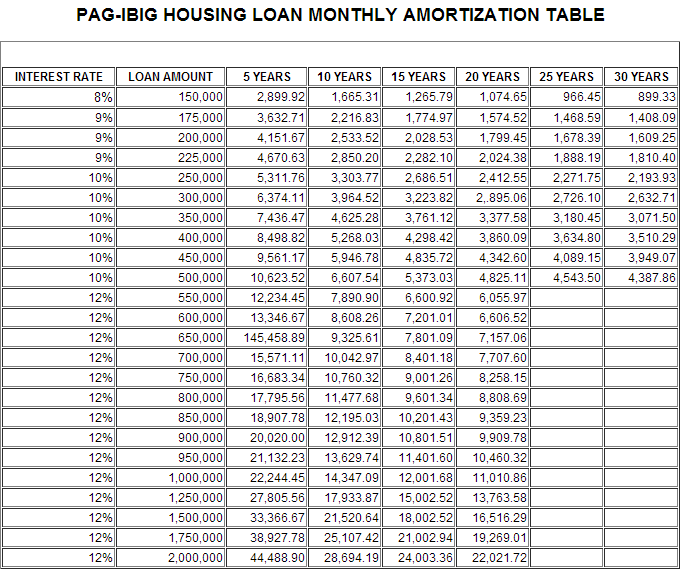

PAG IBIG funding institution aims to provide shelter to Filipino citizens. The institute is catering in various ways, like monthly loan offers and short or long-term loans. Though, when borrowers sign their agreement for housing loans, the institute has managed specific aspects to compute their loan payments. You are a PAG IBIG member and interested in taking advantage of the appropriate loan; it makes sense to compute your monthly update. Thus your monthly amortization detail is well elaborated in table format here.

Furthermore, the PAG organization dynamically updates PAG IBIG housing loan monthly amortization table. The purpose is to make a customer-friendly table. It is the most responsible way to assist workers in receiving payment and renovating their dream houses.

CHECK: Pag Ibig Housing Loan Interest Rate 2023

Contents

- 1 What are the interest rates of PAG IBIG?

- 2 Application required Documents for PAG IBIG Loan Repayment

- 3 What are the verified proofs of your documents?

- 4 Loan requirements checklist

- 5 Further verification documents for local employers

- 6 Document for OFW; Oversea Filipino Workers

- 7 Self Employed Documents list

- 8 How can a beginner compute his PAG IBIG Housing Loan Monthly Amortization Table?

- 9 Final Thoughts

- 10 Author

What are the interest rates of PAG IBIG?

Before your monthly loan amortization computation, you must know that the payment scheme is extended for 30 years. You are allowed to pay your payment at 25 years maximum.

It’s according to your Payment time;

| 1-Year | 3-Years | 5-Years | 10-Year | 15-Years | 20-Years | 25-Years | 30-Years |

| 5.375% | 6.375% | 7.270% | 8.035% | 8.585% | 8.800% | 9.050% | 10.000% |

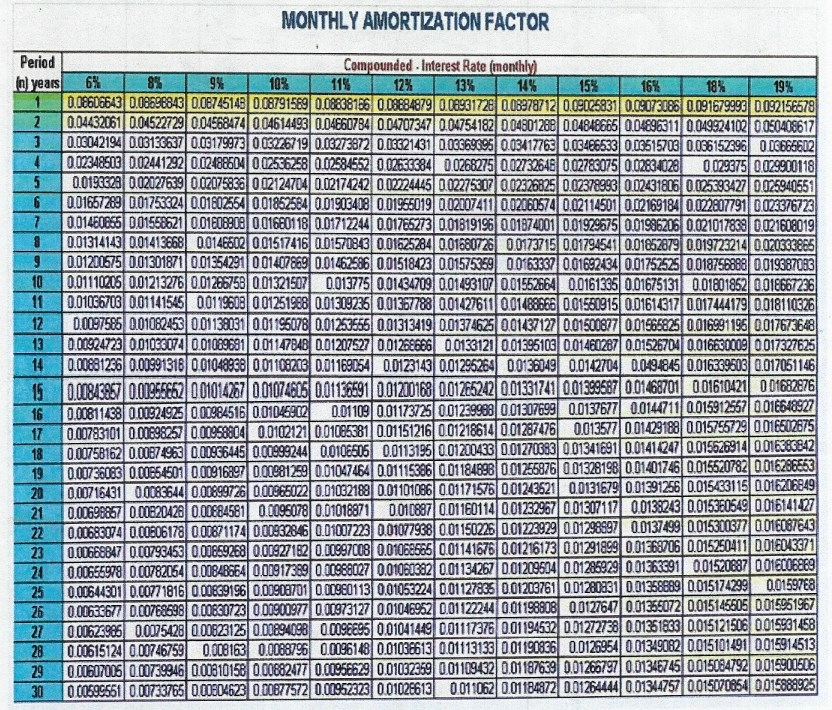

In case you are unfamiliar with our terms and this table looks complicated. Let us break it into the most superficial points. When you have achieved your membership for 1-year payment according to your requirement. Your interest rate would be 5.375%. As for applying the total Php100, 000.00 loans, the net Php8, 781.25 would be your monthly amortization for the whole year (12 months). PAG loan amortization is calculated as;

Loan (100, 000) x (5.375%) = 5, 375.00

100, 000 + 5, 375.00 = 105, 375.00

105, 375.00 / 12

= 8781.25 PHP

Hence, the principle rule would be similar if you have some other interest amount. Multiply your loan amount by regarding interest percentage. Meanwhile, you must pay your amount below 9,000.00 monthly.

Application required Documents for PAG IBIG Loan Repayment

The Loan requirements are elaborated here for beginners, so you don’t need to go elsewhere for further information. Once you have achieved your interest package, and can repay monthly payments. The next thing is the documentation arrangement.

CHECK: Pag Ibig Housing Loan Calculator

What are the verified proofs of your documents?

Loan requirements checklist

Further verification documents for local employers

Document for OFW; Oversea Filipino Workers

Self Employed Documents list

How can a beginner compute his PAG IBIG Housing Loan Monthly Amortization Table?

Firstly, note your net loan amount, and multiply it by your desired loan interest rate. If you select the monthly amortization for a year, divide your first conclusion by twelve. It would be your monthly loan interest. Now take the subtraction of this amount from the total payment, and the remaining is your amount.

Final Thoughts

After verifying your PAG IBIG membership, you are qualified to receive your loan payment. Buy your property, construct your house, or fulfill further requirements. Meanwhile, you need to check your amortization method. You must know about the documents that are compulsory for your repayments. For your understanding of the loan ins and outs, we have established an official amortization table. The borrowers must figure out their remarkable loan payments and safely enjoy their experience with our PAG Housing loan.

REF: https://www.pagibigfinancing.com/mortgage-calculator-amortization-table/