unlimited calculations, and there will not be a single drop in efficiency.

The calculator is free to use on official websites without hidden subscription fees, making it the best way to maximize your savings.

These were some of the top benefits of the Pag-IBIG MP2 calculator. Now we will walk you through the step-by-step instructions on how to use the Pag-IBIG MP2 calculator.

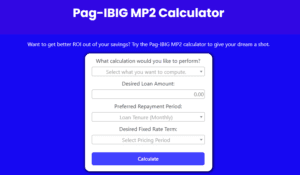

How to use the Pag-IBIG MP2 calculator?

Using the Pag-IBIG MP2 calculator may seem daunting, but it’s straightforward.

Here are the quick and easy steps to use the pag-ibig calculator.

Go to the Pag-IBIG MP2 website.

The first step is to head toward the Pag-IBIG MP2 calculator website. You can do this by quickly searching on the web.

Look for the page-ibig mp2 calculator.

Once you have arrived at the website, the next step is to search for the mp2 calculator.

Input your investment details.

Arrived on the calculator page? Great! Now fill in the required information, such as your investment amount, investment period, and interest rate.

Review the Results

Once you have filled in your investment details, the calculator should automatically generate your estimated earnings based on your input. The results might show you your total savings, dividends, and estimated annual dividends.

Experiment with different investment options

One of the best things about the Pag-IBIG MP2 calculator is that you can play off with multiple investment options to decide your perfect savings option.

For example, you can adjust the investment amount and its period to have an eye on how your changes affect the estimated earnings.

Save or print the result.

Lastly, if you are satisfied with the results generated, you can save or print the result for future reference.

This can be helpful when you want to compare different investment options.

FAQs

Can I use the Pag-IBIG MP2 calculator to calculate my potential savings for different investment amounts or periods?

Yes, the Pag-IBIG MP2 calculator is highly flexible. You can put in different amounts of investment options and periods to determine the potential savings.

No matter your investment amounts or periods, you can always calculate the savings from the Pag-IBIG MP2 calculator.

How accurate are the savings estimates generated by the Pag-IBIG MP2 calculator, and are there any factors that might affect my actual earnings?

You should remember that the results generated by the Pag-IBIG MP2 calculator are based on the current dividend rate of the MP 2 program. Which is subjective to market conditions such as inflation and interest rates

You should check the current dividend rate to get accurate earnings calculations.

Are there any fees or charges associated with using the Pag-IBIG MP2 calculator, and is it available to all Pag-IBIG MP2 program participants?

Nope, there are no hidden charges for the pag-ibig calculator. You can use it infinitely. And yes, it is available for all the Pag-IBIG MP2 program participants.

Wrapping Up

This was all about the Pag-IBIG MP2 calculator. This incredible calculator lets you calculate your earnings on the savings for the Pag-IBIG MP2 program.

Apart from standard calculations, the calculator lets you enjoy the benefits of time-saving, better investment options, and a broader view of different investment strategies.

Using the Pag-IBIG MP2 calculator is easier than it sounds. With the proper step-by-step instructions listed above, you can seamlessly use the tool whether you are a beginner or a professional.

Moreover, the sleek user-defined interface ensures you quickly find all the required options on the homepage.

Want to maximize your savings earnings? Use the Pag-IBIG MP2 calculator.

REF: https://www.pagibigfund.gov.ph/Membership_ModifiedPagIBIG2.html