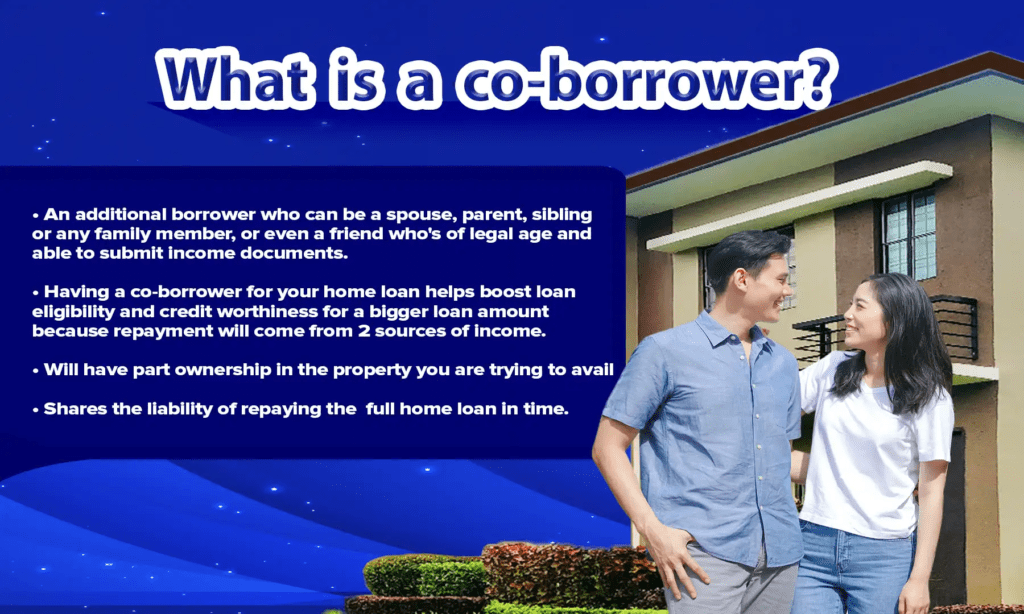

PAG IBIG Housing loan needs the appropriate paperwork. This lawful agency has allowed the borrowers to participate in housing loans, and you can also associate with your co-partners. However, it will enable three persons as co-borrowers for the loan. The co-loaner can be your family, friends, relatives, or non-relative individual. This shared loan is also called a tacked loan.

CHECK: Pag ibig Housing Loan Requirements

Best co Borrower for your PAG IBIG Housing Loan

Your blood-brothers, children, parents, grandparents, siblings, and grandchildren can be your co-borrowers. Likewise, your in-laws and spouse can be on the consanguinity second degree of ownership. You can make your trusted person your co-partner. PAG IBIG allows the sharing opportunity for three persons at a time.

Your co-borrower will occupy your property with you, so it can also be your wife. Furthermore, we have seen various questions about foreign co-borrowers and whether it’s allowable. For our users’ understanding, we like to be clear that PAG IBIG allows loans for OFWs. Likewise, your foreign partners can apply for their housing loan with you in the Philippines. Even a separate set of documentation is not required for your foreign partners.

Furthermore, filling out the co-member application form will take just 5 minutes. Before getting your co-borrowers set up, you must evaluate the eligibility criteria. Here PAG-IBIG ensures you and your co-borrower or co-maker for loan payment. It is a beneficial step for gauging your members’ payment capacity.

There are some fundamental requirements for your co-borrowers, especially if they are non-relatives. Thus, co-borrowers must meet the following standards:

CHECK: Pag ibig housing loan requirements for ofw

The loan is issued after your entire obligation for a housing loan. At last, you will receive the full payment of your loan.

PAG-IBIG Co-Borrower’s Form

Let’s comply with our simple form for your co-borrower of the PAG-IBIG House Loan.

PAG IBIG Housing Loan permits the members to achieve their desired houses of a maximum of P6 million. For user-friendly packages, we have updated the whole loan management. Now you can get your loan along with your co-partners. These co-members can be any of your trusted ones. They just meet the essential criteria for loan achievements. The loan requirements are not specific for co-borrowers, but they must fill out the co-membership form and add their required data only.

Hi Marina, I have been trying to find information for borrowers who is not an OFW but an immigrant in the US. My niece is applying for a housing loan and she listed my sister as her co borrower. Help.

Thanks and God bless

Hello! If your niece is applying for a Pag-IBIG housing loan in the Philippines and wants to include your sister, who is an immigrant in the US, as a co-borrower, they will need to follow the steps below:

Check eligibility: Both your niece and sister should be active Pag-IBIG members with at least 24 monthly contributions. They should also meet other eligibility requirements such as age, income, and credit history.

Obtain the housing loan application form: Your niece can download the housing loan application form from the Pag-IBIG Fund website (www.pagibigfund.gov.ph) or obtain it from the nearest Pag-IBIG office.

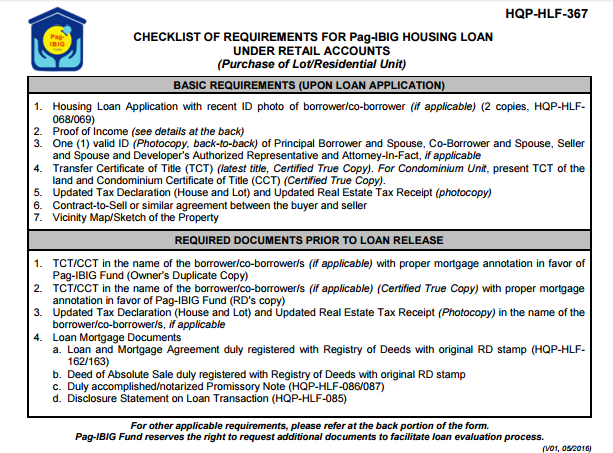

Prepare required documents: Along with the completed housing loan application form, your niece and sister will need to prepare necessary supporting documents such as:

Photocopies of valid IDs for both borrowers

Proof of income (e.g., payslips, employment contract, or a certificate of employment and compensation) for both borrowers

For your sister, proof of immigrant status in the US (e.g., green card or valid US visa)

Any other relevant documents as required by Pag-IBIG, such as property documents, tax declaration, or collateral documents

Special Power of Attorney (SPA): Since your sister is in the US, she will need to appoint a representative in the Philippines through a Special Power of Attorney (SPA) to act on her behalf during the loan application process. The SPA should be notarized and, if necessary, authenticated by the Philippine Consulate in the US.

Submit the application: Your niece or the representative appointed by your sister should submit the completed application form and required documents to the nearest Pag-IBIG branch or designated partner establishment in the Philippines.

Await approval and loan release: Once Pag-IBIG has evaluated and approved the housing loan application, they will release the loan proceeds accordingly.

Correction.

Co borrower

Hi marina i would like to ask if is it necessary to attend pagibig seminar even though i have SPA because im a seaman?

Im a co borrower

hello.

can a co borrower avails his own housing loan after he or she allow relative to be his/her co-borrower.

thank you

Yes, a co-borrower who allowed a relative to be their co-borrower for a housing loan with Pag-IBIG can still avail their own housing loan in the future. The fact that someone acted as a co-borrower for someone else’s loan does not disqualify them from applying for their own housing loan later on.

Each individual’s eligibility for a Pag-IBIG housing loan is determined based on their own qualifications, financial capacity, and compliance with Pag-IBIG’s loan requirements. As long as the co-borrower meets the necessary criteria and is not in default or has any outstanding obligations related to their previous co-borrower role, they can apply and avail their own housing loan from Pag-IBIG when they are ready to do so.

It’s important to note that each loan application is subject to Pag-IBIG’s assessment and approval based on the applicant’s individual circumstances and financial standing at the time of application.

Hi. I am applying to be a co borrower of my sister in law. But within the next five years, I do have a plan to apply for a housing loan. What are the cons for me being a co borrower? Thanks

Hi Marina,

I would like to ask for a clarification. Can I get a housing loan for my parent’s owned property? Land Title is under their name. How will it affect my capacity to get a personal housing loan in the future?

Has there ever been a situation where siblings combine their PAGIBIG housing loans to purchase 1 property? Is that possible?

Hi Marina,

I have the same scenario as Kim. I would like to have my sister as Co-Borrower who is a US Immigrant. The question is, she is not an active Pag IBIG member but have more than 24 months of contribution, can she still be qualified as my Co-Borrower? What if she continue to pay her monthly contributions, can she be qualified?

Thank you.

Hi Ms. MARINA , my parents are planning to sell their house so they can move to the province, is it possible that I will buy my parents house thru pg ibig housing loan? Thank you